As geopolitical tensions in the Middle East have recently influenced global markets, Germany's DAX Index has seen a decline of 1.81%, reflecting broader investor caution across Europe. Despite these challenges, high-growth tech stocks in Germany continue to capture attention due to their potential for innovation and resilience, making them worthy of exploration for those interested in navigating the current economic landscape effectively.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.52% | 29.17% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

All for One Group (XTRA:A1OS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and other international markets with a market cap of approximately €249.96 million.

Operations: The company generates revenue primarily through its CORE segment, contributing €442.47 million, and its LOB segment, which adds €77.01 million. The focus on providing business software solutions for major platforms like SAP, Microsoft, and IBM across various regions supports its market presence.

All for One Group SE, a German tech firm, has demonstrated robust financial recovery and strategic market maneuvers. Recently reporting a significant turnaround with third-quarter sales reaching €122.28 million, up from €120.35 million the previous year, and transforming last year's net loss into a profit of €0.525 million showcases their resilience. This performance is underpinned by a notable 59.6% earnings growth over the past year and an anticipated annual profit surge of 24.6%. The company also actively engages in shareholder value activities, evidenced by its recent share repurchase program totaling €3.7 million. The firm's commitment to innovation is evident in its R&D investments which are crucial for maintaining competitive advantage in the rapidly evolving tech landscape; however, specific figures were not disclosed here for deeper analysis on R&D spending trends relative to revenue or total expenses. Looking ahead, All for One Group SE’s presence at significant industry events like the Baader Investment Conference suggests ongoing efforts to strengthen industry connections and potentially forge new paths in high-tech solutions across Europe.

- Click here and access our complete health analysis report to understand the dynamics of All for One Group.

Gain insights into All for One Group's past trends and performance with our Past report.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally with a market capitalization of approximately €462.94 million.

Operations: The company generates revenue primarily from IT services, amounting to €1.39 billion, and IT solutions, contributing €128.12 million. The business focuses on delivering technology-driven solutions across various regions while managing costs associated with consolidation and reconciliation.

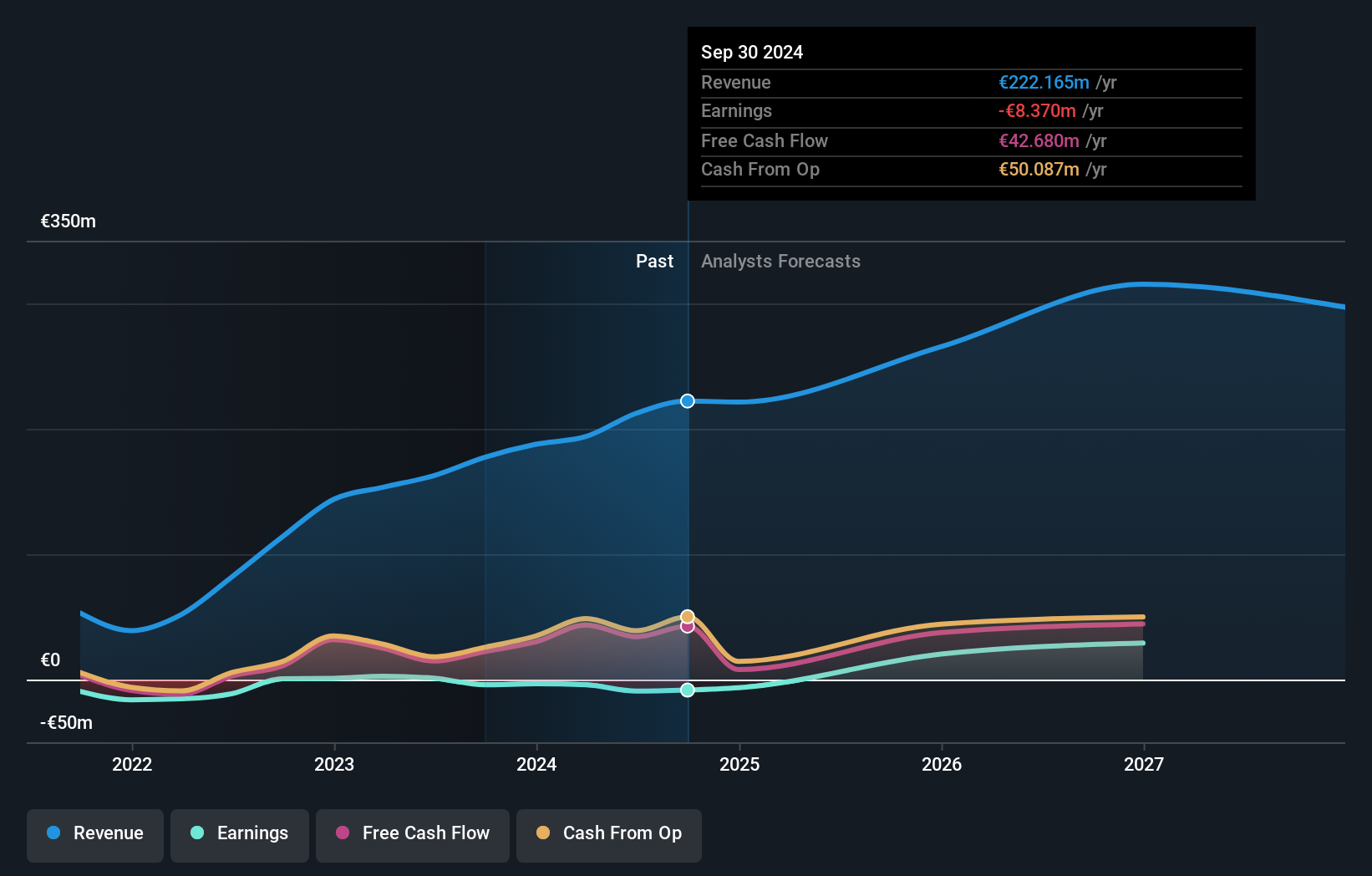

Adesso SE, navigating through a challenging landscape, posted a revenue increase to €633.47 million from €548.19 million year-over-year, reflecting an 11.7% growth rate which outpaces the German market's average of 5.4%. Despite this revenue upswing, the firm faced a net loss expansion to €9.86 million from €5.89 million previously reported, indicating areas needing strategic refinement. The company's commitment to innovation is underscored by its R&D efforts; however, it's crucial to note that R&D expenses have surged by 46.4%, signaling a potent focus on developing cutting-edge solutions in software and AI technologies that could shape future profitability and market position.

- Take a closer look at adesso's potential here in our health report.

Evaluate adesso's historical performance by accessing our past performance report.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market capitalization of approximately €281.04 million.

Operations: Brockhaus Technologies generates revenue primarily from its Security Technologies and Financial Technologies segments, with Financial Technologies contributing €174.59 million and Security Technologies adding €37.03 million.

Brockhaus Technologies AG, amidst a vibrant tech landscape, is navigating through an intriguing phase of growth and innovation. Recently spotlighted at multiple industry conferences, the company has reaffirmed its revenue targets for 2024 and 2025, aiming for up to €240 million and €320 million respectively. This projection aligns with a robust R&D investment strategy that saw expenses climb by 16.8%, underscoring its commitment to advancing technological capabilities. Moreover, despite current unprofitability, Brockhaus anticipates a significant turnaround with earnings expected to surge by 93% annually. This strategic pivot towards enhanced R&D could be pivotal in transitioning from recent losses—evidenced by a net loss of €6.65 million in the first half of 2024—to projected profitability, positioning it as a potential key player in Germany's tech sector evolution.

Key Takeaways

- Embark on your investment journey to our 41 German High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives