Despite lower earnings than a year ago, secunet Security Networks (ETR:YSN) investors are up 57% since then

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the secunet Security Networks Aktiengesellschaft (ETR:YSN) share price is up 55% in the last 1 year, clearly besting the market return of around 17% (not including dividends). So that should have shareholders smiling. Zooming out, the stock is actually down 32% in the last three years.

While the stock has fallen 4.6% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, secunet Security Networks actually saw its earnings per share drop 4.1%.

We don't think that the decline in earnings per share is a good measure of the business over the last twelve months. It makes sense to check some of the other fundamental data for an explanation of the share price rise.

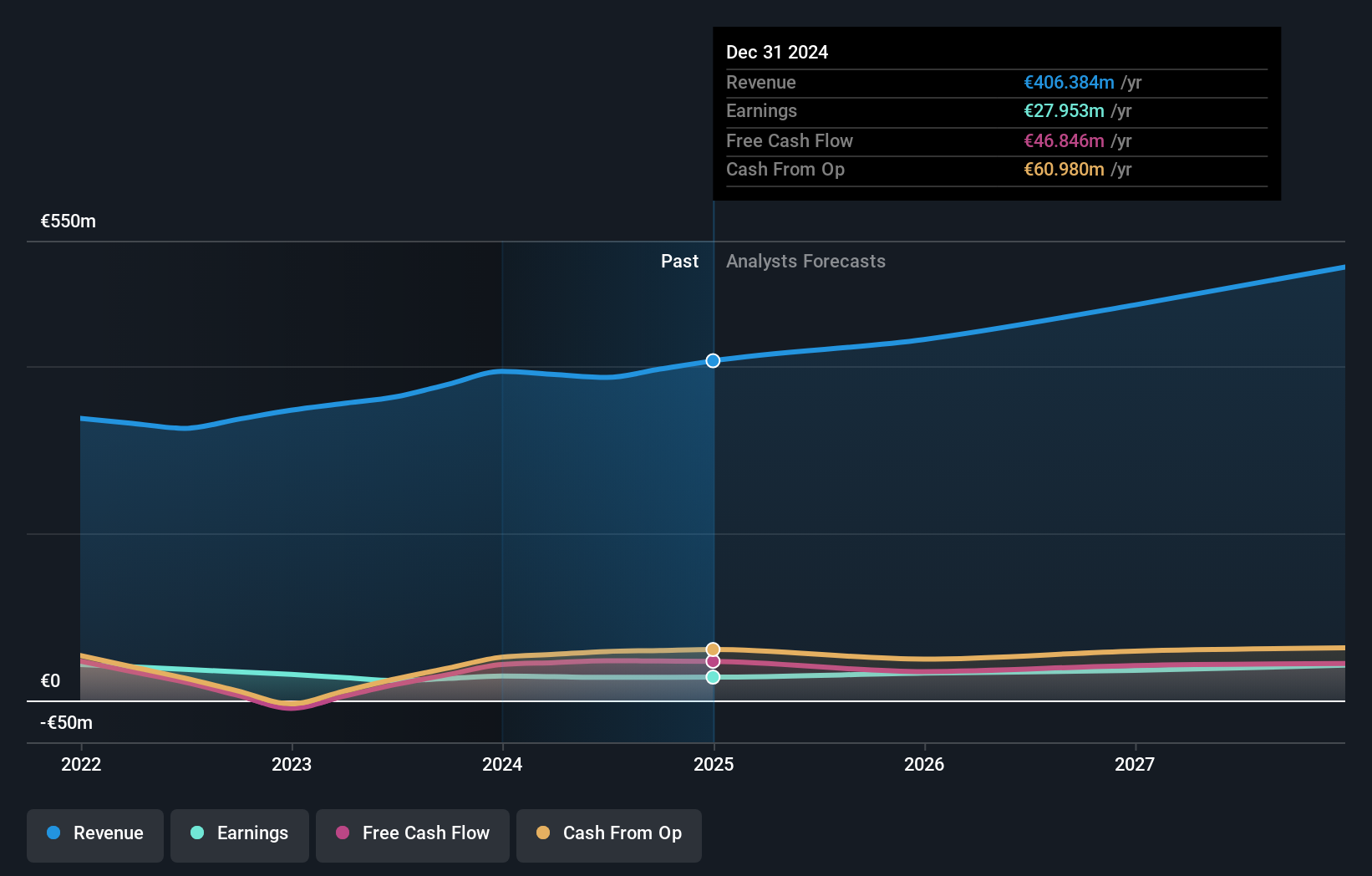

We doubt the modest 1.3% dividend yield is doing much to support the share price. However the year on year revenue growth of 3.2% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think secunet Security Networks will earn in the future (free profit forecasts).

A Different Perspective

It's good to see that secunet Security Networks has rewarded shareholders with a total shareholder return of 57% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 0.7%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand secunet Security Networks better, we need to consider many other factors. For example, we've discovered 1 warning sign for secunet Security Networks that you should be aware of before investing here.

Of course secunet Security Networks may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:YSN

secunet Security Networks

Operates as a cybersecurity company in Germany and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives