- Germany

- /

- Tech Hardware

- /

- XTRA:C3RY

Cherry SE (ETR:C3RY) Shares Slammed 30% But Getting In Cheap Might Be Difficult Regardless

To the annoyance of some shareholders, Cherry SE (ETR:C3RY) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 66% loss during that time.

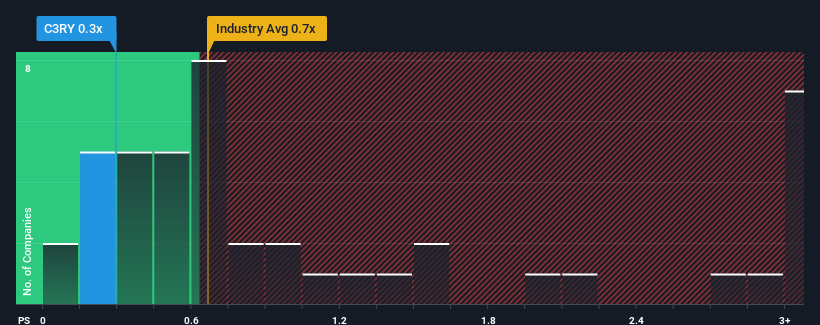

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Cherry's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Tech industry in Germany is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Cherry

What Does Cherry's P/S Mean For Shareholders?

Cherry could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Cherry will help you uncover what's on the horizon.How Is Cherry's Revenue Growth Trending?

Cherry's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 8.7% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 9.2% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 10% per annum, which is not materially different.

With this in mind, it makes sense that Cherry's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Cherry's P/S Mean For Investors?

Cherry's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Cherry's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Tech industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Cherry that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:C3RY

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives