As global markets navigate a complex landscape marked by fluctuating economic indicators and competitive pressures in the technology sector, investors are closely watching key indices like the Nasdaq Composite, which recently experienced significant volatility due to emerging AI developments. In this environment, identifying promising high-growth tech stocks involves assessing companies that can effectively leverage innovation and adapt to shifting market dynamics while maintaining robust earnings potential.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that develops and commercializes injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK22.93 billion.

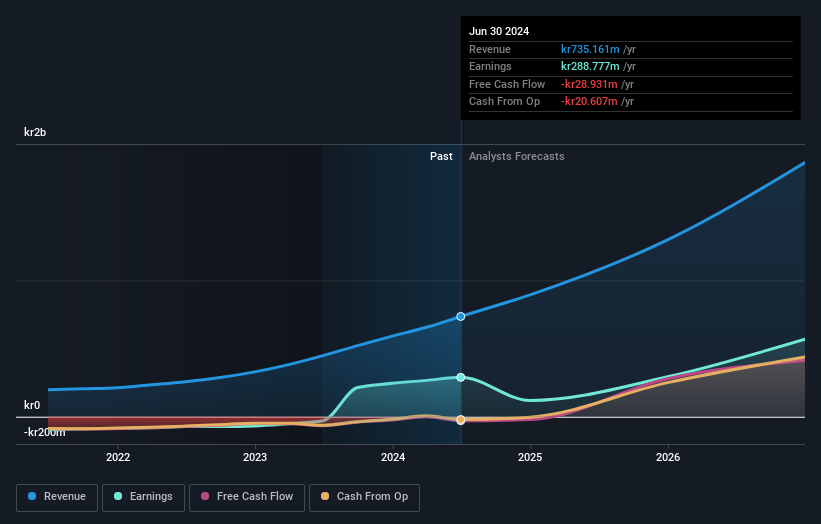

Operations: The company generates revenue primarily from its pharmaceuticals segment, which contributed SEK814.46 million.

Bonesupport Holding AB, a company in the high-growth tech sector, is showcasing robust potential with its innovative CERAMENT products. Recent clinical studies have demonstrated significant advantages of CERAMENT in treating bone infections, leading to a remarkable increase in 5-year survival rates for patients compared to standard treatments. Financially, BONEX is outpacing industry growth with an annual revenue increase projected at 33.8% and earnings expected to surge by 73.1% annually. This performance starkly contrasts the broader Swedish market's growth rates of just 1.1% for revenue and 13.4% for earnings per year, positioning Bonesupport well above average forecasts and highlighting its strong market presence driven by pioneering medical solutions.

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

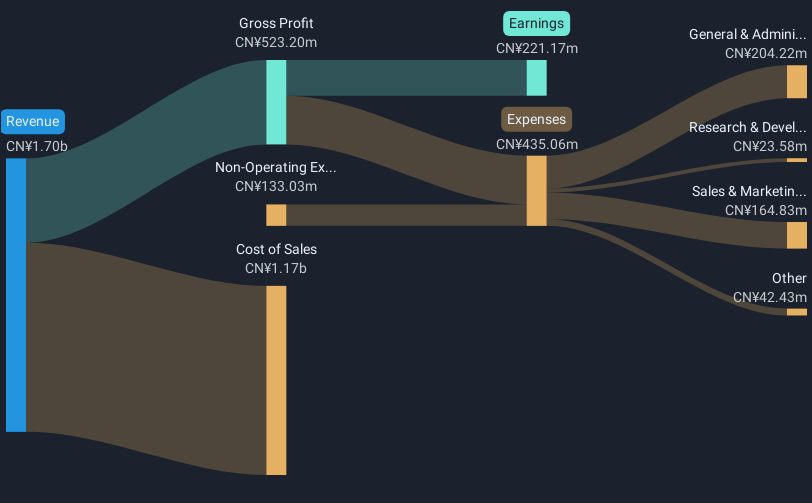

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market capitalization of CN¥14.15 billion.

Operations: Huace Film & TV generates revenue primarily through the production and distribution of film and television content. The company operates within China as well as in international markets, leveraging its expertise in drama series.

Zhejiang Huace Film & TV, amidst a volatile market, is set to outpace its peers with an expected annual revenue growth of 21% and earnings growth of 30.7%. Despite recent challenges, including a significant earnings dip last year, the company's aggressive R&D investment strategy positions it for potential recovery and innovation in the entertainment sector. Notably, its recent dividend affirmation reflects a commitment to shareholder returns even in turbulent times. This blend of strategic financial management and robust growth projections could make Zhejiang Huace Film & TV an interesting entity in the evolving tech landscape of China's entertainment industry.

- Click here to discover the nuances of Zhejiang Huace Film & TV with our detailed analytical health report.

Learn about Zhejiang Huace Film & TV's historical performance.

Basler (XTRA:BSL)

Simply Wall St Growth Rating: ★★★★☆☆

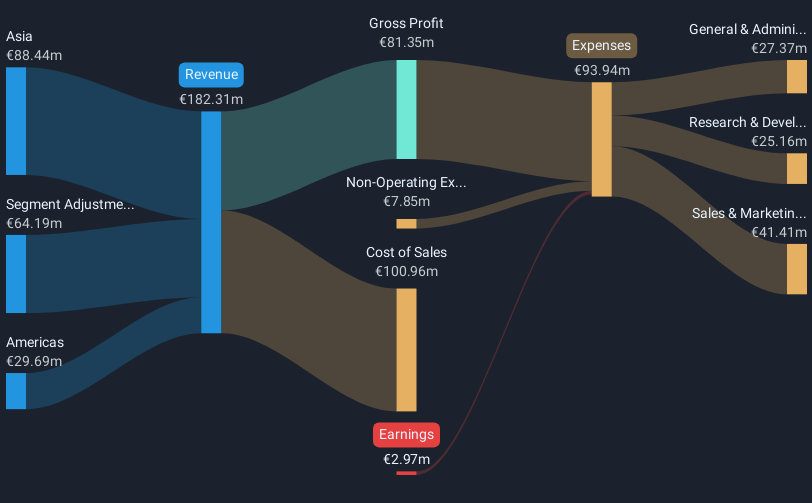

Overview: Basler Aktiengesellschaft specializes in developing, manufacturing, and selling digital cameras for professional users both in Germany and internationally, with a market capitalization of €249.63 million.

Operations: The company generates revenue primarily from its camera segment, which reported €182.31 million.

Amidst a backdrop of executive reshuffling and promising financial forecasts, Basler AG is poised for transformative growth. With the appointment of Ines Brückel as CFO, effective January 2025, the company strengthens its leadership with expertise in finance and technology. This strategic move coincides with an encouraging financial performance; despite a net loss reduction from EUR 17.52 million to EUR 6.68 million year-over-year, Basler's revenue growth forecast stands at a robust 10.8% annually. Moreover, earnings are expected to surge by an impressive 113.84% per year, signaling strong future prospects in the competitive tech landscape where innovation and agile management are key drivers of success.

- Take a closer look at Basler's potential here in our health report.

Explore historical data to track Basler's performance over time in our Past section.

Summing It All Up

- Click through to start exploring the rest of the 1227 High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BSL

Basler

Engages in the development, manufacture, and sale of digital cameras for professional users in Germany and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives