Market forces rained on the parade of Cherry AG (ETR:C3RY) shareholders today, when the analysts downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. Investors however, have been notably more optimistic about Cherry recently, with the stock price up a notable 24% to €6.80 in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

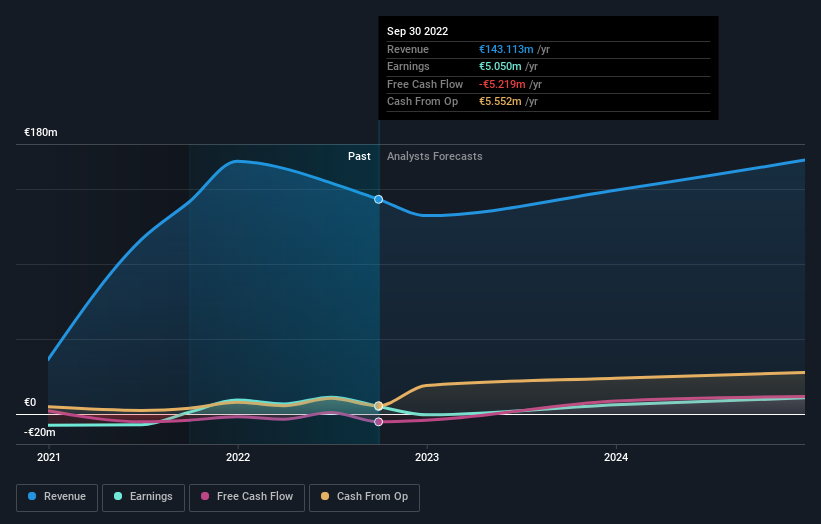

Following the latest downgrade, the current consensus, from the three analysts covering Cherry, is for revenues of €132m in 2022, which would reflect a perceptible 7.6% reduction in Cherry's sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €148m in 2022. The consensus view seems to have become more pessimistic on Cherry, noting the measurable cut to revenue estimates in this update.

Check out our latest analysis for Cherry

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 15% by the end of 2022. This indicates a significant reduction from annual growth of 1.1% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.1% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Cherry is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Given the serious cut to this year's outlook, it's clear that analysts have turned more bearish on Cherry, and we wouldn't blame shareholders for feeling a little more cautious themselves.

Unsatisfied? We have estimates for Cherry from its three analysts out until 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:C3RY

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success