In recent weeks, the European market has shown mixed performance with the pan-European STOXX Europe 600 Index rising slightly due to dovish signals from U.S. Federal Reserve officials and easing trade tensions between the U.S. and China, while individual country indices like Germany's DAX have experienced declines amid industrial output contractions. In this evolving landscape, identifying high-growth tech stocks in Europe requires a keen eye on companies that demonstrate resilience and innovation potential amidst economic fluctuations and sector-specific challenges.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| argenx | 21.79% | 26.68% | ★★★★★★ |

| Bonesupport Holding | 28.68% | 59.41% | ★★★★★★ |

| KebNi | 23.54% | 74.03% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| Comet Holding | 10.81% | 36.12% | ★★★★★☆ |

| CD Projekt | 35.45% | 39.73% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Yubico | 15.46% | 33.06% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stemmer Imaging AG specializes in providing machine vision technology for various applications globally and has a market cap of €390 million.

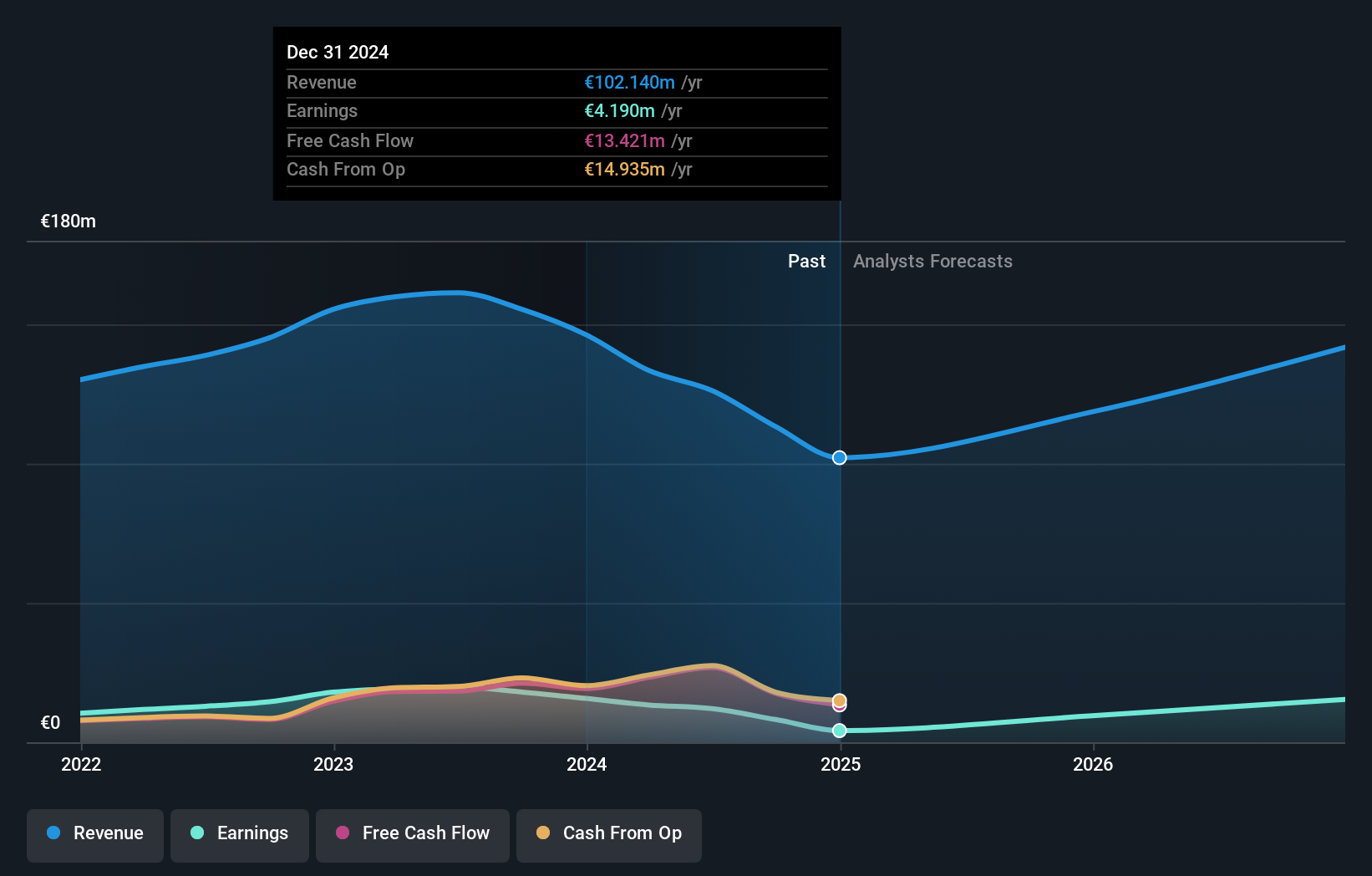

Operations: The company generates revenue primarily from its machine vision technology segment, amounting to €102.14 million. The focus is on delivering solutions for both industrial and non-industrial applications globally.

Stemmer Imaging, transitioning from a distribution firm to a systems house under Arne Dehn's leadership, has significantly broadened its operational scope across continents. Despite recent executive changes with new interim CEO Paul Scholten stepping in, the company maintains robust growth metrics: revenue is expected to grow at 16.4% annually, outpacing the German market's 6%. Moreover, earnings are forecasted to surge by 57.8% per year, well above Germany's average of 16.5%. However, it faces challenges as last year’s earnings dipped by -73.4%, reflecting volatility in its expansion phase and a profit margin reduction from 10.8% to 4.1%. These figures underscore Stemmer Imaging’s dynamic yet tumultuous journey towards becoming a key player in machine vision technology on a global scale.

- Click to explore a detailed breakdown of our findings in Stemmer Imaging's health report.

Explore historical data to track Stemmer Imaging's performance over time in our Past section.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG is involved in the development, production, sale, and servicing of sensor systems, modules, and components across various regions including Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF933.22 million.

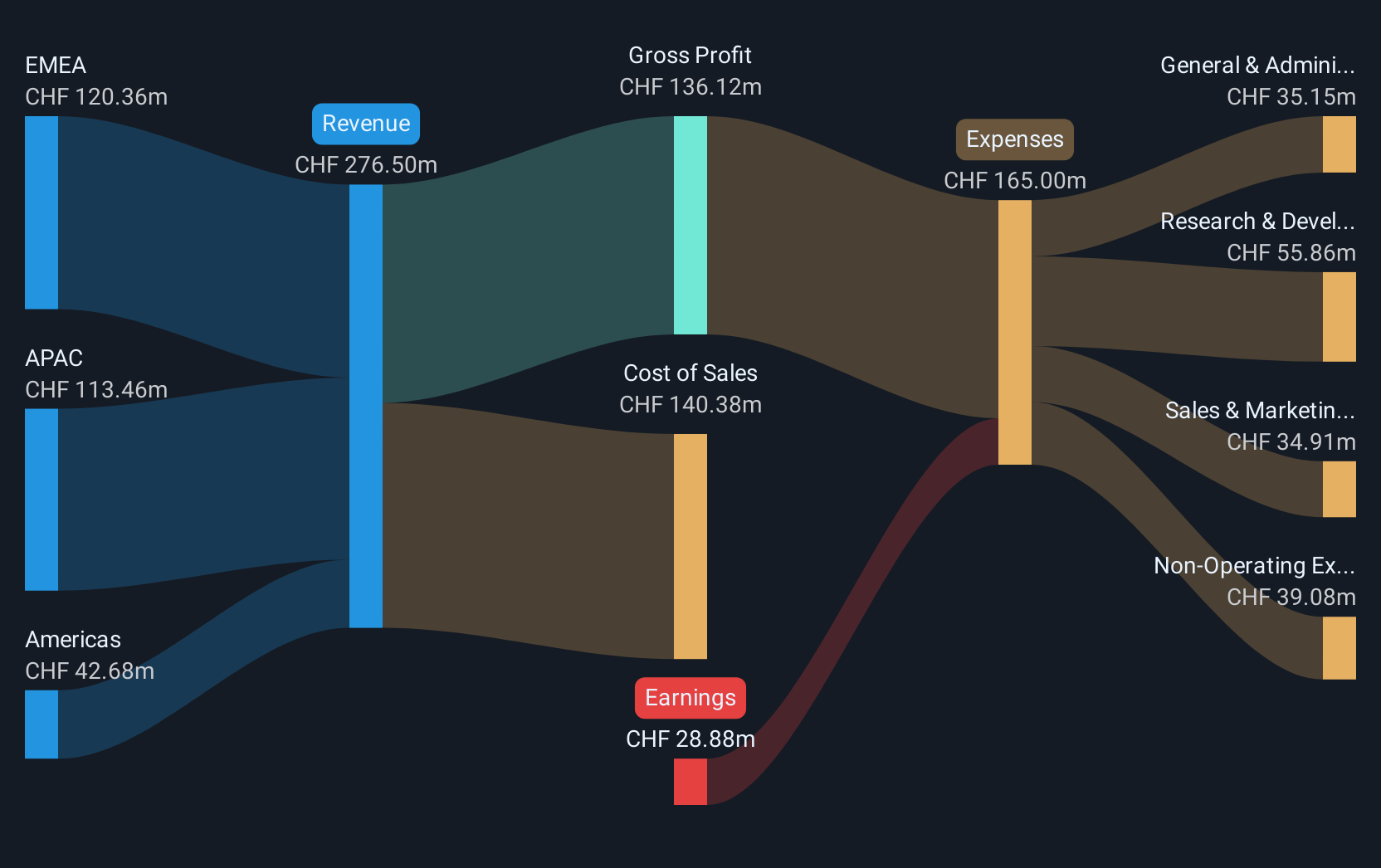

Operations: The company generates revenue primarily from its sensor systems, modules, and components segment, totaling CHF333.08 million.

Sensirion Holding AG, bolstered by its recent partnership with Avnet, is poised to enhance its distribution capabilities significantly. This collaboration not only extends Sensirion's global reach but also enriches its customer service dynamics through Avnet's robust supply chain and technical resources. The launch of the STCC4 sensor marks a notable advancement in CO2 monitoring technology, promising substantial market penetration due to its unique size and efficiency. Financially, Sensirion has shown resilience with a half-year sales jump from CHF 127.97 million to CHF 184.55 million and a swing to a net profit of CHF 10.44 million from a prior loss. The firm's earnings are expected to grow by an impressive 30.2% annually, outpacing the Swiss market forecast of 10.6%, underscoring its recovery and potential for sustained growth amidst economic stability.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synektik Spólka Akcyjna operates in Poland, offering products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications with a market capitalization of PLN2.16 billion.

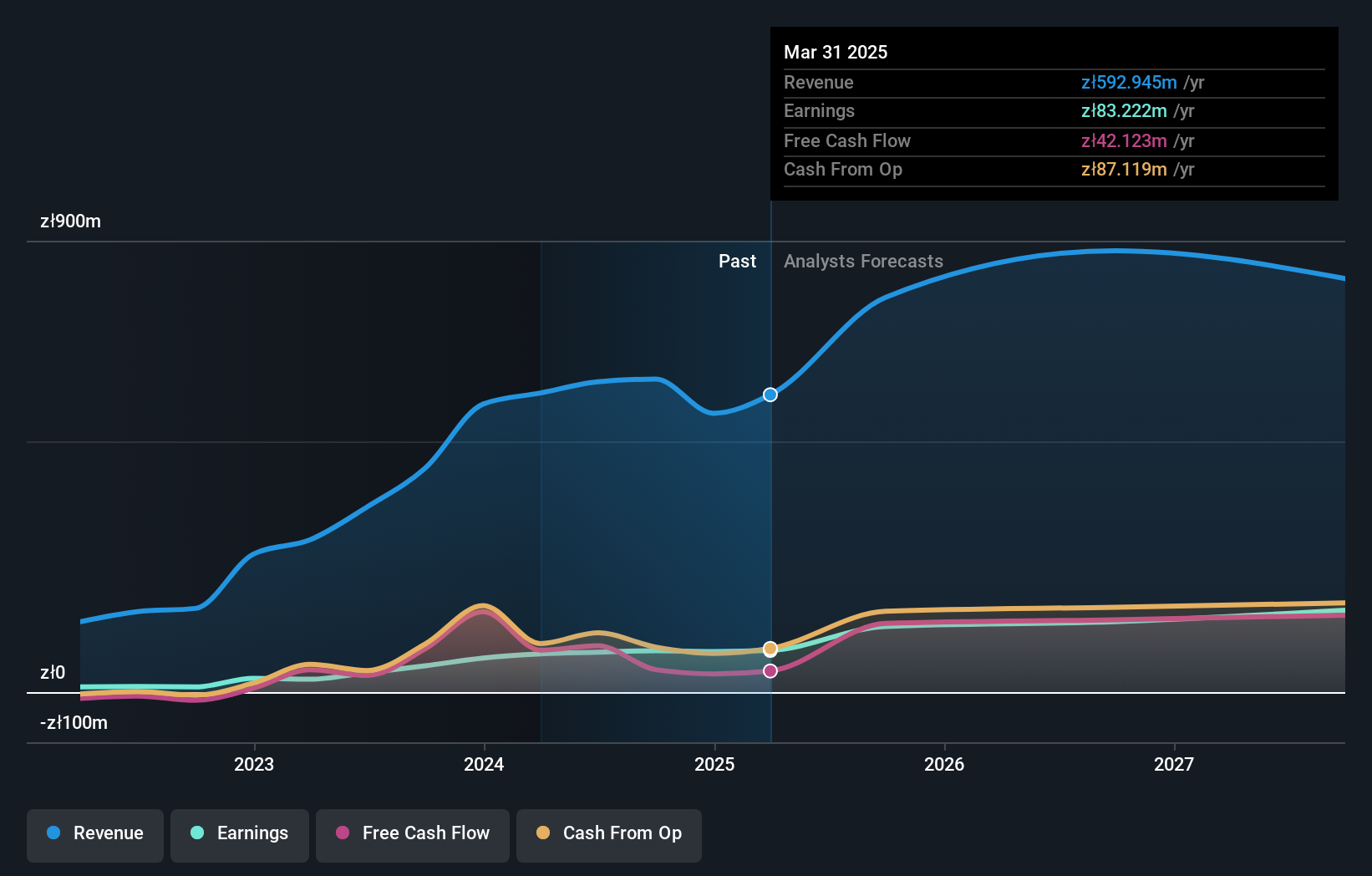

Operations: The company generates revenue primarily from diagnostic and IT equipment, contributing PLN57.92 billion, and the production of radiopharmaceuticals, which adds PLN4.67 billion.

Synektik Spólka Akcyjna, a notable entity within Europe's tech landscape, has demonstrated robust financial health with its recent earnings report. For Q3 2025, the firm posted a revenue of PLN 154.24 million, up from PLN 123.98 million the previous year, and net income surged to PLN 23.71 million from PLN 16.74 million. This performance translates into a significant annualized earnings growth of approximately 24.5%, outpacing the broader Polish market's expectation of 15.9%. Despite slower revenue growth at an annual rate of 6.5%, which lags behind high-growth benchmarks but exceeds the local market forecast of 4.3%, Synektik continues to enhance shareholder value with consistent profit increments and positive free cash flow dynamics, positioning it as a resilient competitor in its sector.

Where To Now?

- Click this link to deep-dive into the 54 companies within our European High Growth Tech and AI Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HMSE:S9I

Stemmer Imaging

Provides machine vision technology for industry and non-industry applications worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives