- Germany

- /

- Semiconductors

- /

- XTRA:S92

Investors one-year losses continue as SMA Solar Technology (ETR:S92) dips a further 7.3% this week, earnings continue to decline

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame SMA Solar Technology AG (ETR:S92) shareholders if they were still in shock after the stock dropped like a lead balloon, down 72% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Even if you look out three years, the returns are still disappointing, with the share price down54% in that time. The falls have accelerated recently, with the share price down 38% in the last three months.

If the past week is anything to go by, investor sentiment for SMA Solar Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for SMA Solar Technology

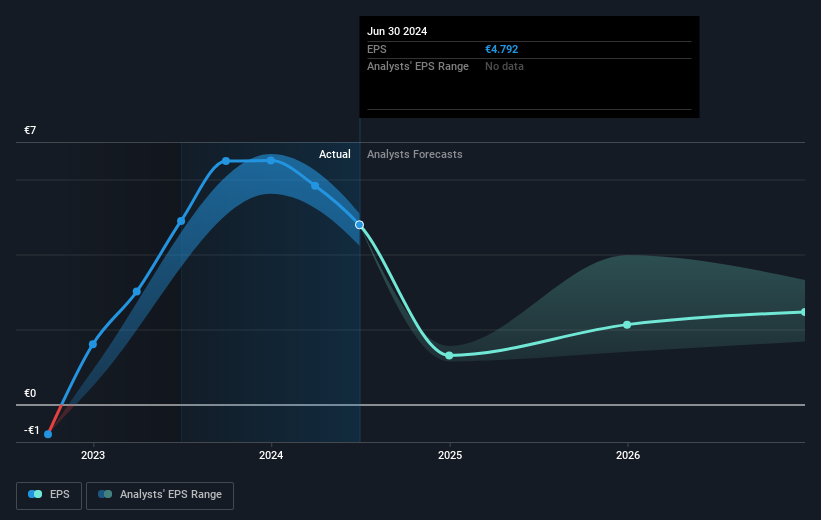

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately SMA Solar Technology reported an EPS drop of 2.1% for the last year. The share price decline of 72% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders more nervous about the business. The less favorable sentiment is reflected in its current P/E ratio of 3.63.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how SMA Solar Technology has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 10% in the last year, SMA Solar Technology shareholders lost 71% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand SMA Solar Technology better, we need to consider many other factors. Take risks, for example - SMA Solar Technology has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:S92

SMA Solar Technology

Develops, produces, and sells PV and battery inverters, transformers, chokes, monitoring systems for PV systems, and charging solutions for electric vehicles in Germany and internationally.

Undervalued with adequate balance sheet.