- Germany

- /

- Semiconductors

- /

- XTRA:IFX

Infineon Technologies (XTRA:IFX): Assessing Valuation After Earnings, Guidance, and New AI Data Center Partnership News

Reviewed by Simply Wall St

Infineon Technologies (XTRA:IFX) just delivered a new wave of updates. Alongside its full-year earnings release, the company issued earnings guidance for the next quarter and revealed a collaboration aiming at AI data center power solutions.

See our latest analysis for Infineon Technologies.

The combination of new earnings guidance and its push into AI data center power solutions has helped Infineon Technologies attract fresh attention this quarter. After a rocky summer, the share price has bounced back with a 7-day gain of 5.8% and a 30-day return of 11.7%. This has contributed to a solid year-to-date price return of 14.3%. Over the longer haul, the total shareholder return clocks in at 17.7% for the past year and nearly 39% over five years. This demonstrates that long-term investors have been rewarded, even if momentum has ebbed and flowed recently.

Curious to find other technology innovators making waves? Now’s the perfect time to see the full list for free with our tech and AI stocks screener: See the full list for free.

But with the stock up strongly this month and fresh news now out, investors are asking a familiar question: Is Infineon still undervalued, or has the market already priced in the company’s AI-driven future growth?

Most Popular Narrative: 16.6% Undervalued

At €35.89, Infineon Technologies trades noticeably below the most widely followed fair value estimate of €43.02. This sets an intriguing stage for the narrative’s take on the next growth phase.

Infineon's power and sensor solutions are experiencing accelerating demand from AI data center build-outs, with projected revenues in this segment growing from approximately €600 million this year to €1 billion next year. This reflects a strong multi-year increase in high-margin revenue from the rapid proliferation of AI infrastructure and rising chip content per device.

Want to know the secret sauce behind this valuation? This narrative hinges on robust expansion forecasts, higher margins, and a significant re-rating of future profits. Which numbers push the fair value so far above today’s price? Check out the critical assumptions that could reshape how you assess Infineon.

Result: Fair Value of €43.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors like ongoing trade tensions and persistently high inventory levels could challenge Infineon’s ability to deliver on these optimistic projections.

Find out about the key risks to this Infineon Technologies narrative.

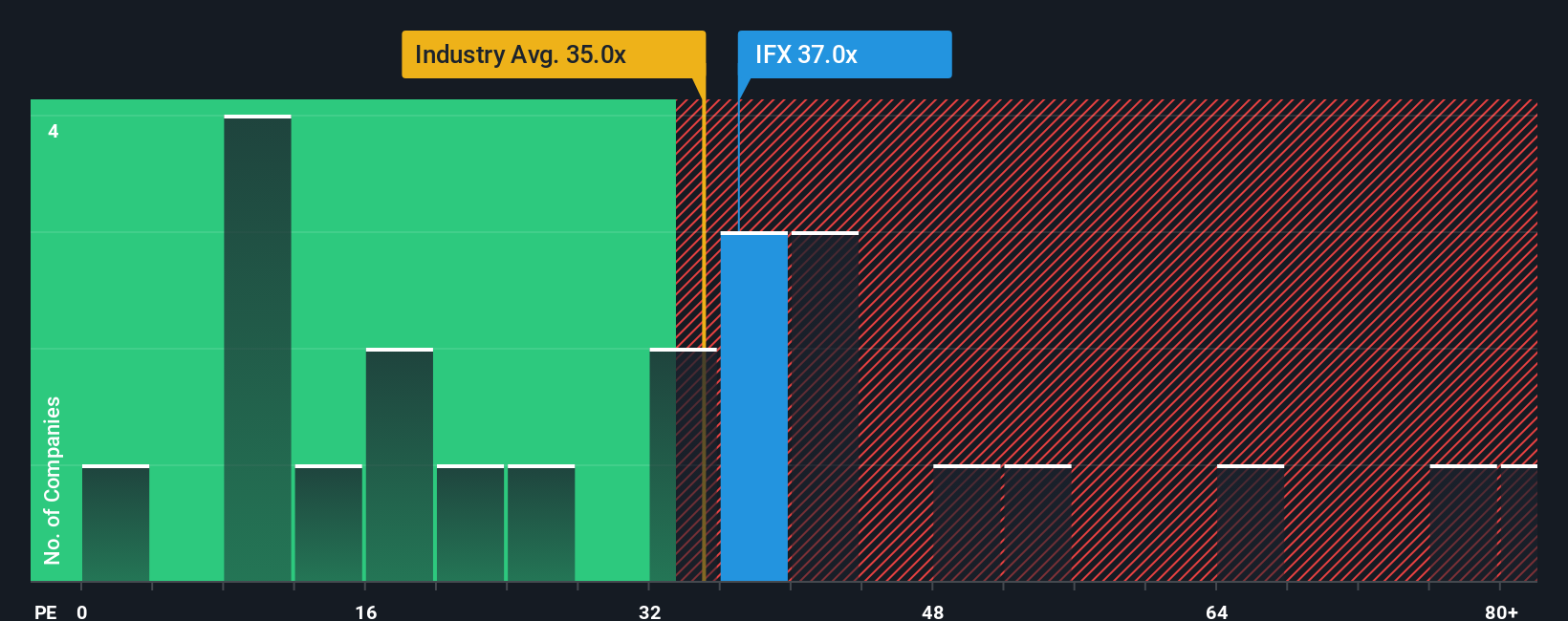

Another View: Looking at Market Multiples

While the analyst consensus points to Infineon being undervalued, market multiples paint a different picture. Infineon's price-to-earnings ratio stands at 41.8x, which is notably higher than both its industry average of 33.5x and its peers at 22.1x. Even compared to the fair ratio of 32x, the current valuation is elevated. In practical terms, this means the market is already expecting significant results, and any misstep or slowdown could put the share price under pressure. Can high expectations be met or even exceeded from this point?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Infineon Technologies Narrative

If the story above doesn't match your perspective or you want to dig into the numbers on your own terms, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Infineon Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your horizons and uncover stocks that fit your unique strategy. If you want to stay ahead, now is the time to take action. Don’t miss the opportunities smart investors are already exploring.

- Boost your income by targeting reliable yields with these 14 dividend stocks with yields > 3% and see which companies are actually delivering on strong payout potential.

- Ride the wave of innovation in intelligent automation by reviewing these 27 AI penny stocks set to benefit most from the AI transformation already underway.

- Stay ahead in the race for digital currency adoption as these 82 cryptocurrency and blockchain stocks redefine how industries transact and secure value across the globe.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IFX

Infineon Technologies

Engages in the design, development, manufacture, and marketing of semiconductors and semiconductor-based solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives