- Germany

- /

- Real Estate

- /

- XTRA:RCMN

RCM Beteiligungs AG's (ETR:RCMN) Recent Stock Price Movement Is Nothing To Get Excited About But Financials Could Add More To The Story

It is easy to overlook RCM Beteiligungs' (ETR:RCMN) given its unimpressive and roughly flat price performance over the past week. However, its fundamentals look pretty strong which means that its price could rise in the future as markets usually follow the long-term financial performance of a business. Specifically, we decided to study RCM Beteiligungs' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for RCM Beteiligungs

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for RCM Beteiligungs is:

20% = €4.8m ÷ €23m (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.20 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

RCM Beteiligungs' Earnings Growth And 20% ROE

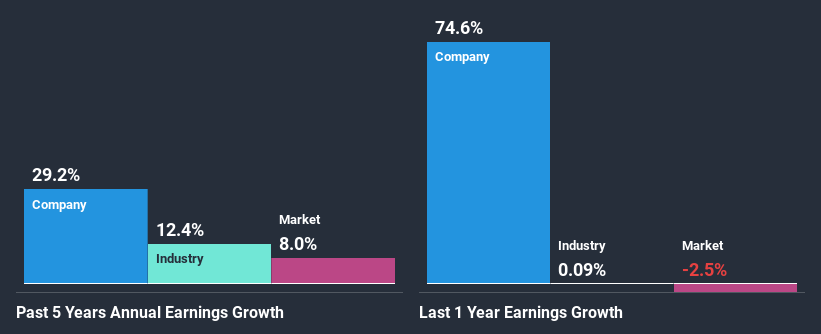

Firstly, we acknowledge that RCM Beteiligungs has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 9.5% also doesn't go unnoticed by us. Under the circumstances, RCM Beteiligungs' considerable five year net income growth of 29% was to be expected.

As a next step, we compared RCM Beteiligungs' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 12%.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is RCM Beteiligungs fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is RCM Beteiligungs Efficiently Re-investing Its Profits?

RCM Beteiligungs has a three-year median payout ratio of 28% (where it is retaining 72% of its income) which is not too low or not too high. So it seems that RCM Beteiligungs is reinvesting efficiently in a way that it sees impressive growth in its earnings (discussed above) and pays a dividend that's well covered.

Additionally, RCM Beteiligungs has paid dividends over a period of four years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

Overall, we are quite pleased with RCM Beteiligungs' performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard would have the 3 risks we have identified for RCM Beteiligungs.

If you decide to trade RCM Beteiligungs, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:RCMN

Slight with imperfect balance sheet.

Market Insights

Community Narratives