- Germany

- /

- Life Sciences

- /

- XTRA:GXI

Could Gerresheimer (XTRA:GXI) Leverage FDA-Approved Home-Infusion Device to Strengthen its Medtech Differentiation?

Reviewed by Sasha Jovanovic

- On October 13, 2025, SQ Innovation announced that the US FDA had granted approval for Lasix ONYU, a combination product for edema in congestive heart failure, which features Gerresheimer’s on-body infusor device for at-home subcutaneous drug delivery.

- This milestone showcases Gerresheimer’s advanced expertise in drug delivery technology and its integral role as a full-service partner in the rapidly evolving medtech space.

- We will examine how FDA approval of a home-infusion device may influence Gerresheimer's medical technology positioning and long-term business prospects.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Gerresheimer Investment Narrative Recap

To be a Gerresheimer shareholder today, you need to believe in the company's transition toward higher-value drug delivery solutions and its ability to capitalize on growth in the medtech and pharmaceutical packaging markets. The recent FDA approval for Lasix ONYU featuring Gerresheimer’s on-body infusor is a solid showcase of its innovation, but as a single product event, it is not a material short-term catalyst for the broader business, nor does it significantly change the primary risk, successful integration of Bormioli Pharma and cost management remain front and center.

Among recent developments, Gerresheimer’s revised full-year 2025 guidance, issued just days before the approval news, stands out: the company now expects organic revenues to decline by 2% to 4%. This guidance highlights how near-term operational performance and integration challenges may outweigh immediate gains from product milestones like Lasix ONYU in shaping business momentum.

In contrast, investors should be aware that even promising medtech launches cannot offset risks related to...

Read the full narrative on Gerresheimer (it's free!)

Gerresheimer's narrative projects €2.9 billion revenue and €197.3 million earnings by 2028. This requires 9.5% yearly revenue growth and a €134 million earnings increase from €63.3 million today.

Uncover how Gerresheimer's forecasts yield a €56.36 fair value, a 97% upside to its current price.

Exploring Other Perspectives

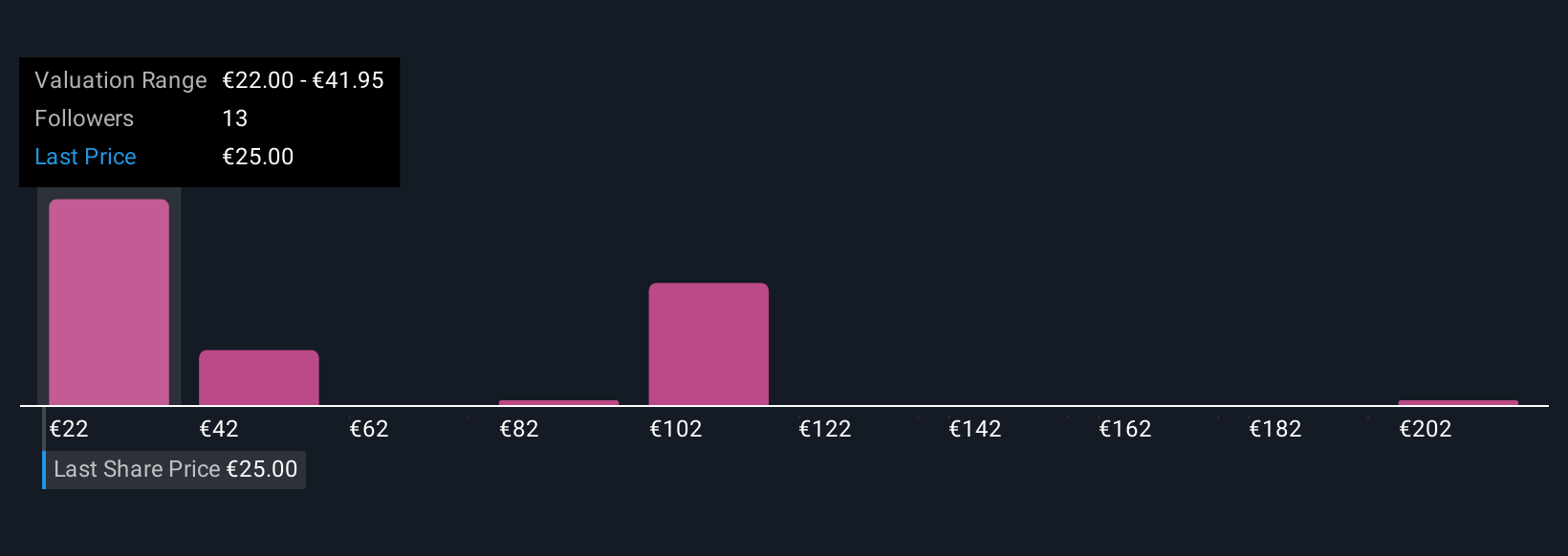

Nine members of the Simply Wall St Community valued Gerresheimer between €47.50 and €221.45, revealing wide differences in growth and profit expectations. While some anticipate successful expansion through new products, others flag concerns over integration and operational hurdles shaping the company’s near-term results.

Explore 9 other fair value estimates on Gerresheimer - why the stock might be worth over 7x more than the current price!

Build Your Own Gerresheimer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gerresheimer research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Gerresheimer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gerresheimer's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:GXI

Gerresheimer

Provides medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives