- Germany

- /

- Specialty Stores

- /

- XTRA:MRX

3 Promising European Penny Stocks With Market Caps Under €200M

Reviewed by Simply Wall St

As European markets experience a boost from improved trade relations between the U.S. and China, major indices such as the STOXX Europe 600 have seen significant gains. In this context, penny stocks—often smaller or newer companies—can present unique opportunities for investors looking to uncover potential value. Despite being considered a niche area of investing, these stocks can offer substantial growth prospects when supported by strong financials, making them intriguing options for those seeking under-the-radar investments with promising potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.295 | SEK2.2B | ✅ 4 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.688 | SEK457.71M | ✅ 3 ⚠️ 4 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.34 | SEK226.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.40 | SEK206.85M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN4.10 | PLN138.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.68 | €56.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.994 | €33.29M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.73 | €17.69M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.205 | €304.43M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 447 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Freelance.com (ENXTPA:ALFRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Freelance.com SA facilitates intermediation between companies and intellectual service providers across several countries including France, Germany, and the United Kingdom, with a market cap of €131.65 million.

Operations: Revenue segments for this company are not reported.

Market Cap: €131.65M

Freelance.com SA, with a market cap of €131.65 million, has demonstrated robust financial performance, reporting sales of €1.05 billion for 2024, up from €857.7 million in 2023. The company’s earnings grew by 23.9% over the past year and have consistently increased by an average of 21.7% annually over five years, outpacing industry trends significantly. Trading at a substantial discount to estimated fair value and showing strong interest coverage with EBIT at 7.9 times interest payments, Freelance.com SA also maintains satisfactory debt levels despite an increase in its debt-to-equity ratio over the past five years to 77%.

- Click here and access our complete financial health analysis report to understand the dynamics of Freelance.com.

- Examine Freelance.com's earnings growth report to understand how analysts expect it to perform.

Groupe OKwind Société anonyme (ENXTPA:ALOKW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Groupe OKwind Société anonyme designs, manufactures, sells, and installs green energy solutions in France with a market cap of €14.26 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: €14.26M

Groupe OKwind Société anonyme, with a market cap of €14.26 million, reported 2024 sales of €57.1 million but incurred a net loss of €3.6 million, highlighting current unprofitability despite reducing losses over five years at 11.4% annually. The company is expanding its industrial capacity in Brittany to support growth and diversify activities, focusing on energy autonomy and sustainability through innovative solutions like dual-axis solar trackers and smart energy management systems. Its debt level is satisfactory with short-term assets covering liabilities, yet high share price volatility persists amidst these strategic developments.

- Click here to discover the nuances of Groupe OKwind Société anonyme with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Groupe OKwind Société anonyme's future.

Mister Spex (XTRA:MRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mister Spex SE is a company that provides and markets eyewear products in Germany and internationally, with a market cap of €50.58 million.

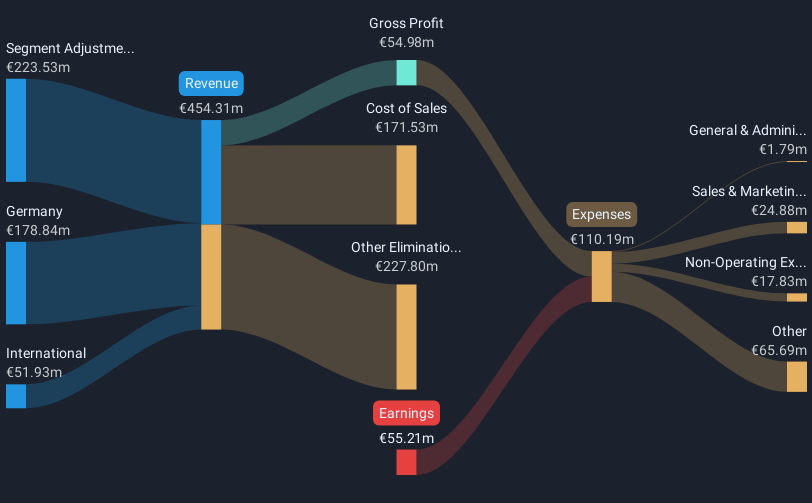

Operations: The company generates revenue from its Online Retailers segment, amounting to €212.69 million.

Market Cap: €50.58M

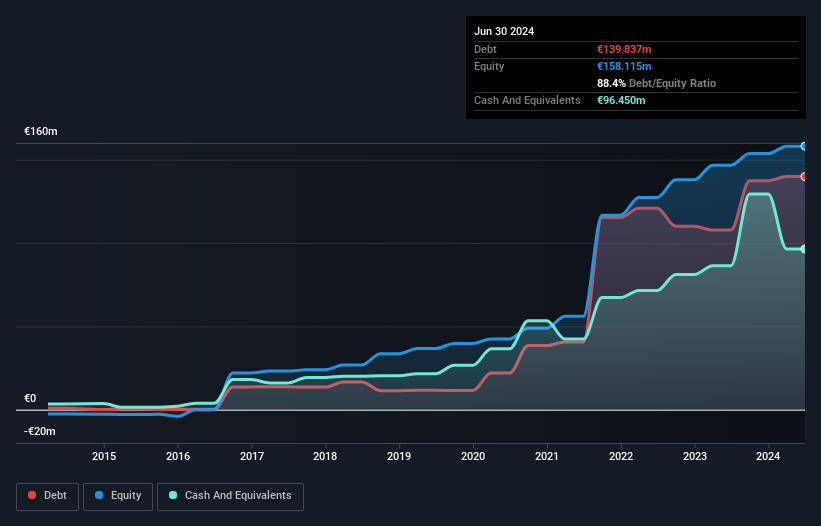

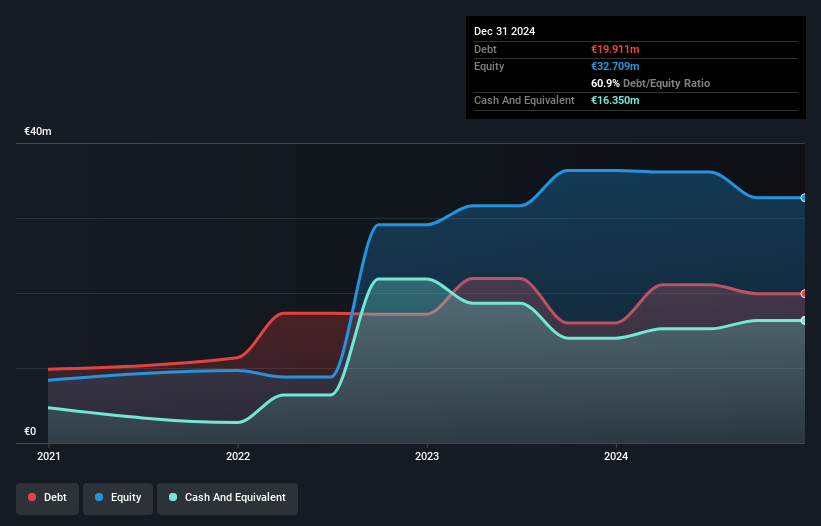

Mister Spex SE, with a market cap of €50.58 million, is navigating challenges typical of penny stocks. Despite generating significant revenue (€212.69 million in 2024), the company remains unprofitable with a negative return on equity and increasing losses over five years. Recent strategic initiatives include launching Mister Spex Switch, a subscription model aimed at enhancing customer retention and profitability by offering flexible eyewear solutions. Although sales have declined recently, the company maintains a strong cash position covering liabilities and has reduced its debt-to-equity ratio significantly over five years, suggesting financial prudence amidst ongoing volatility in share price and management changes.

- Take a closer look at Mister Spex's potential here in our financial health report.

- Assess Mister Spex's future earnings estimates with our detailed growth reports.

Make It Happen

- Click here to access our complete index of 447 European Penny Stocks.

- Searching for a Fresh Perspective? Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mister Spex, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MRX

Mister Spex

Provides and markets eyewear products in Germany and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives