Even after rising 11% this past week, Exasol (ETR:EXL) shareholders are still down 74% over the past three years

It's nice to see the Exasol AG (ETR:EXL) share price up 11% in a week. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 74% in that time. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

While the last three years has been tough for Exasol shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Exasol

Exasol wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

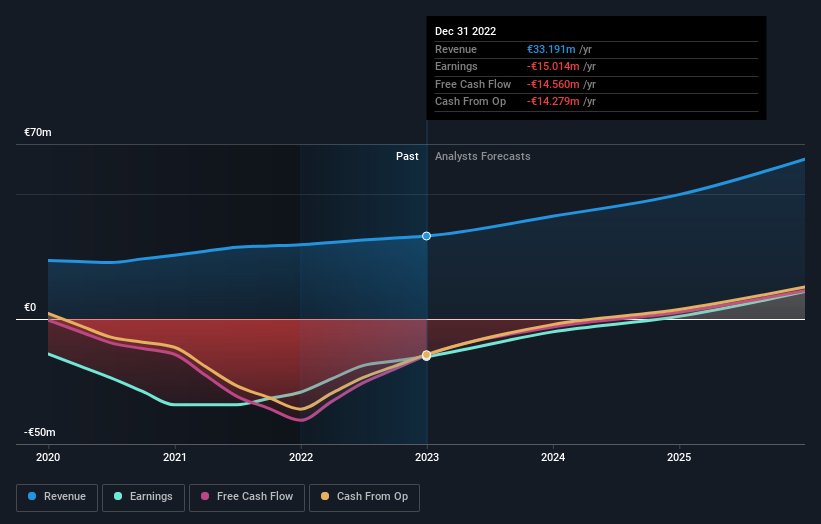

Over three years, Exasol grew revenue at 14% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Exasol shareholders are down 31% for the year, falling short of the market return. Meanwhile, the broader market slid about 4.7%, likely weighing on the stock. However, the loss over the last year isn't as bad as the 20% per annum loss investors have suffered over the last three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Exasol is showing 3 warning signs in our investment analysis , you should know about...

We will like Exasol better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Exasol might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EXL

Exasol

Develops database for analytics and data warehousing in Germany, Austria, Switzerland, Great Britain, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives