- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

With Hapag-Lloyd Aktiengesellschaft (ETR:HLAG) It Looks Like You'll Get What You Pay For

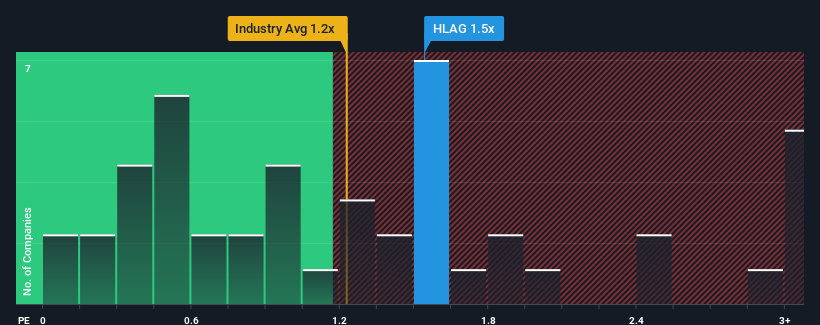

It's not a stretch to say that Hapag-Lloyd Aktiengesellschaft's (ETR:HLAG) price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" for companies in the Shipping industry in Germany, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hapag-Lloyd

How Hapag-Lloyd Has Been Performing

Hapag-Lloyd has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hapag-Lloyd.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Hapag-Lloyd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 10% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 1.5% per year over the next three years. That's shaping up to be similar to the 3.0% per annum growth forecast for the broader industry.

In light of this, it's understandable that Hapag-Lloyd's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Hapag-Lloyd maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 2 warning signs for Hapag-Lloyd (1 is a bit concerning!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hapag-Lloyd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HLAG

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives