- Germany

- /

- Specialty Stores

- /

- XTRA:WEW

Did The Underlying Business Drive Westwing Group's (ETR:WEW) Lovely 858% Share Price Gain?

For many, the main point of investing in the stock market is to achieve spectacular returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Westwing Group AG (ETR:WEW) share price rocketed moonwards 858% in just one year. It's also good to see the share price up 42% over the last quarter. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for Westwing Group

Because Westwing Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Westwing Group's revenue grew by 42%. That's a fairly respectable growth rate. Arguably it's more than reflected in the truly wondrous share price gain of 858% in the last year. We're always cautious when the share price is up so much, but there's certainly enough revenue growth to justify taking a closer look at Westwing Group.

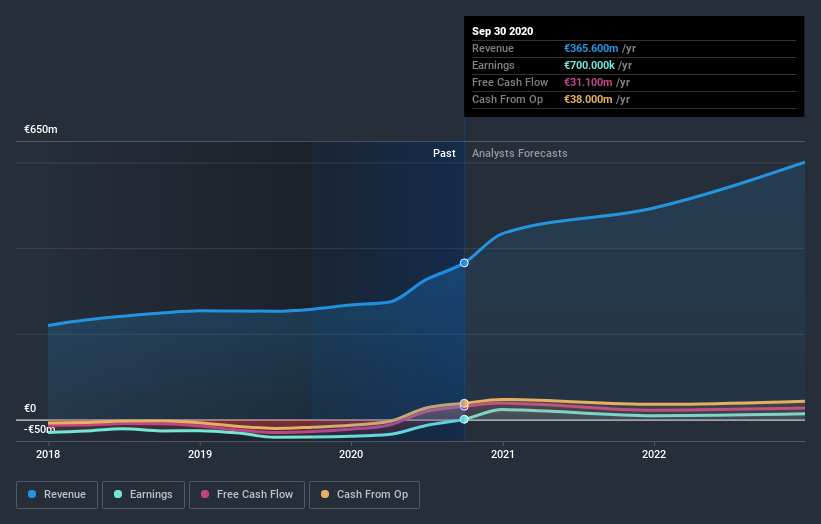

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Westwing Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Westwing Group boasts a total shareholder return of 858% for the last year. The more recent returns haven't been as impressive as the longer term returns, coming in at just 42%. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Westwing Group (1 shouldn't be ignored) that you should be aware of.

But note: Westwing Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you decide to trade Westwing Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Westwing Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:WEW

Westwing Group

Engages in the home and living e-commerce business in Germany, Switzerland, Austria, Spain, Italy, France, Poland, the Czech Republic, the Slovak Republic, Belgium, and the Netherlands.

Flawless balance sheet with reasonable growth potential.