- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Will Infineon’s New Anti-Fraud Gift Card Chips Shift Its Security Narrative (XTRA:IFX)?

Reviewed by Sasha Jovanovic

- Earlier this week, Infineon Technologies introduced two secured prepaid tag solutions designed to combat the significant rise in gift card fraud, using cryptographic NFC chips to protect both open and closed loop card systems.

- This move addresses the growing cost burden on merchants, as each dollar lost to gift card fraud can result in four dollars of operational expenses, and leverages partnerships, including with Karta Gift Card Ltd., to enhance transaction security and simplify adoption for retailers.

- We'll now examine how Infineon's launch of advanced fraud-prevention gift card technologies may influence its broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Infineon Technologies Investment Narrative Recap

To be a shareholder in Infineon Technologies right now, you need to believe in the broad adoption of secure, AI-enabled power and sensor solutions, particularly as AI infrastructure and smarter power systems drive demand for the company’s products. While the launch of advanced secured prepaid tag solutions highlights Infineon's continued innovation in security, the impact on immediate financial performance is unlikely to shift the central catalyst around recovery in AI data center demand, nor does it materially change the biggest risk, persistent margin pressure from elevated inventory and customer destocking trends.

Of the recent announcements, the expanded partnership with Qt Group to integrate high-performance graphics on Infineon’s microcontroller family directly supports the company’s strategy to lead in AI edge devices, a space closely tied to Infineon’s growth catalyst in smart infrastructure and consumer products. This alignment between product launches and ecosystem expansion reinforces the company’s focus on capturing high-value, high-growth opportunities while balancing execution risks and industry cycles.

However, keeping in mind how prolonged inventory challenges and high idle charges could pressure margins, investors should not ignore the possibility that...

Read the full narrative on Infineon Technologies (it's free!)

Infineon Technologies' narrative projects €19.1 billion revenue and €3.4 billion earnings by 2028. This requires 9.4% yearly revenue growth and a €2.3 billion earnings increase from €1.1 billion today.

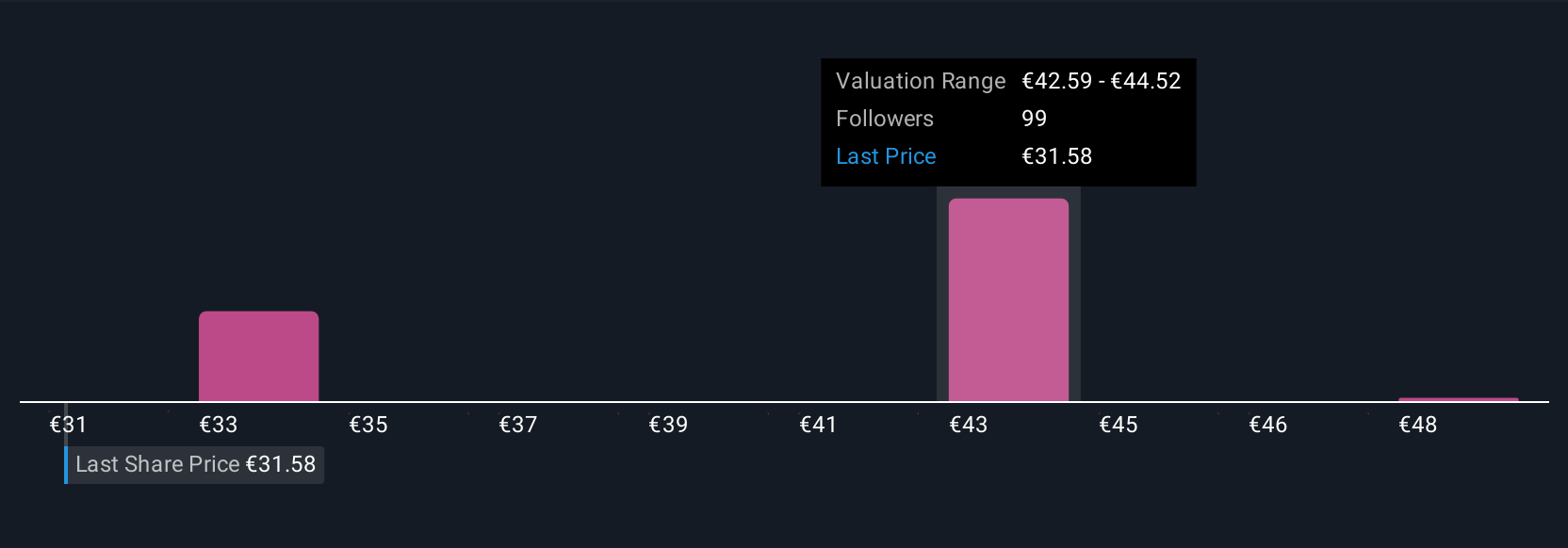

Uncover how Infineon Technologies' forecasts yield a €42.95 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community for Infineon range from €30.93 to €42.95, reflecting diverse expectations across retail investors. As AI-driven demand in power and sensor solutions remains a core catalyst, it is clear that market opinions on future potential can differ significantly, readers are encouraged to examine several viewpoints.

Explore 6 other fair value estimates on Infineon Technologies - why the stock might be worth 8% less than the current price!

Build Your Own Infineon Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infineon Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Infineon Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infineon Technologies' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Engages in the design, development, manufacture, and marketing of semiconductors and semiconductor-based solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives