DATAGROUP SE Just Beat Revenue By 8.2%: Here's What Analysts Think Will Happen Next

It's been a pretty great week for DATAGROUP SE (ETR:D6H) shareholders, with its shares surging 12% to €64.10 in the week since its latest first-quarter results. It was a workmanlike result, with revenues of €109m coming in 8.2% ahead of expectations, and statutory earnings per share of €0.03, in line with analyst appraisals. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for DATAGROUP

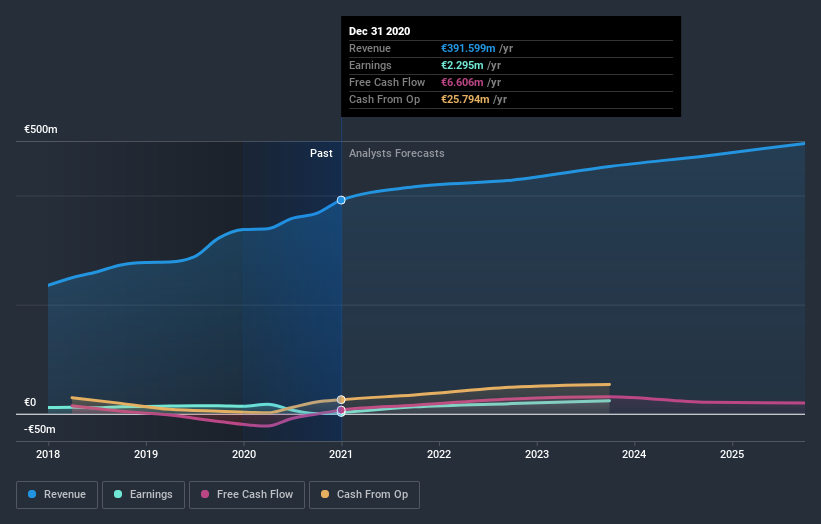

Taking into account the latest results, the most recent consensus for DATAGROUP from six analysts is for revenues of €416.0m in 2021 which, if met, would be an okay 6.2% increase on its sales over the past 12 months. Statutory earnings per share are predicted to leap 4,963% to €1.51. In the lead-up to this report, the analysts had been modelling revenues of €400.9m and earnings per share (EPS) of €1.47 in 2021. So there seems to have been a moderate uplift in sentiment following the latest results, given the upgrades to both revenue and earnings per share forecasts for next year.

It will come as no surprise to learn that the analysts have increased their price target for DATAGROUP 7.0% to €67.38on the back of these upgrades. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values DATAGROUP at €87.00 per share, while the most bearish prices it at €35.00. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's pretty clear that there is an expectation that DATAGROUP's revenue growth will slow down substantially, with revenues next year expected to grow 6.2%, compared to a historical growth rate of 18% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 9.3% next year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than DATAGROUP.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards DATAGROUP following these results. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple DATAGROUP analysts - going out to 2025, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for DATAGROUP that you need to take into consideration.

When trading DATAGROUP or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:D6H

DATAGROUP

Provides information technology (IT) solutions in Germany and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026