- Germany

- /

- Semiconductors

- /

- XTRA:WAF

Assessing Siltronic (XTRA:WAF) Valuation Following Recent Share Price Moves and Analyst Outlook

Reviewed by Kshitija Bhandaru

Siltronic (XTRA:WAF) shares have caught investors' attention lately, with the stock seeing strong movement over the past month. The performance raises fresh questions about the company's current valuation and outlook.

See our latest analysis for Siltronic.

While Siltronic’s 1-month share price return suggests steadiness, the longer-term total shareholder return tells a different story. Over the past year, there has been a modest decline. Recent price movement indicates that investors remain cautious about the company’s growth outlook and overall risk profile.

If you’re looking for other opportunities with strong momentum and hidden potential, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Siltronic’s valuation sitting below analyst targets and a recent dip in net income, investors now face the question: is there value left to unlock, or has the market fairly priced in all the company’s future growth?

Most Popular Narrative: 16.7% Overvalued

Siltronic’s latest fair value estimate sits well below its last close, making recent bullish moves look increasingly stretched by consensus forecasts. The gap between analyst projections and current price now drives a new debate on where the stock’s value truly lies.

Siltronic's recent completion and ramp-up of its new FabNext facility positions the company to capitalize on the accelerating demand from AI, cloud, and data center growth. This enables higher production of advanced 300mm wafers. Once inventory overhangs clear, this capacity expansion is likely to drive meaningful revenue and margin growth.

Curious what growth leaps analysts are banking on? The biggest driver of this estimate is a dramatic profit turnaround powered by sector transformation. What assumptions were bold enough to lift the fair value so far above the current trend? Dive in to find out which growth stories and margin rebounds form the backbone of this forecast.

Result: Fair Value of €45.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high customer inventories or rising international competition could delay Siltronic’s recovery and challenge its ambitions for higher profitability.

Find out about the key risks to this Siltronic narrative.

Another Perspective: What About Cash Flows?

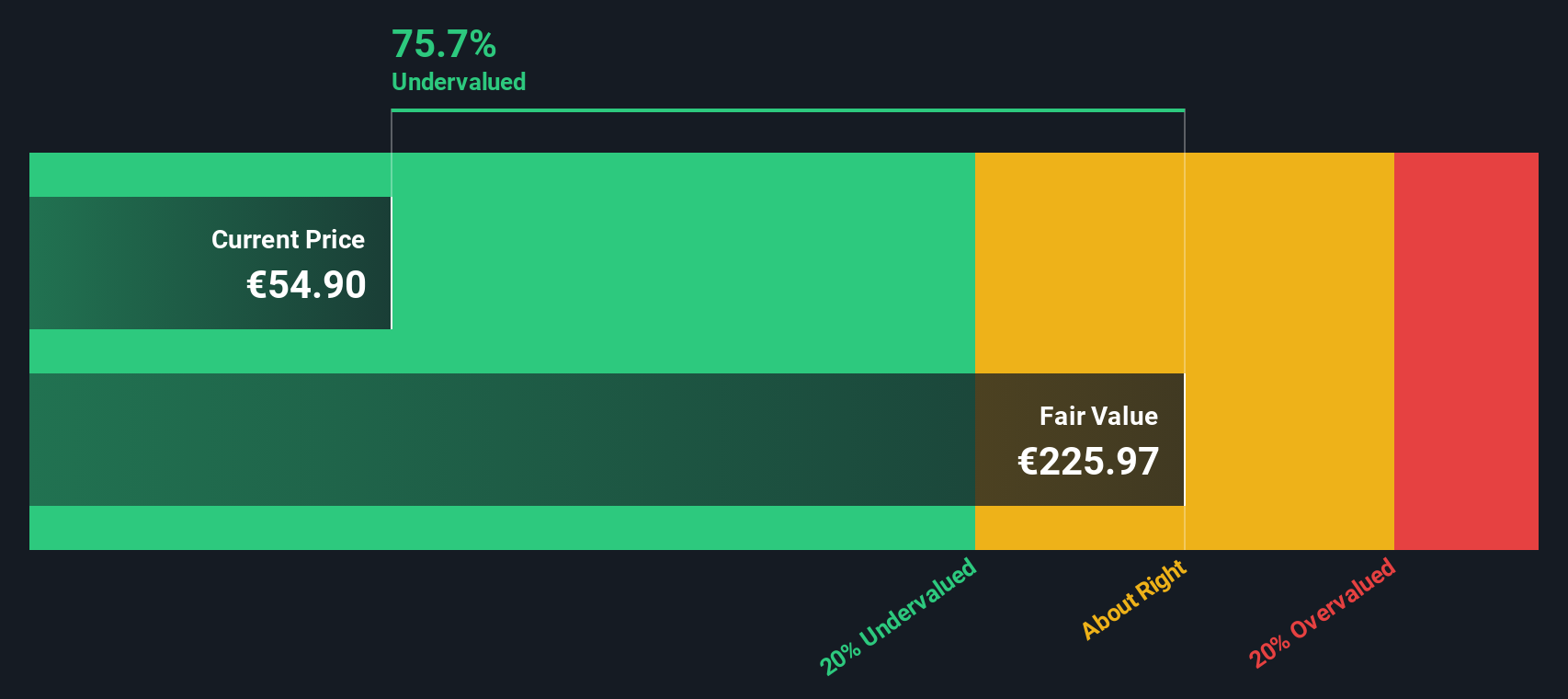

While analyst targets call Siltronic overvalued, our SWS DCF model presents a starkly different scenario. It suggests the shares may actually be trading well below fair value. This could indicate a potential opportunity for those who prioritize long-term cash flow projections rather than near-term multiple concerns. Could this disconnect be a chance for contrarian investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Siltronic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Siltronic Narrative

If you see things differently or want to dig into the details yourself, you can shape your own Siltronic story in just a few minutes with Do it your way

A great starting point for your Siltronic research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s opportunity pass you by. Next-level portfolio growth could be right around the corner if you check out these handpicked investment angles:

- Supercharge your watchlist with these 901 undervalued stocks based on cash flows that the market may have overlooked. These could offer compelling upside potential grounded in strong cash flows.

- Enhance your income strategy and see which companies are rewarding shareholders via these 19 dividend stocks with yields > 3%, consistently delivering yields above 3%.

- Tap into tomorrow’s breakthroughs with these 26 quantum computing stocks, which are pushing the boundaries in quantum computing, data security, and next-generation applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:WAF

Siltronic

Develops, produces, markets, and sells hyperpure silicon wafers for the semiconductor industry in Germany, rest of Europe, the United States, Taiwan, Mainland China, South Korea, rest of Asia, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives