Here's Why It's Unlikely That InTiCa Systems SE's (ETR:IS7) CEO Will See A Pay Rise This Year

Key Insights

- InTiCa Systems will host its Annual General Meeting on 24th of July

- Total pay for CEO Gregor Wasle includes €215.0k salary

- The overall pay is comparable to the industry average

- InTiCa Systems' EPS declined by 73% over the past three years while total shareholder loss over the past three years was 76%

The results at InTiCa Systems SE (ETR:IS7) have been quite disappointing recently and CEO Gregor Wasle bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 24th of July. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for InTiCa Systems

How Does Total Compensation For Gregor Wasle Compare With Other Companies In The Industry?

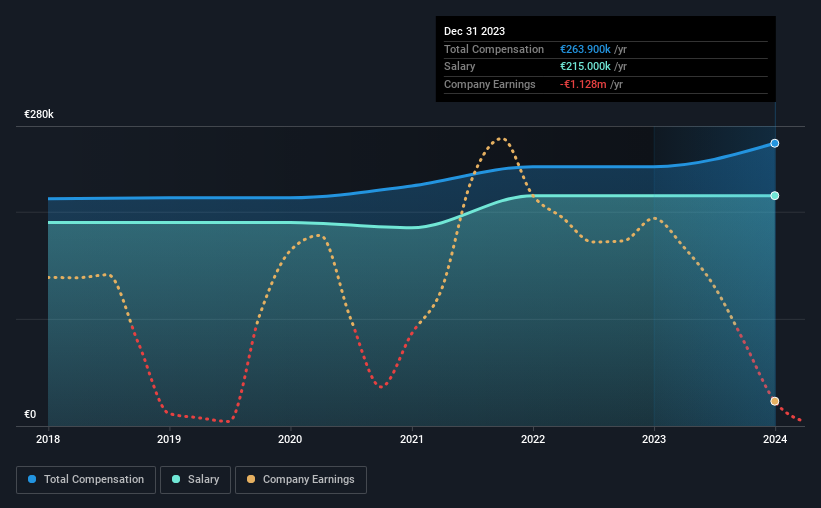

At the time of writing, our data shows that InTiCa Systems SE has a market capitalization of €15m, and reported total annual CEO compensation of €264k for the year to December 2023. We note that's an increase of 9.0% above last year. Notably, the salary which is €215.0k, represents most of the total compensation being paid.

In comparison with other companies in the German Electronic industry with market capitalizations under €183m, the reported median total CEO compensation was €344k. So it looks like InTiCa Systems compensates Gregor Wasle in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €215k | €215k | 81% |

| Other | €49k | €27k | 19% |

| Total Compensation | €264k | €242k | 100% |

Speaking on an industry level, nearly 49% of total compensation represents salary, while the remainder of 51% is other remuneration. InTiCa Systems is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

InTiCa Systems SE's Growth

InTiCa Systems SE has reduced its earnings per share by 73% a year over the last three years. Its revenue is down 5.0% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has InTiCa Systems SE Been A Good Investment?

The return of -76% over three years would not have pleased InTiCa Systems SE shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for InTiCa Systems (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from InTiCa Systems, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IS7

InTiCa Systems

Develops, produces, and markets inductive components and systems, passive analog circuit technology, and mechatronic assemblies in Germany and internationally.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion