- Germany

- /

- Industrials

- /

- XTRA:INH

3 Dividend Stocks To Consider With Up To 5.9% Yield

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence dipping and major stock indexes experiencing moderate gains, investors are increasingly seeking stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration for those looking to balance risk and reward amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

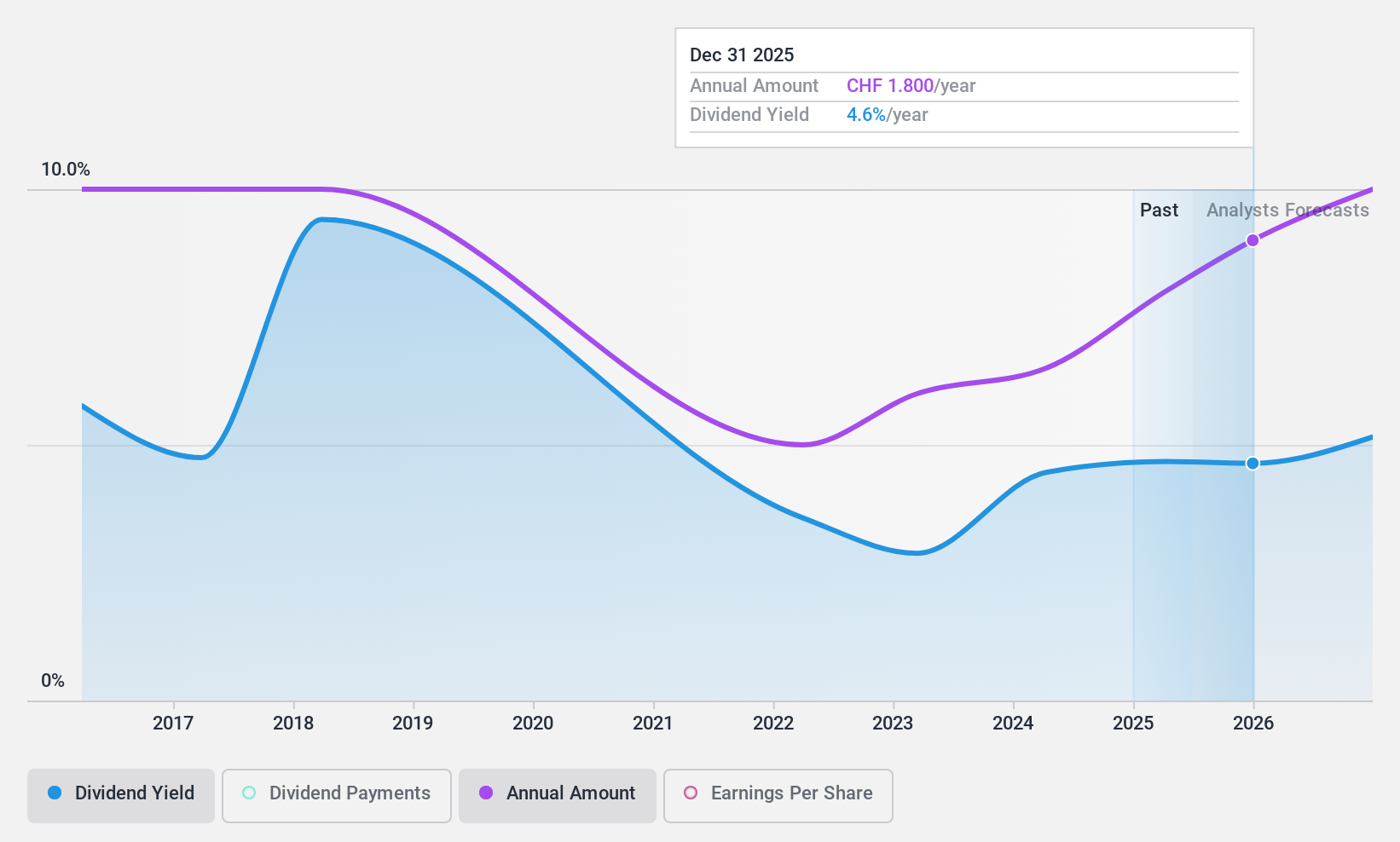

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG is a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF318.89 million.

Operations: Meier Tobler Group AG generates revenue through its Service segment, contributing CHF104.01 million, and its Distribution segment, which accounts for CHF404.27 million.

Dividend Yield: 4.6%

Meier Tobler Group's dividend yield of 4.6% ranks it among the top 25% in the Swiss market, yet its dividend sustainability is questionable due to unreliable and volatile payments over the past decade. The payout ratio of 76.3% suggests coverage by earnings, but a high cash payout ratio of 179.3% indicates poor coverage by free cash flows. Despite trading significantly below estimated fair value, profit margins have declined from last year, and share price volatility remains high.

- Get an in-depth perspective on Meier Tobler Group's performance by reading our dividend report here.

- The analysis detailed in our Meier Tobler Group valuation report hints at an deflated share price compared to its estimated value.

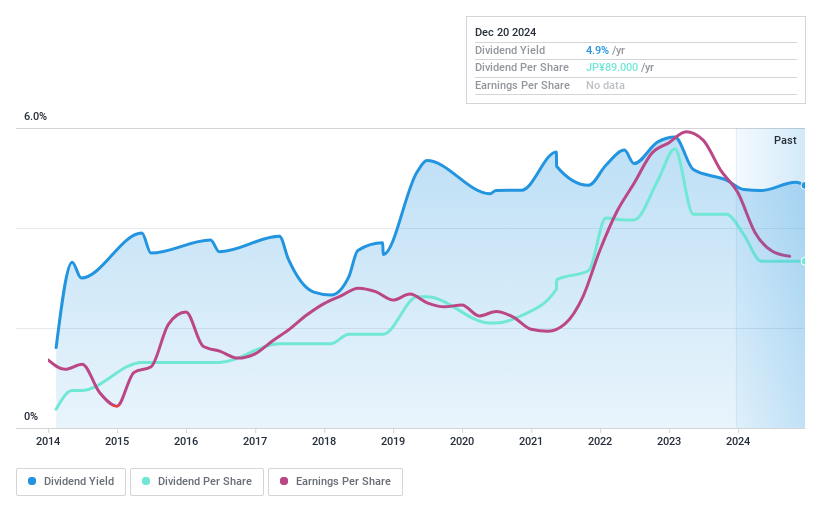

Suzuden (TSE:7480)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Suzuden Corporation operates in Japan, focusing on the purchasing and selling of electrical and electronic components, with a market cap of ¥26.37 billion.

Operations: Suzuden Corporation's revenue is primarily derived from its Electrical and Electronic Components Sales segment, which accounts for ¥45.70 billion, supplemented by its Manufacturing Business segment at ¥255.66 million.

Dividend Yield: 4.7%

Suzuden's dividend yield of 4.73% places it in the top 25% of Japanese dividend payers, supported by a payout ratio of 82.3% and a low cash payout ratio of 28.6%, indicating strong coverage by earnings and cash flows. Despite this, Suzuden's dividends have been volatile over the past decade, raising concerns about reliability. Trading at 81.6% below estimated fair value suggests potential undervaluation despite an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Suzuden stock in this dividend report.

- The analysis detailed in our Suzuden valuation report hints at an inflated share price compared to its estimated value.

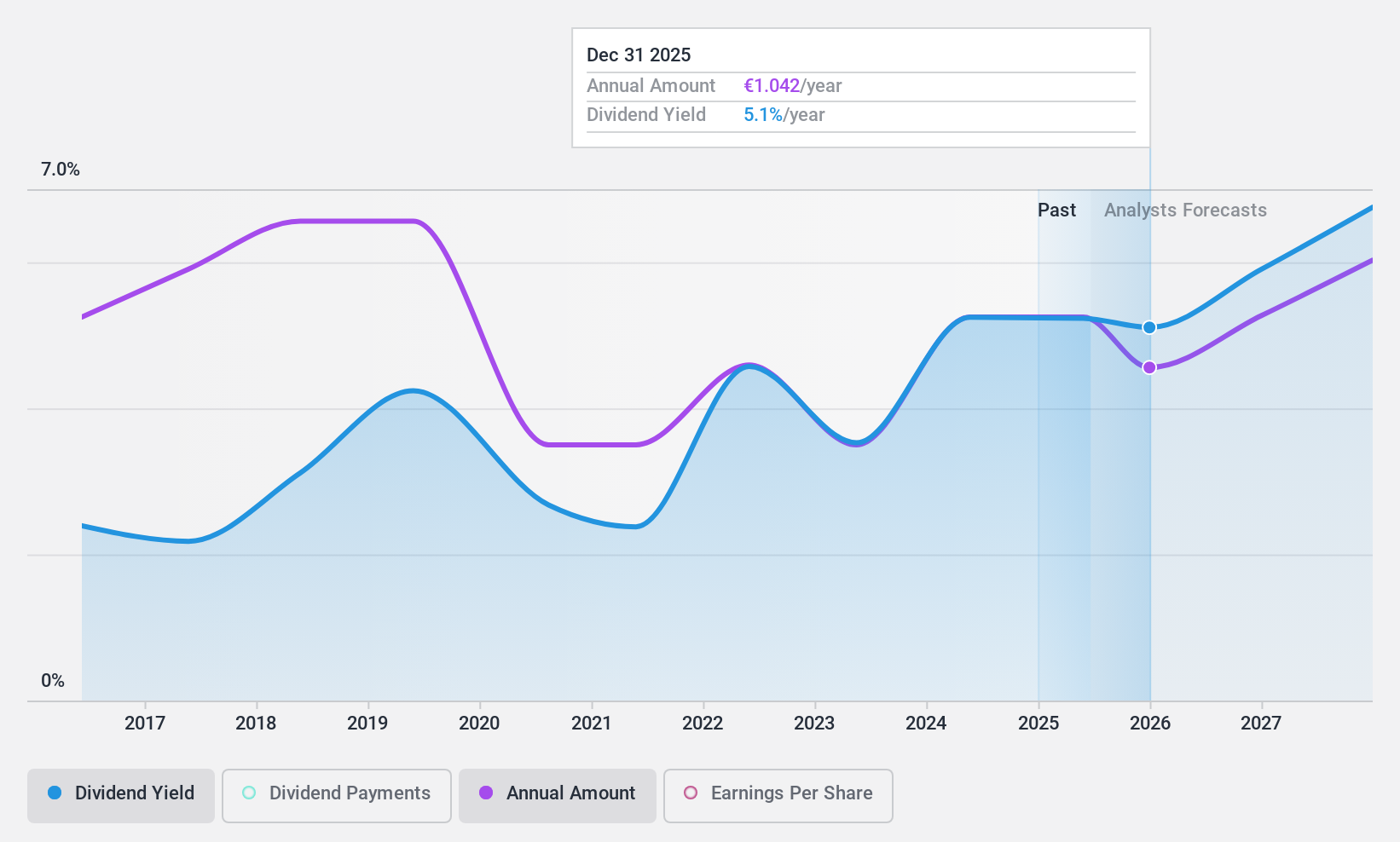

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm focused on mergers, acquisitions, and corporate spin-offs, with a market cap of €523.28 million.

Operations: INDUS Holding AG generates its revenue from three main segments: Materials (€573.57 million), Engineering (€585.87 million), and Infrastructure (€562.75 million).

Dividend Yield: 5.9%

INDUS Holding offers a dividend yield of 5.91%, ranking in the top 25% of German payers, with dividends covered by earnings (payout ratio: 51.1%) and cash flows (cash payout ratio: 24.7%). Despite this coverage, its dividend history is volatile and unreliable over the past decade. The company trades at an estimated 58% below fair value, though recent earnings show decreased sales and net income compared to last year, indicating potential financial challenges.

- Click to explore a detailed breakdown of our findings in INDUS Holding's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of INDUS Holding shares in the market.

Where To Now?

- Reveal the 1940 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:INH

INDUS Holding

A private equity firm specializing in mergers and acquisitions and corporate spin-offs.

Very undervalued established dividend payer.