European Growth Companies With High Insider Ownership In April 2025

Reviewed by Simply Wall St

In April 2025, European markets have shown resilience amid easing global trade tensions, with major indices like Germany’s DAX and France’s CAC 40 posting significant gains. As the economic landscape stabilizes, investors are increasingly looking toward growth companies with high insider ownership as potential opportunities; these firms often exhibit strong alignment between management and shareholder interests, which can be particularly appealing in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

Let's explore several standout options from the results in the screener.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of NOK3.99 billion.

Operations: The company generates revenue primarily from the sale of collaboration services, amounting to NOK1.12 billion.

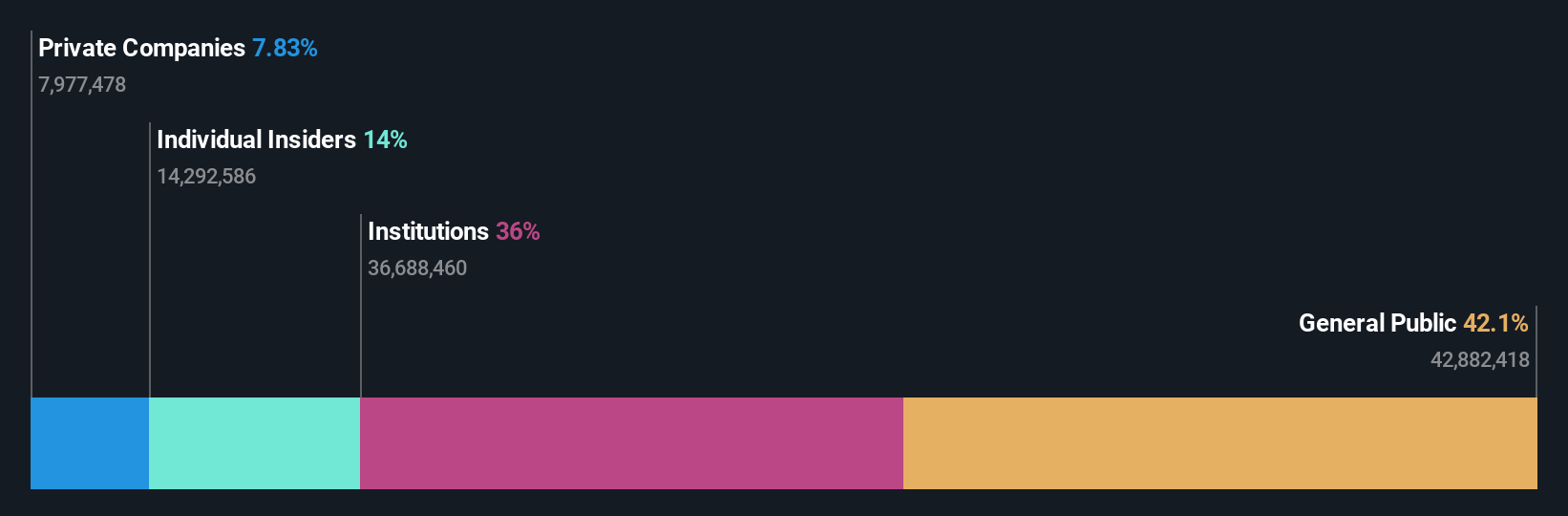

Insider Ownership: 14.5%

Pexip Holding shows strong growth potential with earnings expected to grow significantly at 26.9% per year, outpacing the Norwegian market. Despite a dividend yield of 6.37%, it isn't well-supported by earnings or free cash flow, raising sustainability concerns. Recent developments include an expanded partnership with Google and substantial insider buying over selling in the past three months, reflecting confidence in its strategic direction and future prospects despite trading below estimated fair value.

- Click to explore a detailed breakdown of our findings in Pexip Holding's earnings growth report.

- Upon reviewing our latest valuation report, Pexip Holding's share price might be too pessimistic.

Troax Group (OM:TROAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Troax Group AB (publ) manufactures and distributes mesh panel solutions across the Nordic region, the United Kingdom, North America, Europe, and other international markets, with a market cap of SEK8.04 billion.

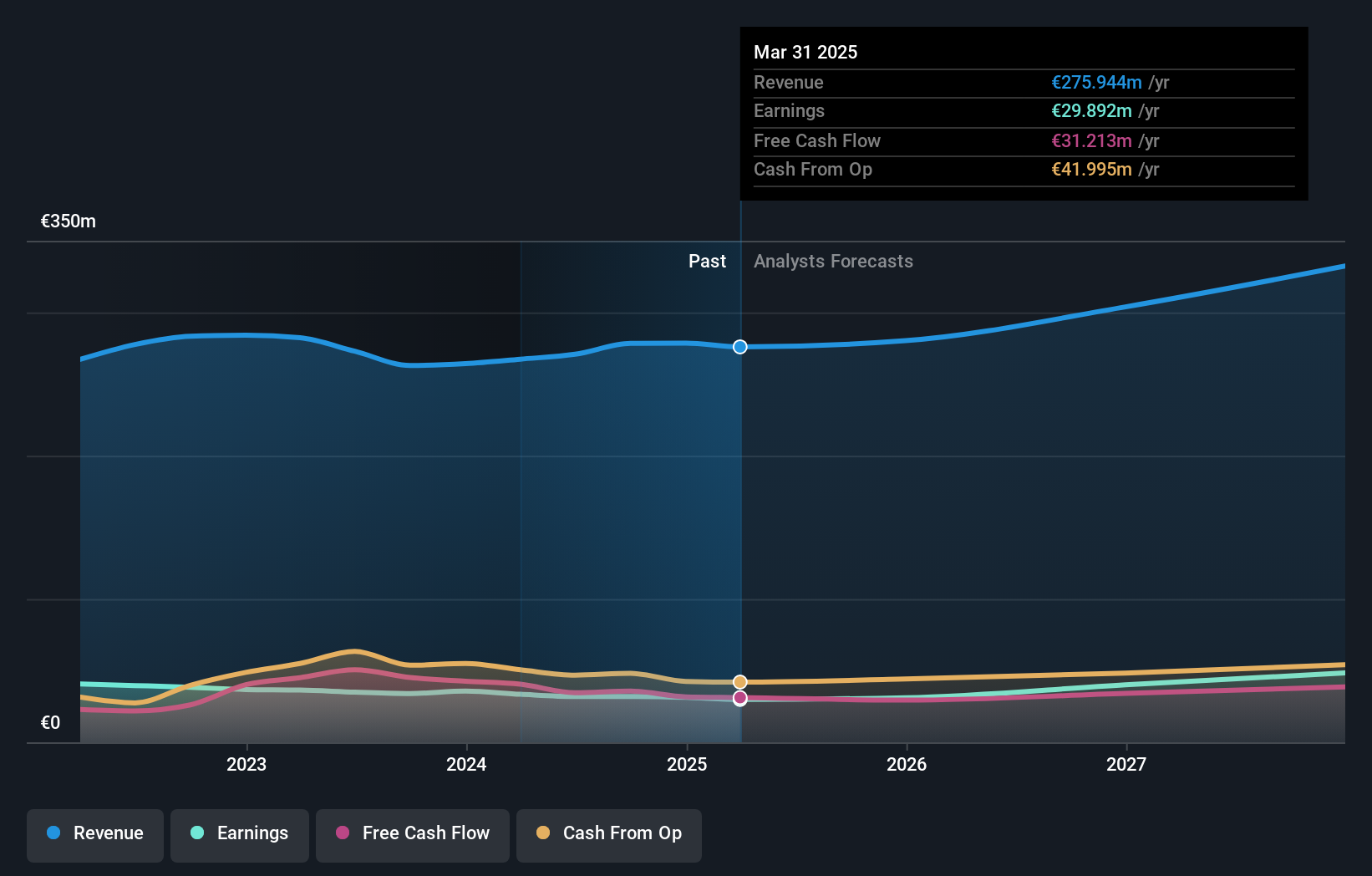

Operations: The company's revenue primarily comes from its mesh panels segment, generating €275.94 million.

Insider Ownership: 11.8%

Troax Group demonstrates growth potential with earnings forecasted to grow at 18.5% annually, outpacing the Swedish market. Despite a slight decline in Q1 2025 sales and net income, insider activity shows more buying than selling recently, indicating confidence in its strategy. The stock trades below fair value estimates and analysts predict a price rise of 45.7%. However, dividend sustainability remains unstable due to inconsistent earnings support despite recent affirmations.

- Click here and access our complete growth analysis report to understand the dynamics of Troax Group.

- The valuation report we've compiled suggests that Troax Group's current price could be quite moderate.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market cap of €399.93 million.

Operations: Formycon AG generates revenue primarily from its Drug Delivery Systems segment, which contributed €69.67 million.

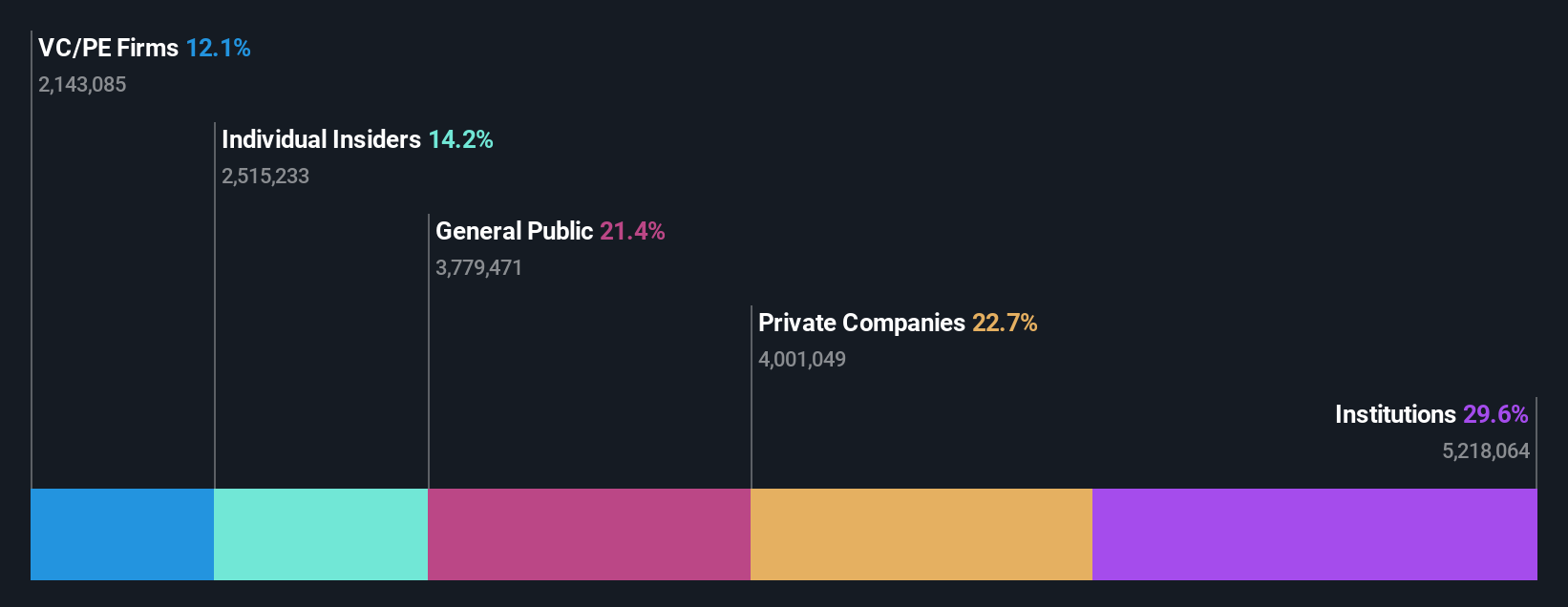

Insider Ownership: 14.2%

Formycon AG shows strong growth potential with revenue expected to grow at 18.4% annually, surpassing the German market average. Despite a net loss of €125.67 million in 2024, insider ownership remains significant, indicating confidence in its strategic direction. Recent FDA approvals for biosimilars like FYB203 and the launch of Otulfi in the U.S. bolster its competitive edge. However, share price volatility and low forecasted return on equity present challenges for investors seeking stability.

- Unlock comprehensive insights into our analysis of Formycon stock in this growth report.

- Our expertly prepared valuation report Formycon implies its share price may be lower than expected.

Next Steps

- Access the full spectrum of 208 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PEXIP

Pexip Holding

A video technology company, provides end-to-end video conferencing platform and digital infrastructure in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives