LUDWIG BECK am Rathauseck - Textilhaus Feldmeier AG (ETR:ECK) Stock Rockets 27% But Many Are Still Ignoring The Company

LUDWIG BECK am Rathauseck - Textilhaus Feldmeier AG (ETR:ECK) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

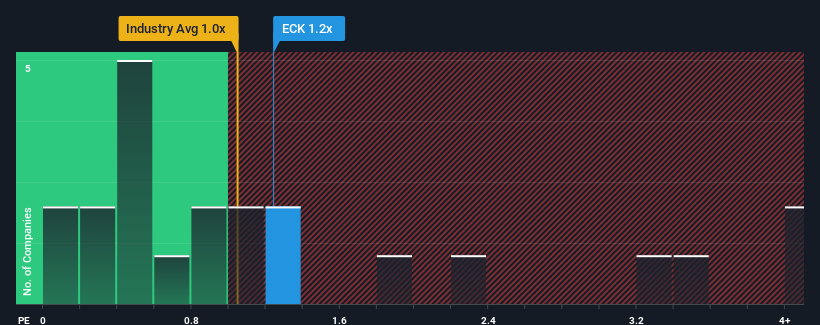

Although its price has surged higher, there still wouldn't be many who think LUDWIG BECK am Rathauseck - Textilhaus Feldmeier's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Germany's Multiline Retail industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for LUDWIG BECK am Rathauseck - Textilhaus Feldmeier

How Has LUDWIG BECK am Rathauseck - Textilhaus Feldmeier Performed Recently?

The recent revenue growth at LUDWIG BECK am Rathauseck - Textilhaus Feldmeier would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on LUDWIG BECK am Rathauseck - Textilhaus Feldmeier will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LUDWIG BECK am Rathauseck - Textilhaus Feldmeier will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like LUDWIG BECK am Rathauseck - Textilhaus Feldmeier's to be considered reasonable.

Retrospectively, the last year delivered a decent 5.9% gain to the company's revenues. Revenue has also lifted 19% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 2.7% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that LUDWIG BECK am Rathauseck - Textilhaus Feldmeier is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

LUDWIG BECK am Rathauseck - Textilhaus Feldmeier appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision LUDWIG BECK am Rathauseck - Textilhaus Feldmeier's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 4 warning signs for LUDWIG BECK am Rathauseck - Textilhaus Feldmeier (1 doesn't sit too well with us!) that you need to take into consideration.

If these risks are making you reconsider your opinion on LUDWIG BECK am Rathauseck - Textilhaus Feldmeier, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade LUDWIG BECK am Rathauseck - Textilhaus Feldmeier, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ECK

LUDWIG BECK am Rathauseck - Textilhaus Feldmeier

Engages in the textile retail business in Germany.

Low and slightly overvalued.