- Germany

- /

- Wireless Telecom

- /

- XTRA:1U1

The three-year shareholder returns and company earnings persist lower as 1&1 (ETR:1U1) stock falls a further 3.7% in past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term 1&1 AG (ETR:1U1) shareholders, since the share price is down 40% in the last three years, falling well short of the market return of around 18%. And the ride hasn't got any smoother in recent times over the last year, with the price 25% lower in that time. Furthermore, it's down 20% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 12% in the same timeframe.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for 1&1

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

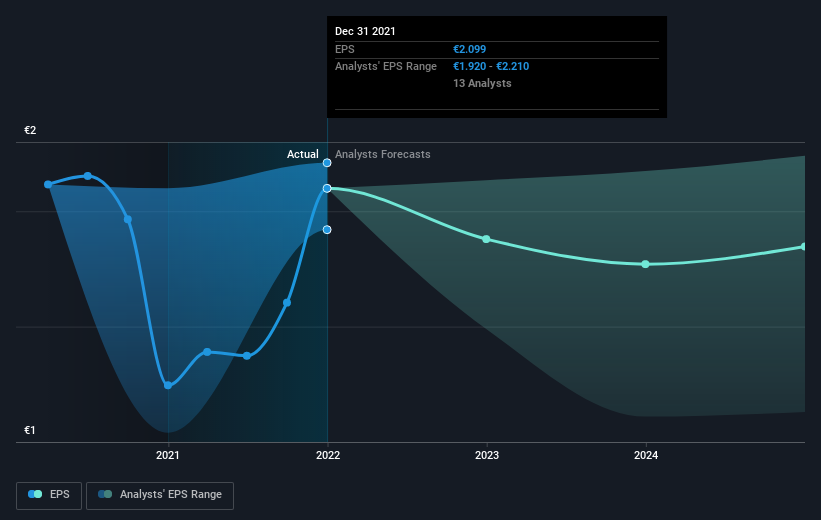

During the three years that the share price fell, 1&1's earnings per share (EPS) dropped by 3.0% each year. This reduction in EPS is slower than the 16% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 9.18.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that 1&1 has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

The last twelve months weren't great for 1&1 shares, which performed worse than the market, costing holders 25%, including dividends. Meanwhile, the broader market slid about 11%, likely weighing on the stock. Shareholders have lost 12% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for 1&1 (1 makes us a bit uncomfortable) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:1U1

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives