- Germany

- /

- Specialty Stores

- /

- XTRA:H24

Loss-making home24 (ETR:H24) sheds a further €14m, taking total shareholder losses to 80% over 1 year

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to avoid truly shocking capital losses. So we hope that those who held home24 SE (ETR:H24) during the last year don't lose the lesson, in addition to the 80% hit to the value of their shares. That'd be a striking reminder about the importance of diversification. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 3.8% in three years. Furthermore, it's down 56% in about a quarter. That's not much fun for holders.

If the past week is anything to go by, investor sentiment for home24 isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for home24

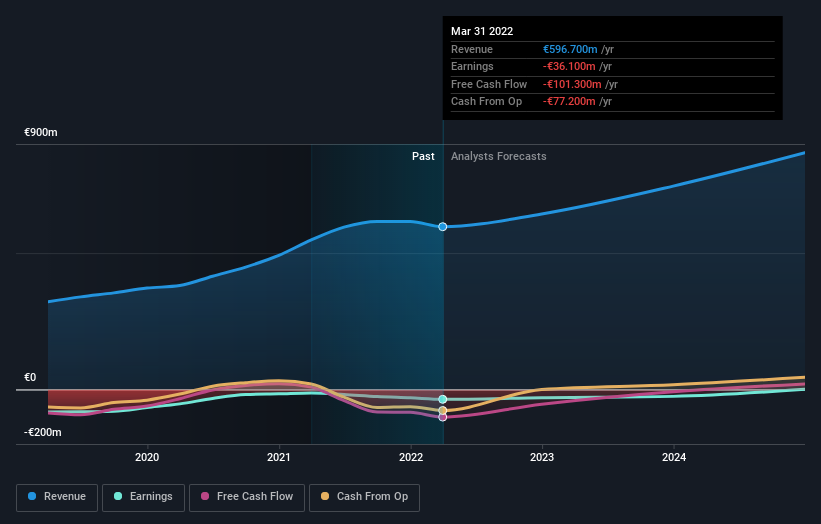

Because home24 made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

home24 grew its revenue by 8.8% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Even so you could argue that it's surprising that the share price has tanked 80%. Clearly the market was expecting better, and this may blow out projections of profitability. But if it will make money, albeit later than previously believed, this could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at home24's financial health with this free report on its balance sheet.

A Different Perspective

The last twelve months weren't great for home24 shares, which performed worse than the market, costing holders 80%. The market shed around 21%, no doubt weighing on the stock price. The three-year loss of 1.3% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand home24 better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for home24 you should know about.

Of course home24 may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:H24

home24

Engages in marketing, sale, and shipping of furniture and home furnishings.

Excellent balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives