- Germany

- /

- Communications

- /

- XTRA:ADV

It Looks Like Shareholders Would Probably Approve ADVA Optical Networking SE's (ETR:ADV) CEO Compensation Package

The performance at ADVA Optical Networking SE (ETR:ADV) has been quite strong recently and CEO Brian Protiva has played a role in it. Coming up to the next AGM on 19 May 2021, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for ADVA Optical Networking

How Does Total Compensation For Brian Protiva Compare With Other Companies In The Industry?

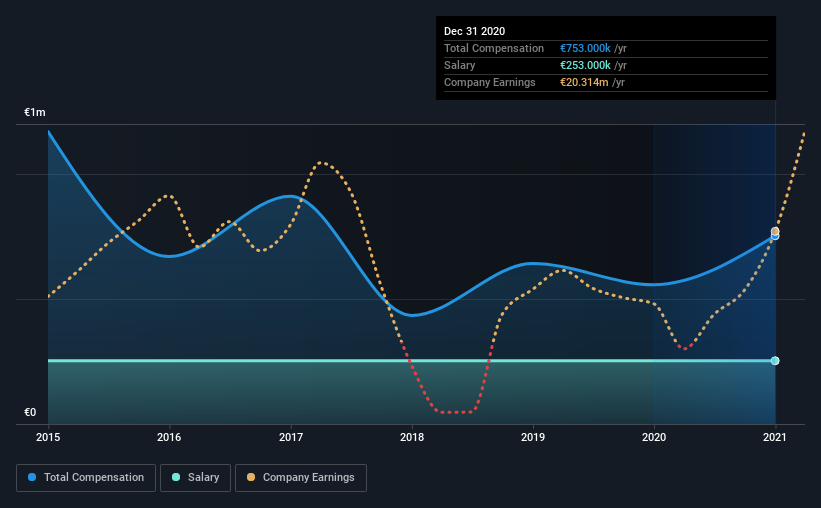

Our data indicates that ADVA Optical Networking SE has a market capitalization of €507m, and total annual CEO compensation was reported as €753k for the year to December 2020. Notably, that's an increase of 35% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at €253k.

On examining similar-sized companies in the industry with market capitalizations between €331m and €1.3b, we discovered that the median CEO total compensation of that group was €814k. This suggests that ADVA Optical Networking remunerates its CEO largely in line with the industry average. Moreover, Brian Protiva also holds €4.0m worth of ADVA Optical Networking stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €253k | €253k | 34% |

| Other | €500k | €304k | 66% |

| Total Compensation | €753k | €557k | 100% |

Talking in terms of the industry, salary represented approximately 74% of total compensation out of all the companies we analyzed, while other remuneration made up 26% of the pie. ADVA Optical Networking sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

ADVA Optical Networking SE's Growth

Over the past three years, ADVA Optical Networking SE has seen its earnings per share (EPS) grow by 83% per year. Its revenue is up 2.7% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has ADVA Optical Networking SE Been A Good Investment?

Most shareholders would probably be pleased with ADVA Optical Networking SE for providing a total return of 67% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

Whatever your view on compensation, you might want to check if insiders are buying or selling ADVA Optical Networking shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade ADVA Optical Networking, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026