- Germany

- /

- Specialty Stores

- /

- DB:YOU

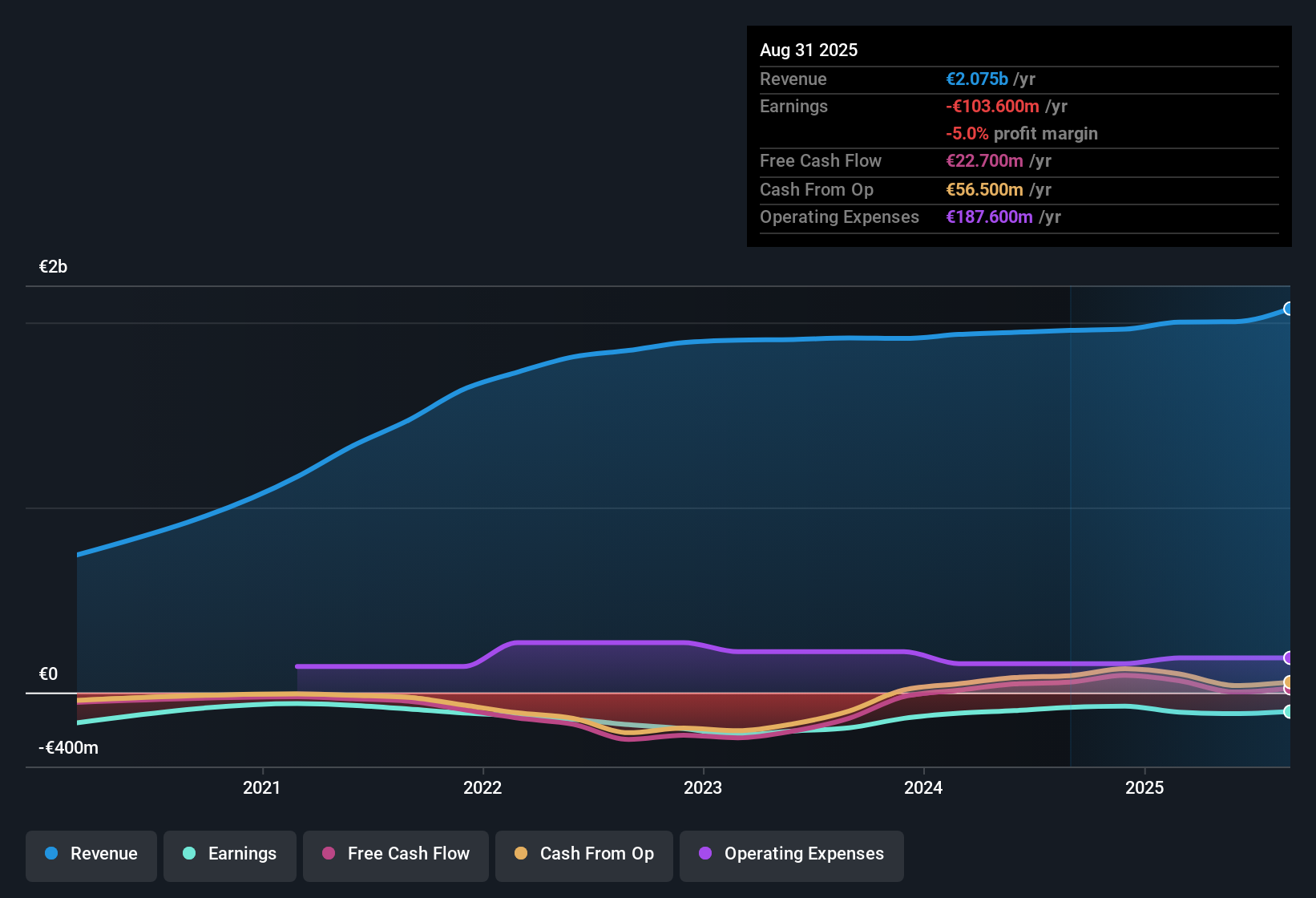

ABOUT YOU (DB:YOU): Ongoing Losses Challenge Growth-Focused Bullish Narratives Despite Forecast-Beating Revenue Outlook

Reviewed by Simply Wall St

ABOUT YOU Holding (DB:YOU) continues to operate at a loss, with forecasts indicating ongoing unprofitability for at least the next three years. Over the past five years, losses have been trimmed by 0.5% per year, while revenue is projected to grow 6.33% annually, comfortably outpacing the broader German market’s 6% yearly forecast. For investors, this means weighing a robust top-line growth trajectory against persistent bottom-line challenges as the company’s share price trades at €6.63, notably below its estimated fair value of €14.89.

See our full analysis for ABOUT YOU Holding.Next, we’ll set these latest numbers against the market’s widely followed narratives to see which themes hold up and where new perspectives might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Loss Reduction Remains Slow

- Losses have been decreasing at a modest rate of 0.5% per year over the past five years, which underscores the company’s ongoing struggle to achieve profitability despite consistent efforts to trim expenses.

- The steady decline in losses connects to bullish arguments that ABOUT YOU is actively adapting through concrete actions such as digital platform enhancements and new market entries.

- However, with forecasts showing the company will remain unprofitable for at least three more years, the persistent negative bottom line challenges the idea that these initiatives will convert to earnings gains in the near term.

- Bulls point to management’s adaptive strategies, but the numbers so far indicate a long recovery runway as improvement is incremental and not transformative.

Valuation Premium Tested by Losses

- At a price-to-sales ratio of 0.6x, ABOUT YOU trades above its European Specialty Retail peers (0.3x) and industry average (0.4x), even as it operates without profits. This raises questions about what investors are actually rewarding in the current valuation.

- Ongoing losses challenge any bullish case that a premium valuation is justified in the absence of profitability. However, the company’s above-market forecasted sales growth tempers a purely bearish outlook.

- Investors may be tolerating the premium due to projected annual revenue growth of 6.33%, outpacing the German market’s 6%. Yet the lack of earnings improvement means there is real risk of sentiment shifting if growth momentum slows.

- The current share price of €6.63, while below the DCF fair value of €14.89, suggests that even “cheap” may not mean “undervalued” as long as red ink persists.

Profitability Remains the Key Risk

- Despite ongoing top-line expansion, the primary risk flagged is the company’s continued inability to achieve profits, with unprofitability forecast to continue for the next three years.

- Analysis of recent trends suggests that while ABOUT YOU benefits from higher-than-average revenue growth, critics highlight that all progress remains vulnerable until a clear path to earnings is established.

- Revenue gains by themselves have not translated into sustained profit, which is a critical hurdle for earning long-term investor confidence.

- This profit gap means that ABOUT YOU’s investment case hinges on more than just outpacing peers on sales; breaking even will likely be the milestone that moves sentiment in a lasting way.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ABOUT YOU Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ABOUT YOU’s persistent unprofitability and sluggish pace of loss reduction make its investment case vulnerable, even though it reports robust sales growth.

If you want companies pairing consistent gains with bottom-line strength, start your search with stable growth stocks screener (2097 results) that showcase steady earnings and revenue momentum year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:YOU

ABOUT YOU Holding

ABOUT YOU Holding SE retails lifestyle and fashion products for women, men, babies, girls, and boys.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives