3 European Stocks Estimated To Be Up To 49.5% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the backdrop of uncertainty surrounding U.S. trade policies, European markets have experienced mixed results, with the STOXX Europe 600 Index snapping a ten-week streak of gains. Despite these challenges, opportunities may exist for investors seeking undervalued stocks in Europe, as some equities are estimated to be trading significantly below their intrinsic value. Identifying such stocks often involves looking at companies with strong fundamentals that have been overlooked or mispriced due to broader market concerns.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €33.00 | €65.34 | 49.5% |

| Vimi Fasteners (BIT:VIM) | €0.965 | €1.91 | 49.4% |

| Airbus (ENXTPA:AIR) | €163.00 | €321.97 | 49.4% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.12 | SEK165.50 | 49.8% |

| Wienerberger (WBAG:WIE) | €34.58 | €68.85 | 49.8% |

| TF Bank (OM:TFBANK) | SEK368.00 | SEK720.43 | 48.9% |

| JOST Werke (XTRA:JST) | €50.30 | €98.63 | 49% |

| Star7 (BIT:STAR7) | €6.15 | €12.29 | 50% |

| Neosperience (BIT:NSP) | €0.54 | €1.06 | 49% |

| Cavotec (OM:CCC) | SEK17.15 | SEK33.80 | 49.3% |

Let's review some notable picks from our screened stocks.

Sword Group (ENXTPA:SWP)

Overview: Sword Group S.E. is a global provider of IT and software solutions with a market capitalization of €312.43 million.

Operations: The company's revenue is derived from its IT and software services across three primary regions: Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

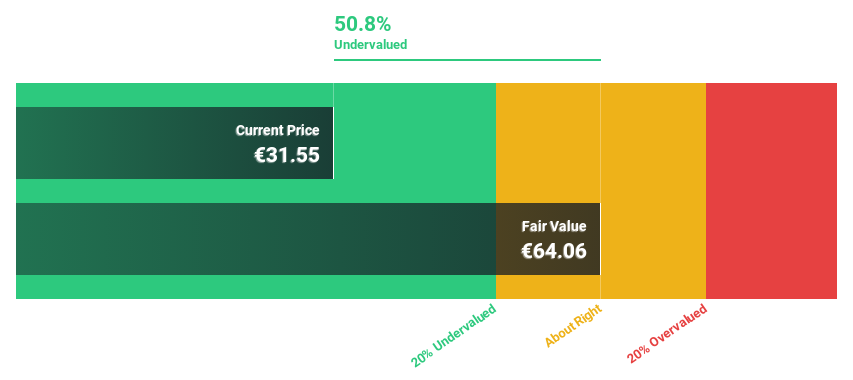

Estimated Discount To Fair Value: 49.5%

Sword Group is trading at €33, significantly below its estimated fair value of €65.34, presenting a compelling case for undervaluation based on discounted cash flow analysis. The stock is priced 49.5% under this fair value estimate and trades favorably compared to peers and the industry. While earnings are projected to grow at 17.3% annually, surpassing the French market's growth rate, revenue growth remains moderate at 13.5%. However, its dividend yield of 5.15% lacks coverage by free cash flows.

- Our growth report here indicates Sword Group may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Sword Group's balance sheet health report.

USU Software (HMSE:OSP2)

Overview: USU Software AG, with a market cap of €228.83 million, offers software and service solutions for IT and customer service management both in Germany and internationally through its subsidiaries.

Operations: The company generates revenue through its Product Business segment, which accounts for €90.33 million, and its Service Business segment, contributing €41.93 million.

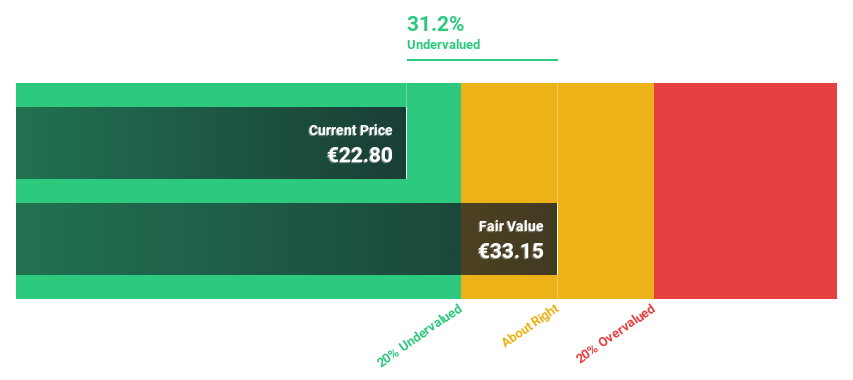

Estimated Discount To Fair Value: 32%

USU Software, trading at €22.70, is significantly undervalued with a fair value estimate of €33.40 based on discounted cash flow analysis. Its earnings are forecast to grow at 30.7% annually, outpacing the German market's 16.1%. Recent developments include the launch of USU FinOps for cloud cost optimization and securing major clients for IT Service Management solutions, enhancing its growth prospects despite outdated financial reports over six months old.

- Our earnings growth report unveils the potential for significant increases in USU Software's future results.

- Take a closer look at USU Software's balance sheet health here in our report.

Nordic Waterproofing Holding (OM:NWG)

Overview: Nordic Waterproofing Holding AB (publ) develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure across Sweden, Norway, Denmark, Finland, the rest of Europe, and internationally with a market cap of SEK4.38 billion.

Operations: The company's revenue is primarily derived from two segments: Products & Solutions, generating SEK3.06 billion, and Installation Services, contributing SEK1.18 billion.

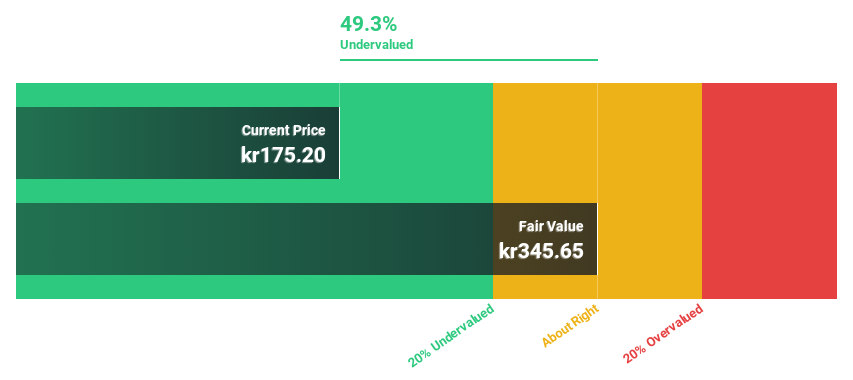

Estimated Discount To Fair Value: 35.1%

Nordic Waterproofing Holding, trading at SEK 182.4, is undervalued with a fair value estimate of SEK 281 based on discounted cash flow analysis. Earnings are forecast to grow significantly at 29% annually, surpassing the Swedish market's growth rate. However, recent earnings showed a decline in sales and net income compared to the previous year. Additionally, Kingspan Holdings' acquisition move could lead to delisting from Nasdaq Stockholm due to increased ownership concentration and liquidity concerns.

- Our expertly prepared growth report on Nordic Waterproofing Holding implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Nordic Waterproofing Holding stock in this financial health report.

Turning Ideas Into Actions

- Dive into all 201 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nordic Waterproofing Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nordic Waterproofing Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NWG

Nordic Waterproofing Holding

Develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure in Sweden, Norway, Denmark, Finland, rest of Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives