In recent weeks, European markets have faced challenges, with the pan-European STOXX Europe 600 Index declining amid escalating trade tensions following proposed tariffs from the U.S. administration. Despite these headwinds, growth companies in Europe with strong insider ownership can offer unique investment opportunities as they often signal confidence in a company's potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Yubico (OM:YUBICO) | 36.2% | 30.4% |

| Vow (OB:VOW) | 13.1% | 84.7% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.3% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Elliptic Laboratories (OB:ELABS) | 25.8% | 79% |

Let's uncover some gems from our specialized screener.

F-Secure Oyj (HLSE:FSECURE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: F-Secure Oyj is a cybersecurity company based in Finland that provides security solutions both domestically and internationally, with a market cap of €344.80 million.

Operations: The company generates revenue primarily from its Consumer Security segment, which amounted to €146.98 million.

Insider Ownership: 37%

F-Secure Oyj's recent strategic partnership with Orange highlights its strong position in the cybersecurity sector, enhancing its growth prospects. The appointment of Fredrik Torstensson as Chief Partner Business Officer is set to bolster F-Secure’s global partnerships and revenue initiatives. Despite a high level of debt, F-Secure trades at good value relative to peers and is expected to see earnings grow by 14.06% annually, outpacing the Finnish market's growth rate.

- Click here to discover the nuances of F-Secure Oyj with our detailed analytical future growth report.

- Our valuation report here indicates F-Secure Oyj may be undervalued.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company offering an end-to-end video conferencing platform and digital infrastructure across multiple regions, with a market cap of NOK5.93 billion.

Operations: The company's revenue primarily comes from the Sale of Collaboration Services, amounting to NOK1.17 billion.

Insider Ownership: 14.6%

Pexip Holding ASA, experiencing significant earnings growth of 23.8% annually, outpaces the Norwegian market's average. Despite trading at a discount to its estimated fair value, its dividend is not fully covered by earnings. Recent insider activity shows substantial buying over selling within the last three months. The company announced a share buyback program worth NOK 100 million and expanded its partnership with Google, enhancing interoperability features for Google Meet hardware users.

- Delve into the full analysis future growth report here for a deeper understanding of Pexip Holding.

- In light of our recent valuation report, it seems possible that Pexip Holding is trading beyond its estimated value.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market cap of €410.52 million.

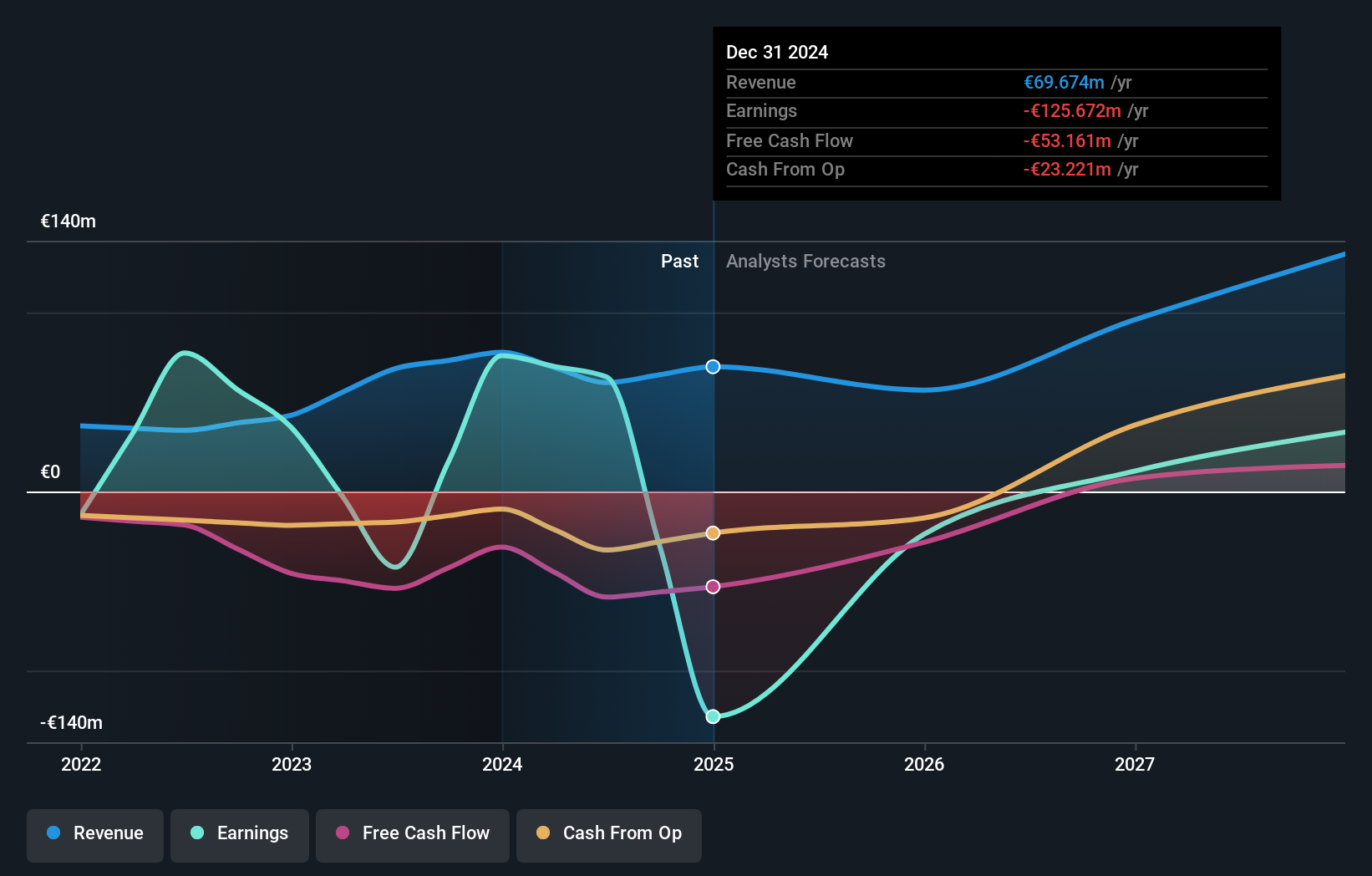

Operations: The company generates revenue from its Drug Delivery Systems segment, amounting to €69.67 million.

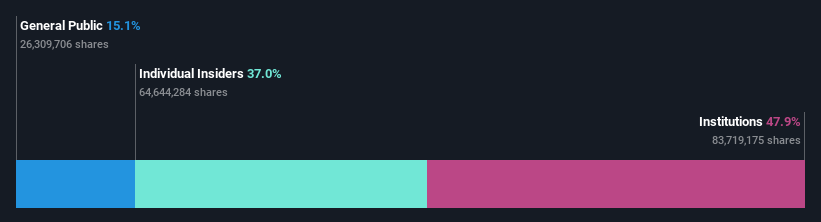

Insider Ownership: 14.2%

Formycon, with substantial insider ownership, is poised for growth as it expects to become profitable within three years. Trading significantly below its estimated fair value, the company benefits from recent FDA approval of its biosimilar Otulfi®, interchangeable with Stelara®. This development enhances Formycon's market potential in the U.S., despite a forecasted revenue growth rate of 18.8% per year being slower than 20%, yet above the German market average.

- Navigate through the intricacies of Formycon with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Formycon shares in the market.

Key Takeaways

- Delve into our full catalog of 210 Fast Growing European Companies With High Insider Ownership here.

- Seeking Other Investments? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FSECURE

F-Secure Oyj

Operates as a cybersecurity company in Finland and internationally.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives