- Germany

- /

- Real Estate

- /

- XTRA:DIC

DIC Asset (ETR:DIC) sheds €67m, company earnings and investor returns have been trending downwards for past three years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term DIC Asset AG (ETR:DIC) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 59% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 55% lower in that time. Furthermore, it's down 33% in about a quarter. That's not much fun for holders.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for DIC Asset

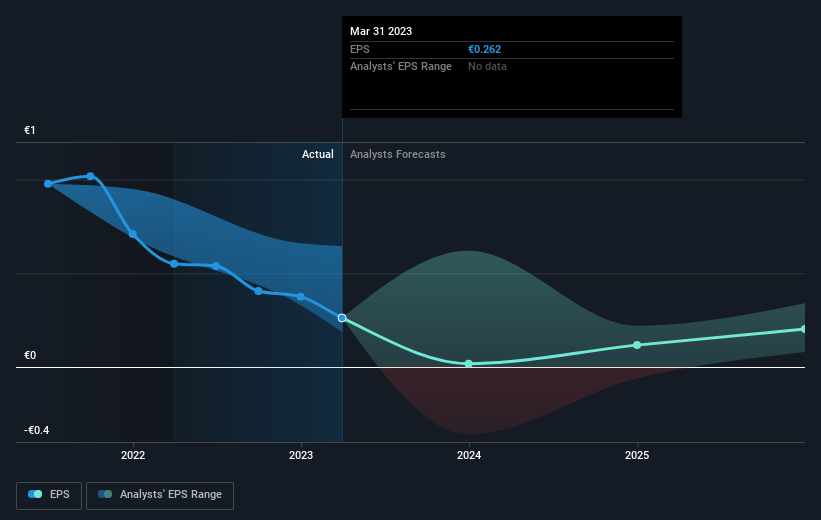

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

DIC Asset saw its EPS decline at a compound rate of 40% per year, over the last three years. In comparison the 26% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into DIC Asset's key metrics by checking this interactive graph of DIC Asset's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, DIC Asset's TSR for the last 3 years was -51%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 14% in the last year, DIC Asset shareholders lost 50% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand DIC Asset better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with DIC Asset (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

But note: DIC Asset may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Branicks Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DIC

Branicks Group

Branicks Group AG (formerly DIC Asset AG) is a leading German listed specialist for office and logistics real estate as well as renewable assets with over 25 years of experience in the real estate market and access to a broad investor network.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives