- Germany

- /

- Communications

- /

- XTRA:ADV

High Growth Tech Stocks in Europe for May 2025

Reviewed by Simply Wall St

As European markets continue to navigate the complexities of global trade tensions, the pan-European STOXX Europe 600 Index has shown resilience, ending its fourth consecutive week on a positive note amid hopes for easing U.S.-China trade tensions. In this environment, high-growth tech stocks in Europe are particularly appealing due to their potential for rapid expansion and innovation-driven growth, making them an interesting focus for investors looking to capitalize on market opportunities despite broader economic uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 22.16% | 27.03% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 51.89% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. is a global provider of IT and software solutions with a market capitalization of €304.77 million.

Operations: The company generates revenue through its IT and software solutions, with significant contributions from its operations in Switzerland (€116.37 million), Belux (€109.25 million), and the United Kingdom (€97.39 million).

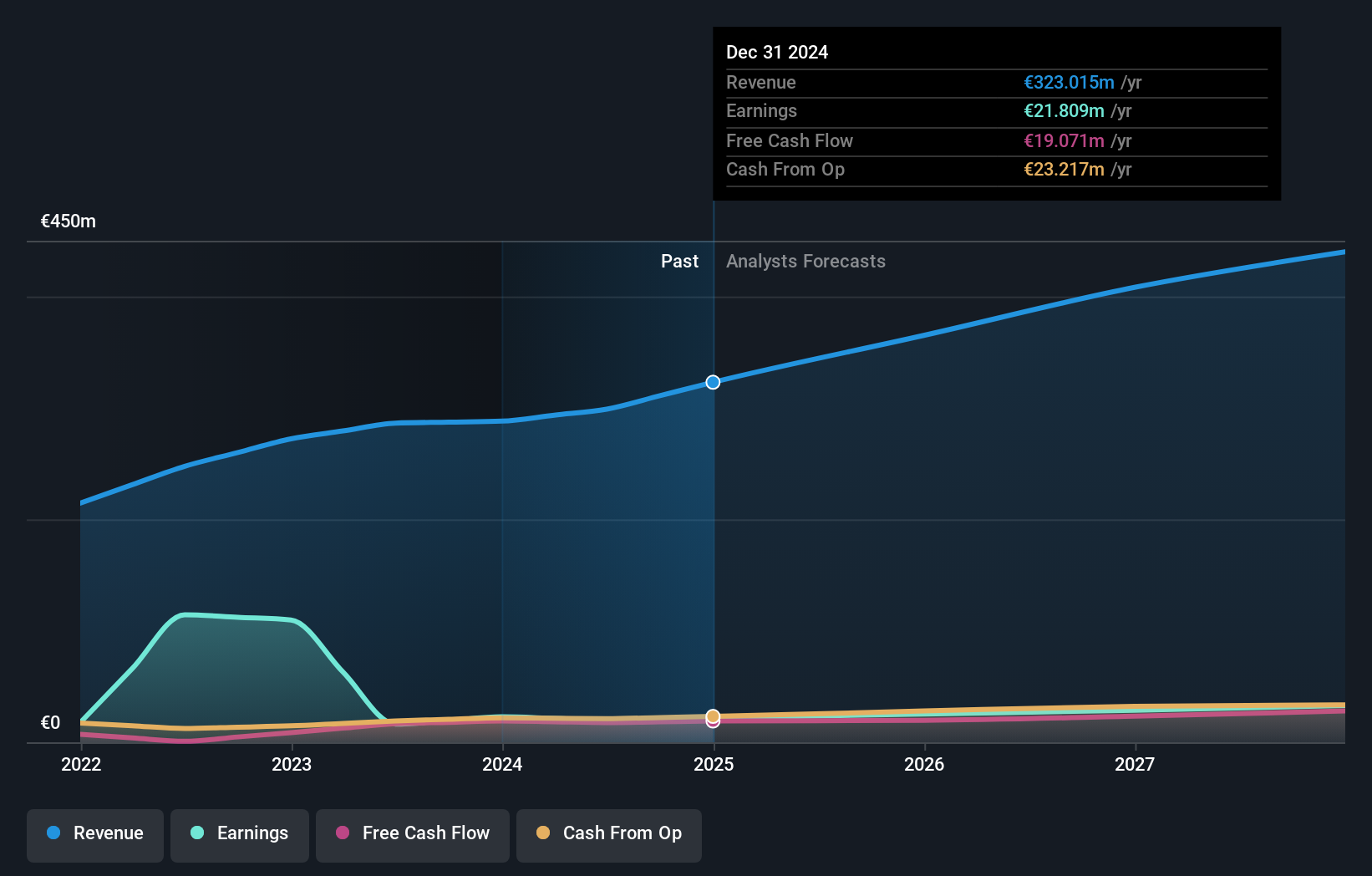

Sword Group's strategic alignment with significant international organizations like WHO underscores its robust positioning in the global tech landscape, marking a notable expansion through a new 5-year contract. This move not only enhances its service offerings but also solidifies its presence in crucial sectors, evidenced by a revenue increase to EUR 323.02 million from EUR 288.13 million year-over-year. Despite a slight dip in net income to EUR 21.81 million, the company's commitment to innovation and international markets is clear, supported by an annual earnings growth forecast of 13.4%, outpacing the French market's average of 12.1%.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market capitalization of €277.30 million.

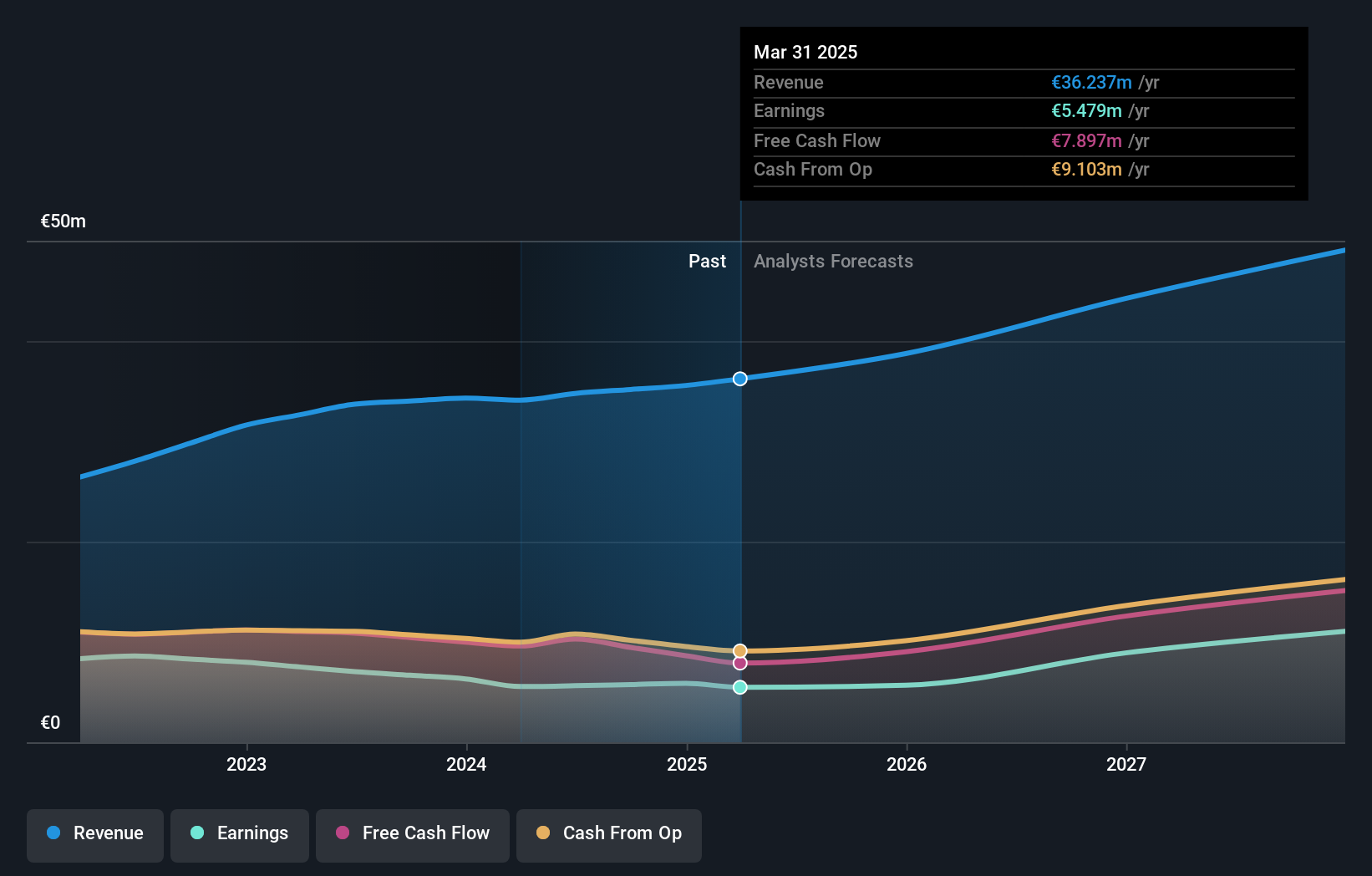

Operations: Admicom Oyj generates revenue primarily from its software and programming segment, which contributed €36.24 million. The company focuses on delivering cloud-based solutions tailored for business process automation within Finland.

Admicom Oyj, a European tech entity, is navigating through a challenging landscape with its revenue and earnings growth outpacing the Finnish market averages. With an annual revenue increase projected at 9.8% and earnings growth forecasted at an impressive 21.5%, Admicom is setting benchmarks in financial performance despite recent setbacks like a significant one-off loss of €3.7M affecting last year's results. The company's strategic focus on R&D has led to substantial investments amounting to €4 million annually, representing about 12% of their total revenue, underscoring their commitment to innovation and future readiness in the competitive software sector. This approach not only fuels their product development but also aligns with industry shifts towards more sustainable and advanced technological solutions.

- Dive into the specifics of Admicom Oyj here with our thorough health report.

Assess Admicom Oyj's past performance with our detailed historical performance reports.

Adtran Networks (XTRA:ADV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adtran Networks SE specializes in creating and distributing optical and Ethernet-based networking solutions aimed at telecommunications carriers and enterprises to facilitate data, storage, voice, and video services, with a market capitalization of approximately €1.06 billion.

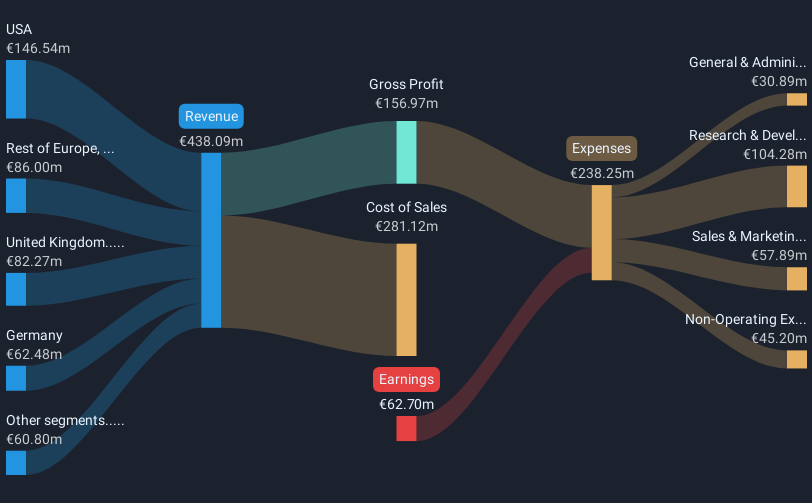

Operations: Adtran Networks SE generates revenue primarily from its optical networking equipment segment, which accounts for €438.09 million. The company's focus is on providing advanced networking solutions tailored for telecommunications carriers and enterprises.

Adtran Networks SE, navigating a turbulent financial landscape, recently amended its credit terms significantly, reducing total commitments to $350 million and addressing prior defaults. Despite these challenges, the company is poised for recovery with an impressive forecasted earnings growth of 145.5% annually. This optimism is tempered by a substantial net loss reported last fiscal year and ongoing concerns from auditors about its viability as a going concern. Adtran's focus on innovation remains evident with R&D expenses strategically aligned to capture evolving market dynamics in tech sectors.

- Get an in-depth perspective on Adtran Networks' performance by reading our health report here.

Examine Adtran Networks' past performance report to understand how it has performed in the past.

Key Takeaways

- Delve into our full catalog of 223 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives