- Germany

- /

- Specialty Stores

- /

- XTRA:ZAL

3 German Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The German market has shown resilience, with the DAX index posting modest gains despite broader European caution following the recent U.S. Federal Reserve rate cut. As investors navigate this evolving landscape, identifying growth companies with high insider ownership can be a strategic move, as it often signals confidence from those closest to the business. In this article, we will explore three German growth stocks that exhibit strong insider ownership and have demonstrated potential for robust performance in today's market conditions.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 98.3% |

| Stemmer Imaging (XTRA:S9I) | 25.2% | 23.2% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| adidas (XTRA:ADS) | 16.6% | 42.1% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| R. STAHL (XTRA:RSL2) | 37.9% | 59.3% |

| Redcare Pharmacy (XTRA:RDC) | 17.4% | 51.8% |

| elumeo (XTRA:ELB) | 25.8% | 120.2% |

| Your Family Entertainment (DB:RTV) | 17.3% | 116.8% |

We'll examine a selection from our screener results.

adidas (XTRA:ADS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: adidas AG, with a market cap of €39.73 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company generates revenue from various regions, including €3.26 billion from Greater China, €2.39 billion from Latin America, and €5.07 billion from North America, with a segment adjustment of €11.29 billion.

Insider Ownership: 16.6%

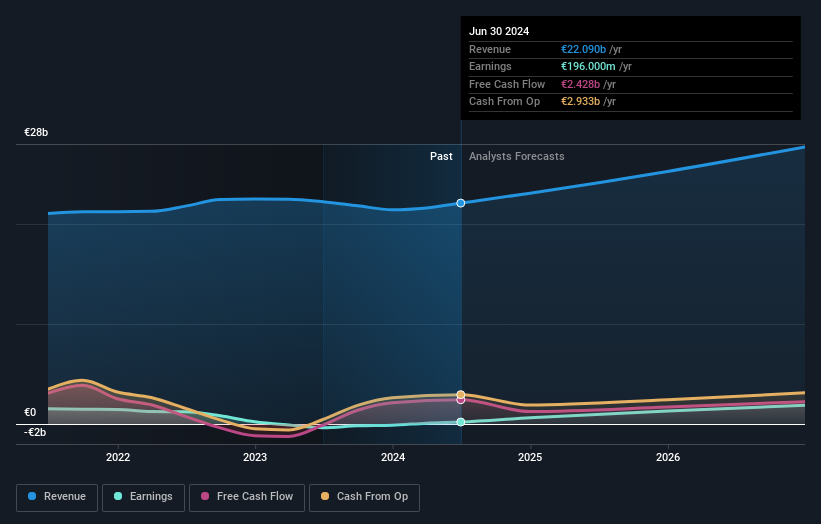

adidas AG, a growth company with high insider ownership, recently reported strong Q2 2024 earnings with sales of €5.82 billion and net income of €190 million. The company has revised its full-year guidance upward, expecting currency-neutral revenues to grow at a high-single-digit rate and operating profit to reach around €1 billion despite unfavorable currency effects. Forecasts indicate adidas's revenue will grow faster than the German market, and its earnings are expected to increase significantly over the next three years.

- Take a closer look at adidas' potential here in our earnings growth report.

- Our expertly prepared valuation report adidas implies its share price may be too high.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.63 billion.

Operations: The company's revenue segments are comprised of €1.74 billion from the DACH region and €391 million from International markets.

Insider Ownership: 17.4%

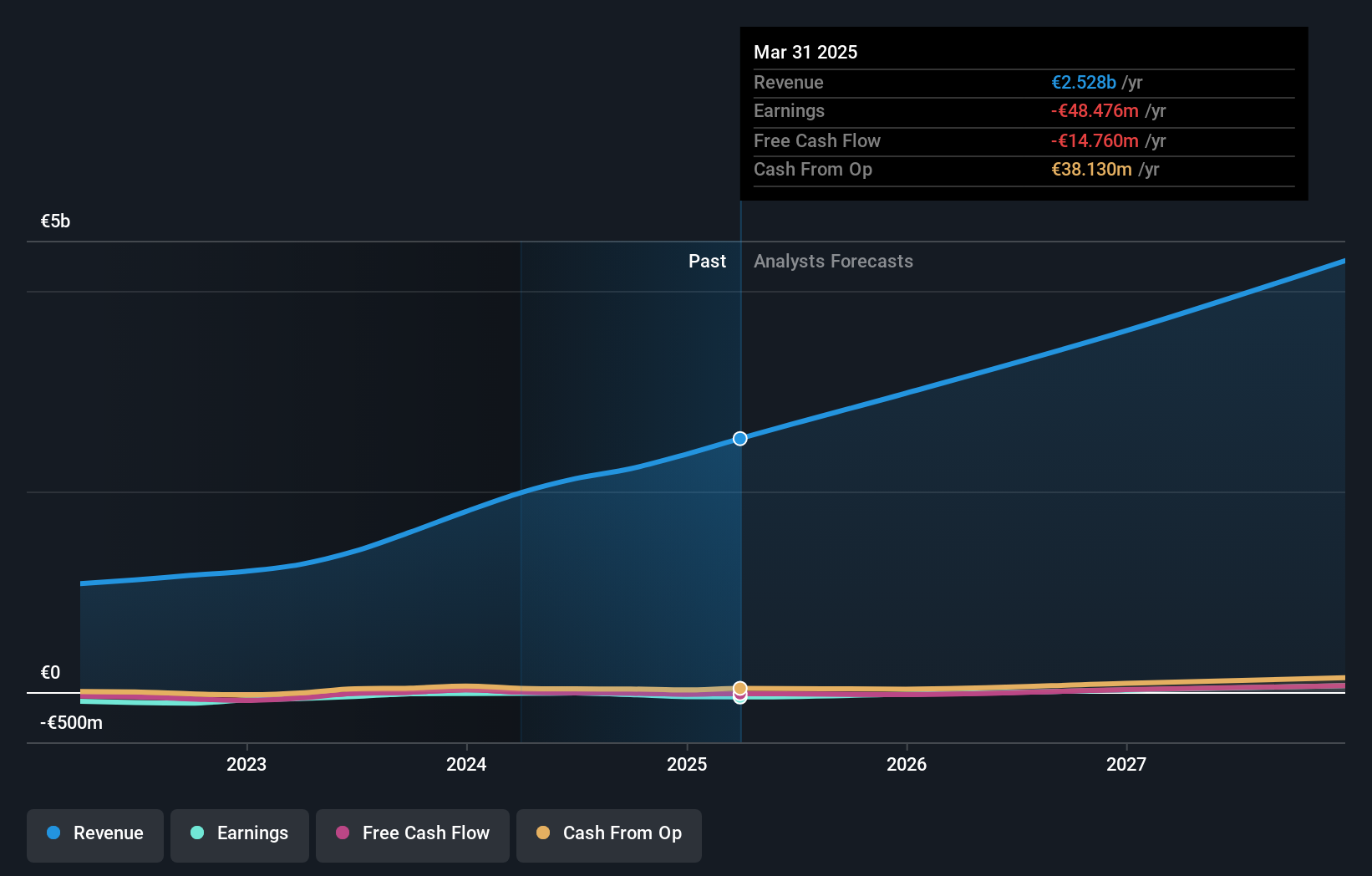

Redcare Pharmacy, with substantial insider ownership, is forecast to see revenue growth of 17.1% per year, outpacing the German market's 5.5%. Despite recent shareholder dilution and significant insider selling over the past three months, earnings are expected to grow at 51.83% annually and become profitable within three years. The company reported half-year sales of €1.12 billion but faced a net loss of €12.07 million, showing improvement from the previous year's €14.78 million loss.

- Delve into the full analysis future growth report here for a deeper understanding of Redcare Pharmacy.

- According our valuation report, there's an indication that Redcare Pharmacy's share price might be on the expensive side.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products, with a market cap of approximately €7.24 billion.

Operations: The company's revenue segments include Reconciliation at -€275 million and Segment Adjustment at €10.49 billion.

Insider Ownership: 10.4%

Zalando, with high insider ownership, is experiencing solid growth. The company reported Q2 2024 sales of €2.64 billion and net income of €95.7 million, up from €56.6 million a year ago. Earnings per share increased to €0.37 from €0.22 last year. Forecasts indicate annual earnings growth at 25.15%, surpassing the German market's average of 20%. However, CFO Dr. Sandra Dembeck will not renew her contract beyond February 2025, signaling potential leadership changes ahead.

- Unlock comprehensive insights into our analysis of Zalando stock in this growth report.

- The valuation report we've compiled suggests that Zalando's current price could be inflated.

Summing It All Up

- Click this link to deep-dive into the 22 companies within our Fast Growing German Companies With High Insider Ownership screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zalando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ZAL

Excellent balance sheet with proven track record.