- Germany

- /

- Electronic Equipment and Components

- /

- XTRA:BKHT

German Growth Stocks With High Insider Ownership For October 2024

Reviewed by Simply Wall St

As the German market navigates through a period of cautious investor sentiment due to escalating Middle East tensions, the DAX index has mirrored this unease with a notable decline. Amidst this backdrop, identifying growth companies with high insider ownership can be particularly appealing, as such stocks often suggest confidence from those closest to the company and may offer resilience in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| Stemmer Imaging (XTRA:S9I) | 25% | 23.2% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

| adidas (XTRA:ADS) | 16.6% | 41.8% |

| pferdewetten.de (XTRA:EMH) | 20.6% | 97.9% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| R. STAHL (XTRA:RSL2) | 37.9% | 59.3% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18.8% | 24.6% |

| Your Family Entertainment (DB:RTV) | 17.3% | 124.4% |

| elumeo (XTRA:ELB) | 25.8% | 118.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €297.76 million.

Operations: The company's revenue is primarily generated from its Security Technologies segment, contributing €37.03 million, and its Financial Technologies segment, which accounts for €174.59 million.

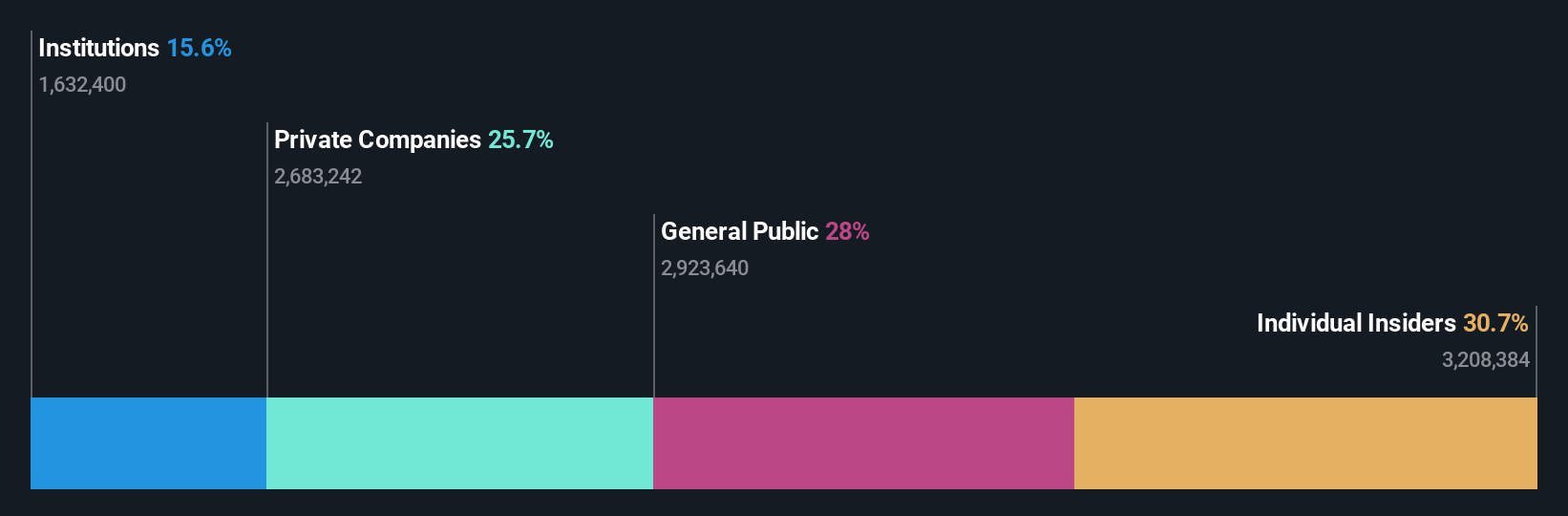

Insider Ownership: 26.6%

Brockhaus Technologies has a significant insider ownership structure, aligning management's interests with shareholders. Despite no recent insider trading activity, the company is forecast to become profitable within three years, showing above-average market growth potential. Although its revenue growth of 16.8% annually is below 20%, it surpasses the German market average. Recent earnings guidance confirmed expected revenues between €220 million and €240 million for 2024 and up to €320 million for 2025, despite current net losses.

- Click here and access our complete growth analysis report to understand the dynamics of Brockhaus Technologies.

- Insights from our recent valuation report point to the potential undervaluation of Brockhaus Technologies shares in the market.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

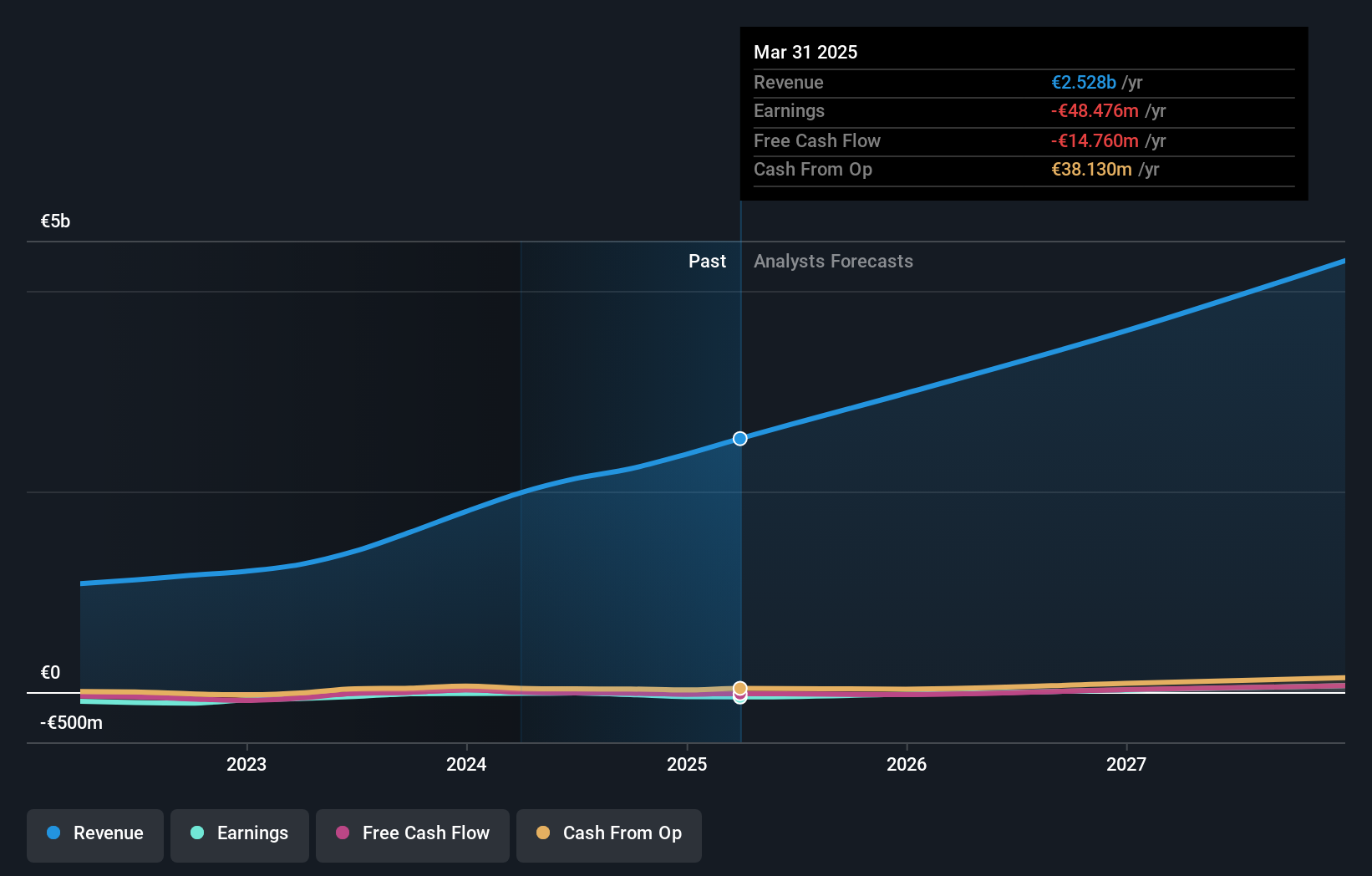

Overview: Redcare Pharmacy NV operates as an online pharmacy across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.79 billion.

