Further Upside For Müller - Die lila Logistik SE (ETR:MLL) Shares Could Introduce Price Risks After 27% Bounce

The Müller - Die lila Logistik SE (ETR:MLL) share price has done very well over the last month, posting an excellent gain of 27%. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

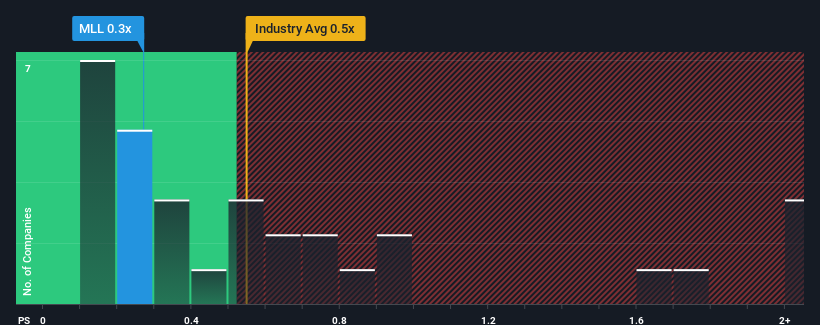

Although its price has surged higher, it's still not a stretch to say that Müller - Die lila Logistik's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Logistics industry in Germany, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Müller - Die lila Logistik

What Does Müller - Die lila Logistik's Recent Performance Look Like?

Müller - Die lila Logistik certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Müller - Die lila Logistik, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Müller - Die lila Logistik's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Müller - Die lila Logistik's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 55%. The strong recent performance means it was also able to grow revenue by 62% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to decline by 1.5% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, we find it intriguing that Müller - Die lila Logistik's P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Müller - Die lila Logistik's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Müller - Die lila Logistik revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Müller - Die lila Logistik that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MLL

Müller - Die lila Logistik

Provides logistics services in Germany and internationally.

Good value with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026