- Germany

- /

- Semiconductors

- /

- XTRA:SMHN

SUSS MicroTec (XTRA:SMHN) Valuation Update After Outlook Cut and Sharp Share Price Drop

Reviewed by Simply Wall St

SUSS MicroTec (XTRA:SMHN) shares dropped sharply after the company trimmed its full-year outlook for the second time this year. The company cited continuing margin pressures and softer-than-expected order intake. Investors quickly responded to the updated guidance.

See our latest analysis for SUSS MicroTec.

SUSS MicroTec’s momentum has clearly faded, with markets reacting to the latest guidance cut and margin concerns. The share price plunged over 24% in the past week and is now down more than 46% for the year to date. The one-year total shareholder return is a stark -52%. Despite this sharp pullback, the long-term numbers still show the stock is well above where it was three and five years ago, highlighting the volatility that can come with changing outlooks in the semiconductor space.

If you’re wondering what other opportunities are worth watching amid these swings, now’s the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares now trading at a notable discount to analyst targets, the question is whether recent weakness offers a compelling entry point or if the market is accurately reflecting SUSS MicroTec’s future outlook and risks.

Most Popular Narrative: 40.2% Undervalued

Market sentiment appears to have overshot the downside, with the latest widely followed narrative suggesting SUSS MicroTec’s fair value is significantly above its last close. The most optimistic case rests on evolving product launches and strategic expansion. The market’s current discount hints at skepticism about near-term growth.

Expansion in products, technology, and regional manufacturing strengthens SUSS MicroTec's market position, supports innovation, and mitigates customer concentration risk. Strong industry demand and a diversified customer base underpin recurring revenue, stable margins, and future growth despite temporary fluctuations in order intake.

Want to know what financial dynamics justify this massive narrative gap? The story is driven by bolder earnings and revenue projections than the market seems to believe. Find out how changing margin assumptions and future profit multiples unlocked this fair value target.

Result: Fair Value of $44.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steep declines in order intake and persistent margin compression still threaten both SUSS MicroTec’s earnings momentum and the potential for future valuation recovery.

Find out about the key risks to this SUSS MicroTec narrative.

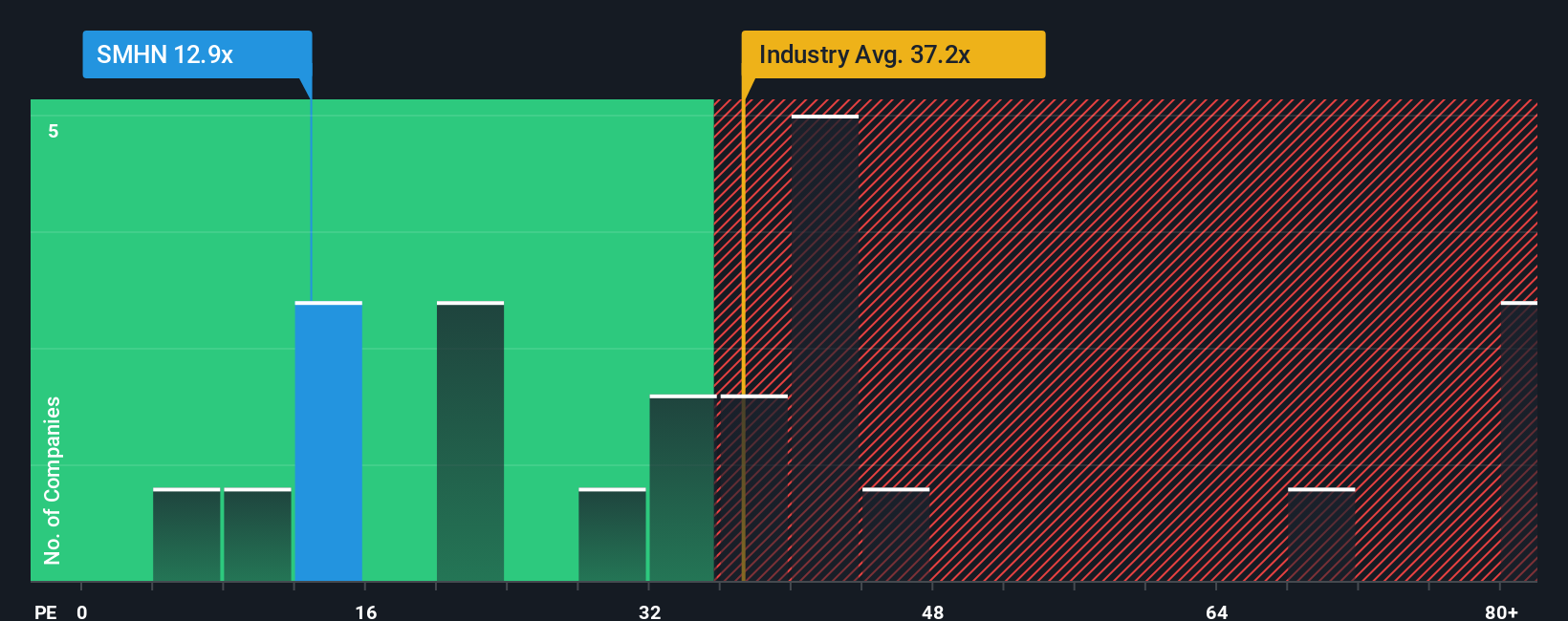

Another Perspective: What About Multiples?

While analyst models point to significant upside, today’s valuation based on the company’s price-to-earnings ratio tells a subtler story. SUSS MicroTec trades at 8.5 times earnings, which is much lower than both its peer average (13.6x) and the wider European semiconductor market (37.1x). Even compared to its fair ratio of 15x, the stock appears attractively priced. This gap could signal opportunity if investor sentiment rebounds, or caution if earnings are at risk. Does this discount reflect hidden risks, or has the selloff gone too far?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SUSS MicroTec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 853 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SUSS MicroTec Narrative

If you want to approach the data from a fresh angle or reach your own conclusion, you can dive in and craft a narrative yourself in just a few minutes. Do it your way

A great starting point for your SUSS MicroTec research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities never run out. Give yourself an edge by checking the latest hand-picked stocks and themes making waves in today’s markets.

- Jump on powerful income trends and see which companies are delivering reliable payouts with these 21 dividend stocks with yields > 3% yielding over 3%.

- Ride the AI surge by tapping into real innovation with these 26 AI penny stocks that are transforming industries from healthcare to automation.

- Unlock value by targeting these 853 undervalued stocks based on cash flows with strong cash flows that are trading at bargain prices before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SMHN

SUSS MicroTec

Develops, manufactures, markets, and maintains systems to produce microelectronics, microelectromechanical systems, and related applications.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)