Operations: The company's revenue is primarily generated from the DACH region with €1.74 billion and internationally with €391 million.

Insider Ownership: 17.4%

Redcare Pharmacy has seen substantial insider buying, indicating confidence in its growth trajectory. The company recently raised its 2024 sales guidance to between €2.35 billion and €2.5 billion, reflecting strong performance with half-year sales reaching €1.12 billion, up from €791.94 million the previous year. Despite a net loss of €12.07 million for the same period, Redcare is forecasted to achieve profitability within three years, outpacing average market growth rates in Germany.

- Click here to discover the nuances of Redcare Pharmacy with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Redcare Pharmacy is priced higher than what may be justified by its financials.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products with a market capitalization of approximately €7.61 billion.

Operations: The company's revenue segments include a Segment Adjustment of €10.49 billion.

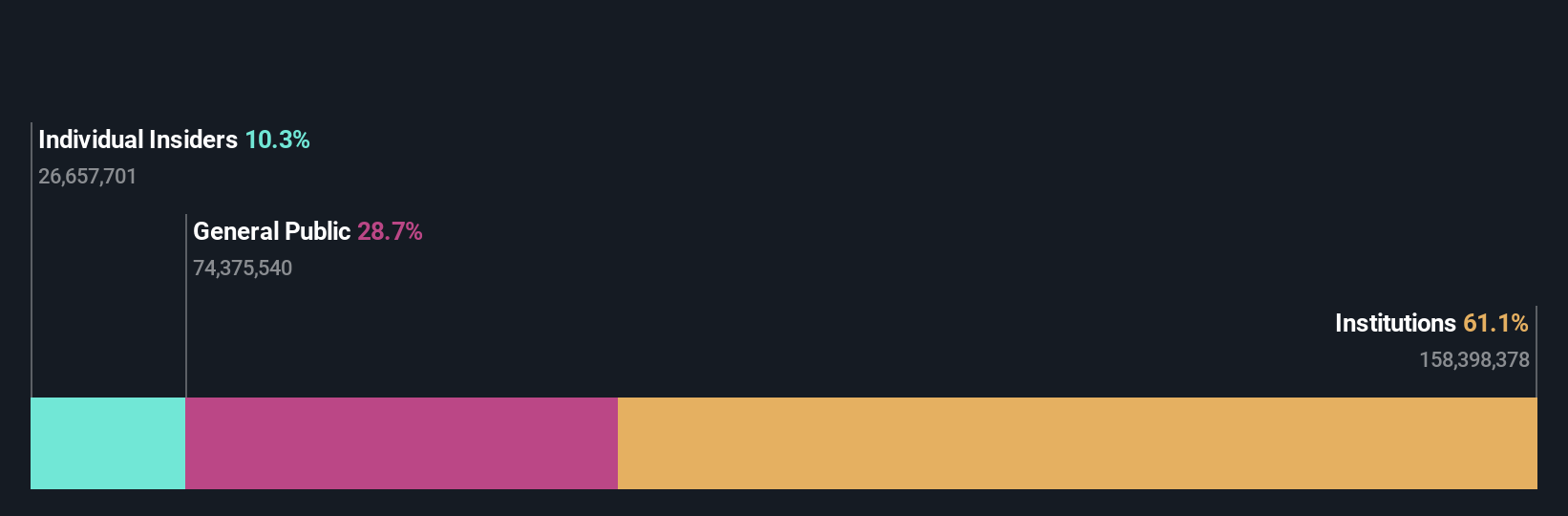

Insider Ownership: 10.4%

Zalando's earnings are forecast to grow significantly at 24.8% annually, surpassing the German market average. Despite a lower projected Return on Equity of 12.7%, the stock is trading at nearly half its estimated fair value, suggesting potential undervaluation. Recent earnings reports show strong performance with net income rising to €95.7 million in Q2 2024 from €56.6 million a year ago, though revenue growth remains modest at 5.6% annually compared to market expectations.

- Delve into the full analysis future growth report here for a deeper understanding of Zalando.

- Our expertly prepared valuation report Zalando implies its share price may be too high.

Next Steps

- Access the full spectrum of 19 Fast Growing German Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Brockhaus Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BKHT

Excellent balance sheet and good value.