As global markets navigate a landscape marked by mixed performance in major indexes and geopolitical developments, investors are keenly observing the ongoing divergence between growth and value stocks. With the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reaching record highs amidst economic updates such as job growth rebounds and anticipated rate cuts from the Federal Reserve, dividend stocks remain an attractive option for those seeking income stability in a dynamic market environment. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can offer potential resilience amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.53% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.40% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1924 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Tianjin Development Holdings (SEHK:882)

Simply Wall St Dividend Rating: ★★★★★☆

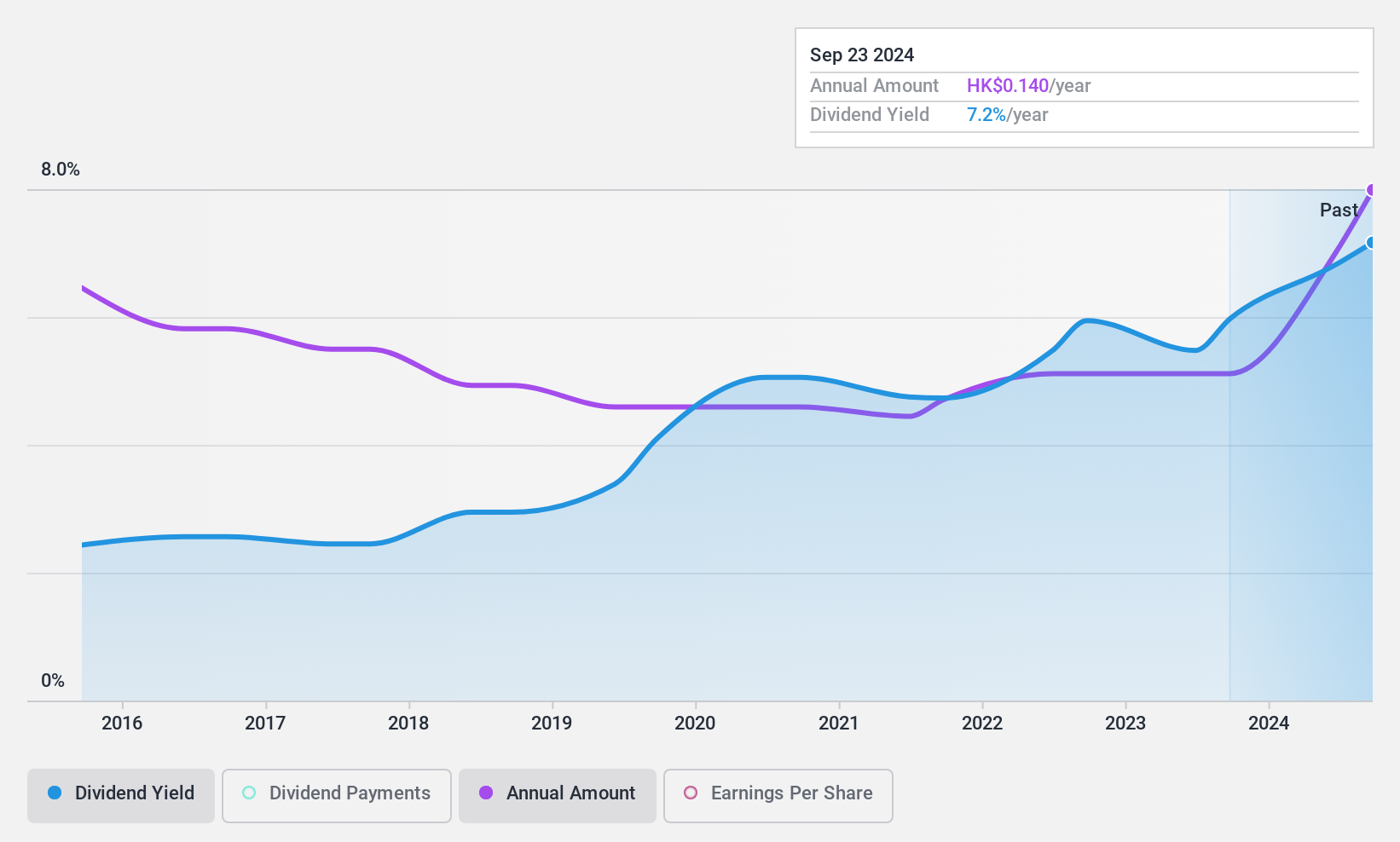

Overview: Tianjin Development Holdings Limited, with a market cap of HK$2.13 billion, operates through its subsidiaries to supply water, heat, thermal power, and electricity to industrial, commercial, and residential customers in the Tianjin Economic and Technological Development Area in China.

Operations: Tianjin Development Holdings Limited generates revenue from its segments which include Utilities (HK$1.51 billion), Pharmaceutical (HK$1.50 billion), Electrical and Mechanical (HK$176.09 million), and Hotel (HK$136.51 million).

Dividend Yield: 7.0%

Tianjin Development Holdings offers a stable dividend profile with a low payout ratio of 27.2%, ensuring dividends are well covered by earnings and cash flows, despite the cash payout ratio being 72.6%. The company has maintained reliable and growing dividends over the past decade, although its current yield of 7.03% is below the top tier in Hong Kong. It trades significantly below its estimated fair value, presenting potential value for investors.

- Dive into the specifics of Tianjin Development Holdings here with our thorough dividend report.

- Our expertly prepared valuation report Tianjin Development Holdings implies its share price may be lower than expected.

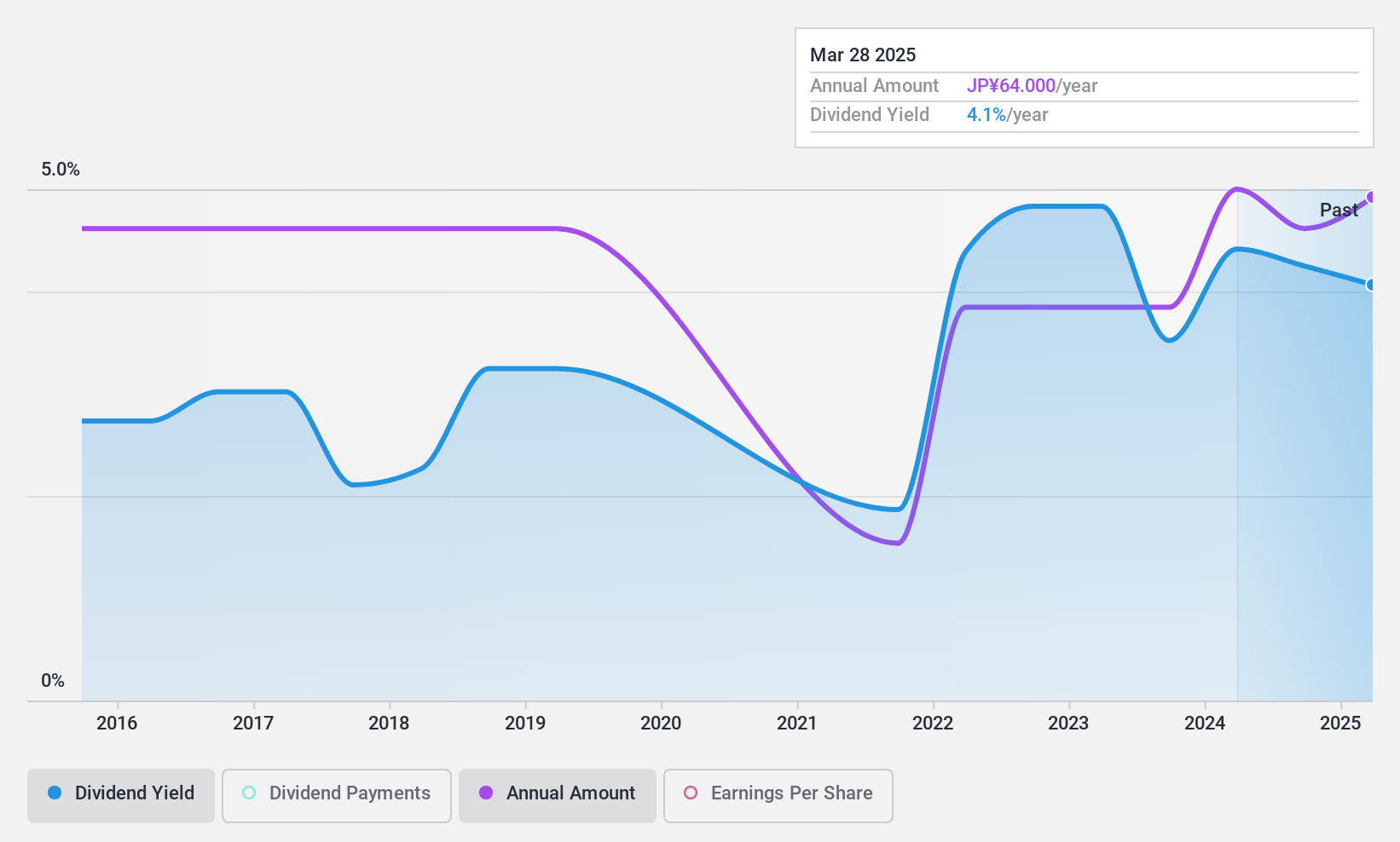

Mitsubishi Steel Mfg (TSE:5632)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Steel Mfg. Co., Ltd. is involved in the manufacturing and sale of steel products, construction machinery parts, automotive parts, and machinery and equipment, with a market cap of ¥21.53 billion.

Operations: Mitsubishi Steel Mfg. Co., Ltd.'s revenue is derived from its diverse operations in steel products, construction machinery parts, automotive parts, and machinery and equipment.

Dividend Yield: 4.5%

Mitsubishi Steel Mfg. offers a dividend yield of 4.49%, placing it among the top 25% in Japan, but its dividends have been volatile and unreliable over the past decade. Despite being covered by cash flows with a low payout ratio, dividends are not well supported by earnings due to unprofitability and high debt levels. Trading at a significant discount to estimated fair value suggests potential value, but dividend sustainability remains questionable.

- Click to explore a detailed breakdown of our findings in Mitsubishi Steel Mfg's dividend report.

- According our valuation report, there's an indication that Mitsubishi Steel Mfg's share price might be on the cheaper side.

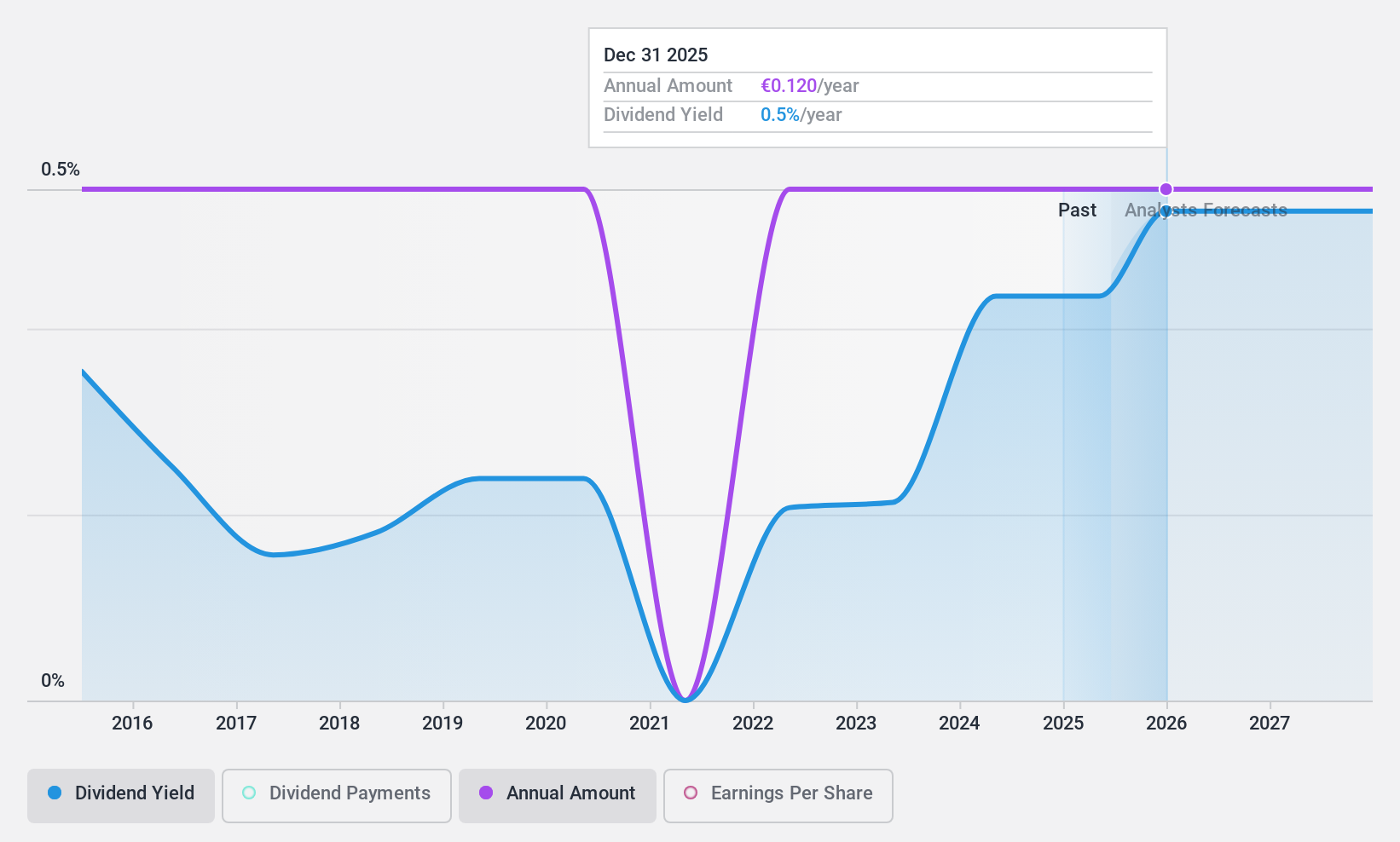

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems both in Germany and internationally with a market cap of €99.44 million.

Operations: DATA MODUL's revenue is primarily derived from its Displays segment, contributing €151.05 million, and its Systems segment, contributing €92.66 million.

Dividend Yield: 6.9%

DATA MODUL's dividend yield of 6.94% ranks in the top 25% of German dividend payers, but its sustainability is concerning due to a high payout ratio of 93%, indicating dividends are not well covered by earnings. Despite being well supported by cash flows with a low cash payout ratio of 23.1%, past volatility and unreliability in dividend payments raise caution for investors seeking stable income, compounded by declining profit margins and recent earnings drops.

- Click here to discover the nuances of DATA MODUL Produktion und Vertrieb von elektronischen Systemen with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that DATA MODUL Produktion und Vertrieb von elektronischen Systemen is trading behind its estimated value.

Taking Advantage

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1921 more companies for you to explore.Click here to unveil our expertly curated list of 1924 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DATA MODUL Produktion und Vertrieb von elektronischen Systemen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DAM

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Engages in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems in Germany and internationally.

Flawless balance sheet, good value and pays a dividend.