- Germany

- /

- Real Estate

- /

- DB:SPB

Sedlmayr Grund und Immobilien AG (FRA:SPB) Not Lagging Industry On Growth Or Pricing

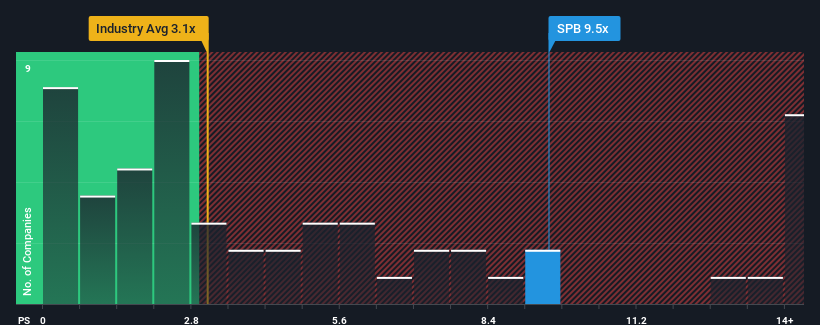

When close to half the companies in the Real Estate industry in Germany have price-to-sales ratios (or "P/S") below 3.1x, you may consider Sedlmayr Grund und Immobilien AG (FRA:SPB) as a stock to avoid entirely with its 9.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sedlmayr Grund und Immobilien

What Does Sedlmayr Grund und Immobilien's Recent Performance Look Like?

The recent revenue growth at Sedlmayr Grund und Immobilien would have to be considered satisfactory if not spectacular. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sedlmayr Grund und Immobilien's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Sedlmayr Grund und Immobilien?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Sedlmayr Grund und Immobilien's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.8% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 7.5% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 37% shows the industry is even less attractive on an annualised basis.

With this in consideration, it's no surprise that Sedlmayr Grund und Immobilien's P/S exceeds that of its industry peers. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Sedlmayr Grund und Immobilien's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Sedlmayr Grund und Immobilien confirms that the company's less severe contraction in revenue over the past three-year years is a major contributor to its higher than industry P/S, given the industry is set to decline even more. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. We still remain cautious about the company's ability to stay its recent course and avoid revenues slipping in line with the industry. At least if the company's outlook remains more positive than its peers, it is unlikely that the share price will experience a significant decline in the near future.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Sedlmayr Grund und Immobilien (2 are a bit concerning) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Sedlmayr Grund und Immobilien, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:SPB

Sedlmayr Grund und Immobilien

Develops and manages real estate properties in Germany.

Proven track record second-rate dividend payer.

Market Insights

Community Narratives