As European markets face volatility due to renewed tariff threats from the U.S., major indices like the STOXX Europe 600 Index have seen declines, reflecting broader uncertainties in economic growth and trade policies. In such a climate, identifying high-growth tech stocks requires a focus on companies with robust innovation strategies and resilience to geopolitical pressures, as these factors can help navigate the challenging market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Intellego Technologies | 31.55% | 51.31% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.03% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| CD Projekt | 33.21% | 37.35% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

izertis (BME:IZER)

Simply Wall St Growth Rating: ★★★★★☆

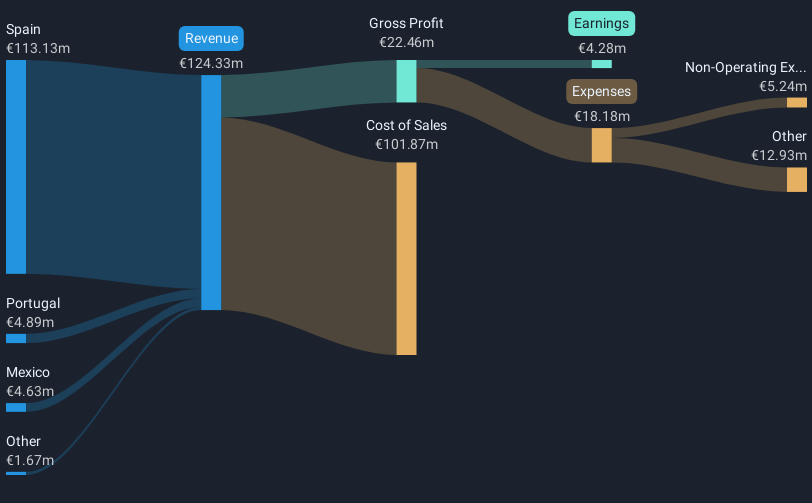

Overview: Izertis, S.A. is a technological consultancy firm operating in Spain, Portugal, and Mexico with a market capitalization of €249.58 million.

Operations: The company offers technological consultancy services across Spain, Portugal, and Mexico.

Izertis, a European tech firm, demonstrated resilience with a revenue jump to EUR 138.08 million, up from EUR 121.29 million last year, underscoring its ability to outpace the Spanish market's growth rate of 4.5% with a robust 23.4%. Despite this revenue surge, net income slightly dipped to EUR 4.28 million from EUR 5.04 million previously. The company is navigating challenges as earnings are not sufficiently covering interest payments; however, it's set on an aggressive growth trajectory with earnings expected to climb by approximately 43.8% annually. This forecast positions Izertis well above typical market performance and highlights its potential in leveraging technology advancements despite current financial pressures.

- Click to explore a detailed breakdown of our findings in izertis' health report.

Gain insights into izertis' past trends and performance with our Past report.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

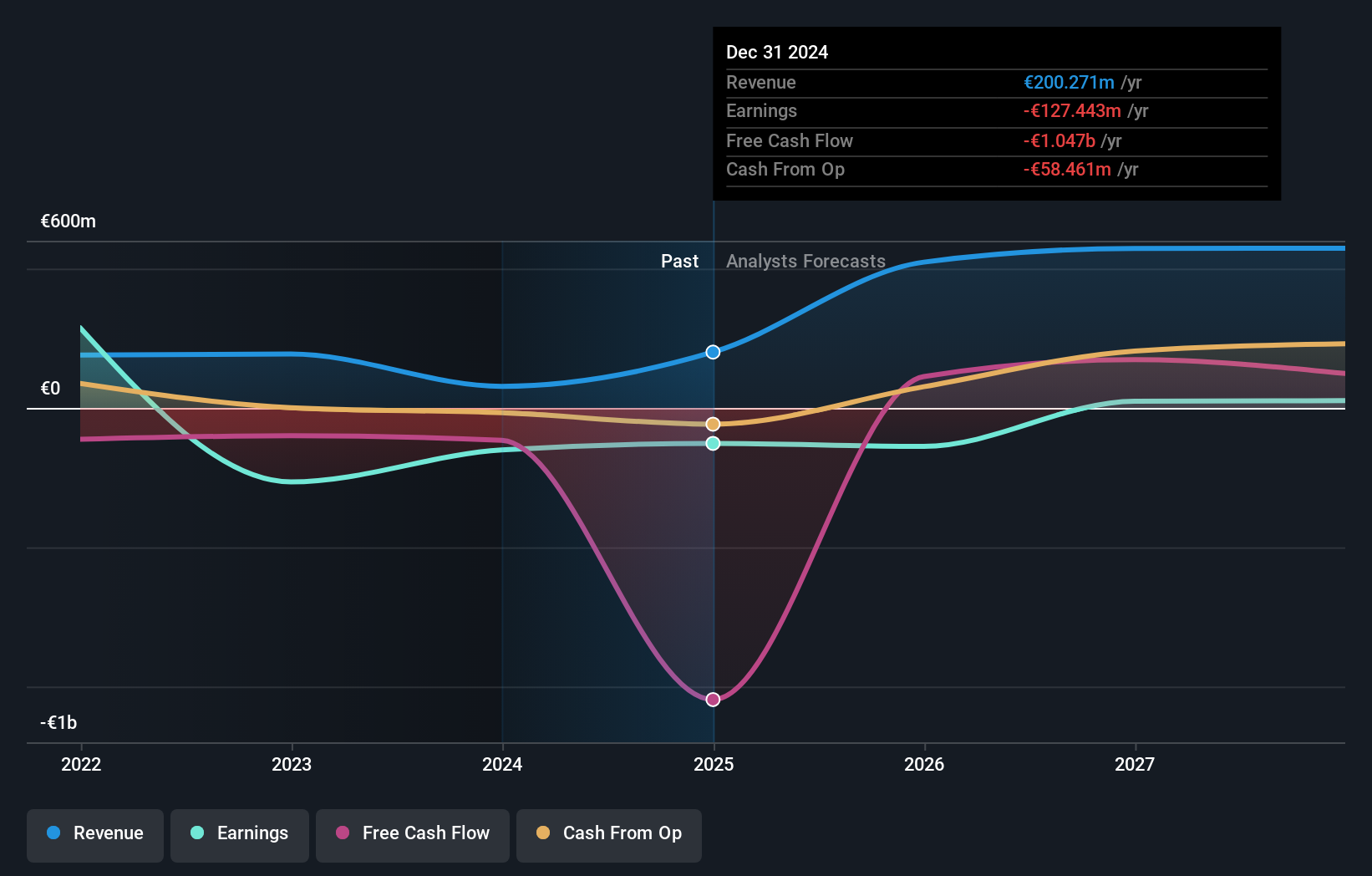

Overview: Northern Data AG develops and operates high-performance computing and artificial intelligence solutions in Europe and North America, with a market cap of €1.61 billion.

Operations: Northern Data AG generates revenue primarily from its Taiga Cloud and Peak Mining segments, contributing €231.88 million and €187.51 million, respectively. Ardent Data Centers adds €21.55 million to the revenue stream. The company's business model focuses on high-performance computing solutions across Europe and North America, with a notable emphasis on cloud services and mining operations.

Northern Data's strategic pivot towards AI-driven solutions is underscored by its recent partnership with Deloitte, aimed at enhancing enterprise AI capabilities across Europe. This collaboration leverages Northern Data's robust GPU infrastructure and Deloitte's industry expertise, promising to streamline AI deployment and scalability for clients. Despite a volatile share price, the company forecasts an ambitious revenue range of EUR 240 million to EUR 320 million for 2025. Furthermore, the firm’s commitment to expanding its European data centers emphasizes GDPR compliance and high sustainability standards, positioning it well within the rapidly growing AI market space.

- Navigate through the intricacies of Northern Data with our comprehensive health report here.

Gain insights into Northern Data's historical performance by reviewing our past performance report.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★☆☆

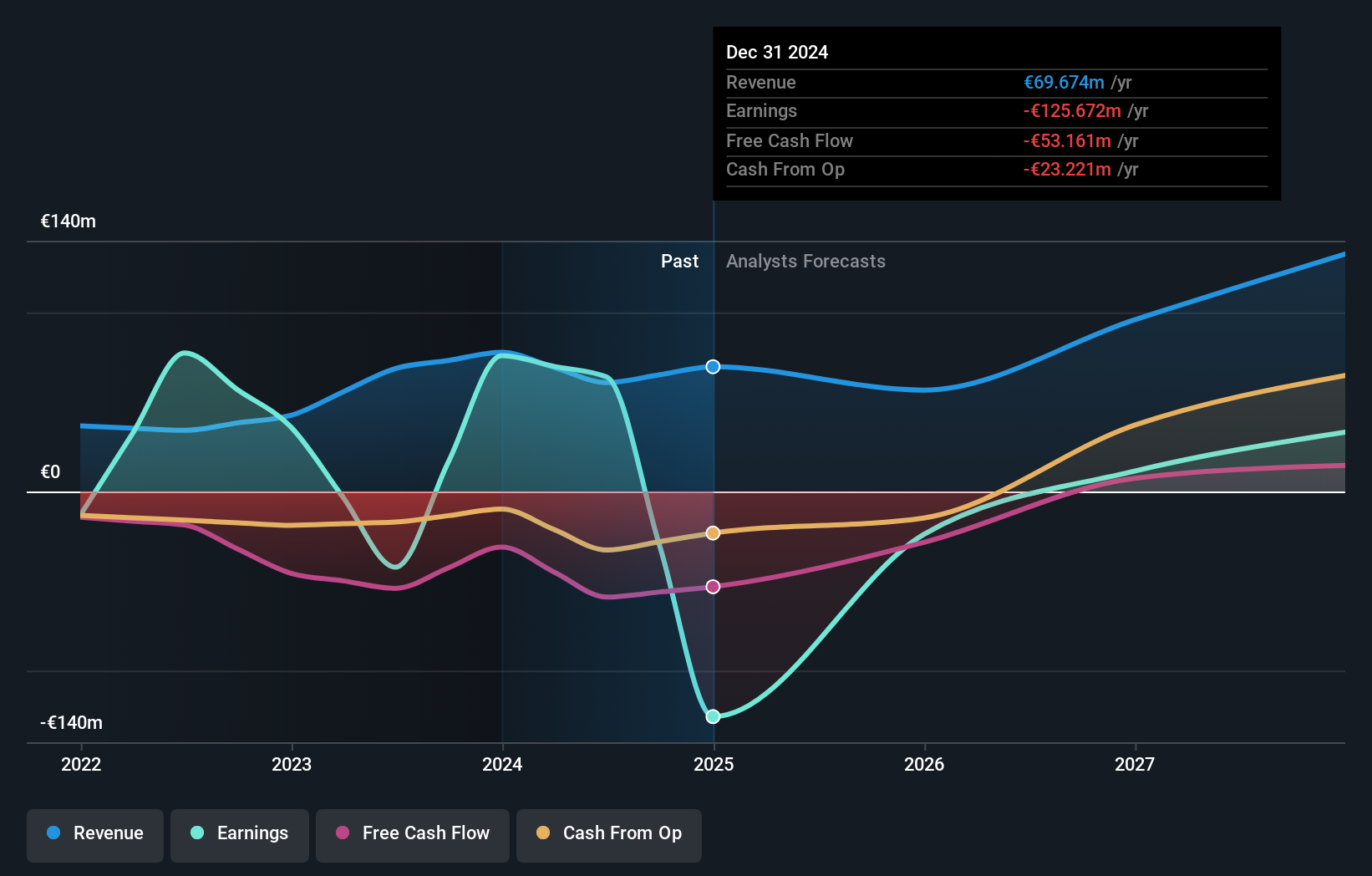

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market capitalization of €410.52 million.

Operations: The company generates revenue primarily from its Drug Delivery Systems, amounting to €69.67 million.

Formycon AG's recent FDA approval and interchangeability designation for Otulfi® mark a significant milestone, enhancing its competitive edge in the U.S. biosimilar market. Despite a challenging fiscal year with revenues dipping to €69.67 million from €77.7 million and transitioning from a net income of €75.8 million to a net loss of €125.67 million, Formycon is navigating through these turbulences with strategic agility. Looking ahead, the company projects an optimistic revenue outlook for 2025, ranging between €55 million and €65 million, reflecting potential stabilization and growth recovery driven by its innovative biopharmaceutical developments and expanding market presence.

- Delve into the full analysis health report here for a deeper understanding of Formycon.

Assess Formycon's past performance with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 226 European High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives