- Germany

- /

- Semiconductors

- /

- XTRA:ELG

Is Elmos Semiconductor SE's (ETR:ELG) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Elmos Semiconductor (ETR:ELG) has had a great run on the share market with its stock up by a significant 24% over the last three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Specifically, we decided to study Elmos Semiconductor's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Elmos Semiconductor

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Elmos Semiconductor is:

11% = €32m ÷ €286m (Based on the trailing twelve months to September 2021).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.11 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Elmos Semiconductor's Earnings Growth And 11% ROE

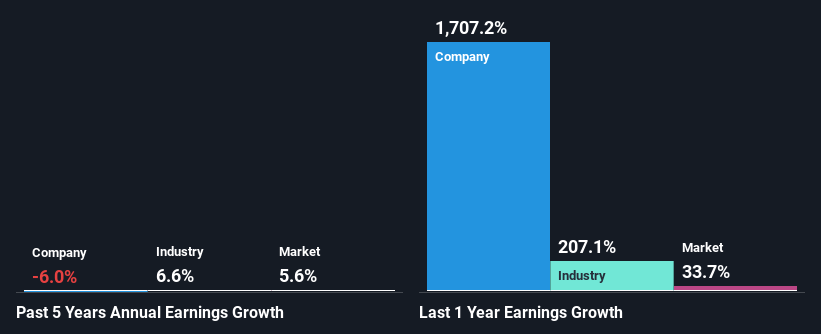

To start with, Elmos Semiconductor's ROE looks acceptable. Even when compared to the industry average of 12% the company's ROE looks quite decent. However, while Elmos Semiconductor has a pretty respectable ROE, its five year net income decline rate was 6.0% . So, there might be some other aspects that could explain this. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

That being said, we compared Elmos Semiconductor's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 6.6% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is ELG fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Elmos Semiconductor Efficiently Re-investing Its Profits?

Elmos Semiconductor's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 54% (or a retention ratio of 46%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run.

Additionally, Elmos Semiconductor has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 30% over the next three years. Despite the lower expected payout ratio, the company's ROE is not expected to change by much.

Conclusion

In total, it does look like Elmos Semiconductor has some positive aspects to its business. However, while the company does have a high ROE, its earnings growth number is quite disappointing. This can be blamed on the fact that it reinvests only a small portion of its profits and pays out the rest as dividends. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Elmos Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:ELG

Elmos Semiconductor

Develops, manufactures, and distributes microelectronic components and system parts, and technological devices for automotive industry in Germany, other European Union countries, the Americas, Asia/Pacific, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026