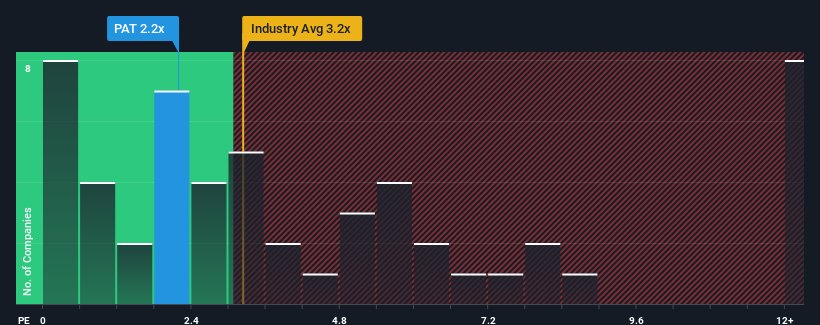

PATRIZIA SE's (ETR:PAT) price-to-sales (or "P/S") ratio of 2.2x might make it look like a buy right now compared to the Real Estate industry in Germany, where around half of the companies have P/S ratios above 3.2x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for PATRIZIA

How Has PATRIZIA Performed Recently?

There hasn't been much to differentiate PATRIZIA's and the industry's retreating revenue lately. It might be that many expect the company's revenue performance to degrade further, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on PATRIZIA will help you uncover what's on the horizon.How Is PATRIZIA's Revenue Growth Trending?

In order to justify its P/S ratio, PATRIZIA would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.9%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 3.2% each year as estimated by the four analysts watching the company. Meanwhile, the industry is forecast to moderate by 17% each year, which indicates the company should perform better regardless.

With this information, it's perhaps strange but not a major surprise that PATRIZIA is trading at a lower P/S in comparison. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares excessively.

What We Can Learn From PATRIZIA's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of PATRIZIA's analyst forecasts revealed that its P/S ratio is lower than expected, given it's set to outperform the broader industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the more attractive outlook. Perhaps there is some hesitation about the company's ability to keep resisting the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally constitute a higher P/S and thus share price.

Before you take the next step, you should know about the 2 warning signs for PATRIZIA that we have uncovered.

If these risks are making you reconsider your opinion on PATRIZIA, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:PAT

PATRIZIA

PATRIZIA has been providing investment opportunities in smart real assets for institutional, semi-professional, and private investors for more than 40 years, focusing on real estate and infrastructure.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives