Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term Bechtle AG (ETR:BC8) shareholders would be well aware of this, since the stock is up 163% in five years. Meanwhile the share price is 3.1% higher than it was a week ago.

See our latest analysis for Bechtle

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

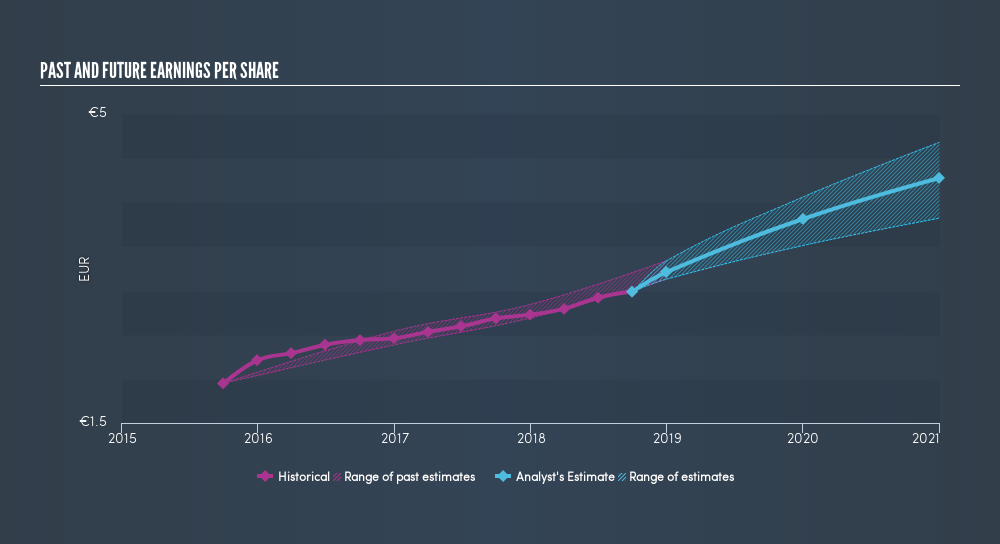

During five years of share price growth, Bechtle achieved compound earnings per share (EPS) growth of 17% per year. This EPS growth is reasonably close to the 21% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Bechtle has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Bechtle will revenue can grow in the future.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Bechtle's TSR for the last 5 years was 183%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Bechtle shareholders have received a total shareholder return of 8.7% over the last year. Of course, that includes the dividend. Having said that, the five-year TSR of 23% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before forming an opinion on Bechtle you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:BC8

Bechtle

Provides information technology (IT) services primarily in Europe.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives