Bayer (XTRA:BAYN) Valuation Check as FDA Wins and New Clinical Trials Draw Investor Attention

Reviewed by Simply Wall St

Bayer (XTRA:BAYN) has been busy, and the stock is catching more eyeballs as a result, with fresh headlines spanning FDA clearances, new trial launches, and regulatory filings across imaging, women’s health, and rare disease.

See our latest analysis for Bayer.

All of this clinical and regulatory progress seems to be feeding into sentiment, with a roughly 72.9% year to date share price return contrasting sharply with a negative three year total shareholder return. This suggests momentum is rebuilding after a difficult stretch.

If Bayer’s rebound has you rethinking the wider healthcare space, it might be a good time to explore other potential movers across healthcare stocks.

With the share price already outpacing analyst targets but still trading at a steep intrinsic discount, is Bayer finally a turnaround story that investors are underestimating, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 13.4% Overvalued

Compared to Bayer’s last close at €33.53, the most closely watched narrative implies a lower fair value estimate of about €29.57. This sets up a valuation gap investors are debating.

Progress on litigation containment, including large case settlements at low average cost, strategic provision management, and an articulated multi-pronged legal strategy with a target to largely resolve legacy glyphosate and PCB exposures by end-2026, has the potential to remove a major overhang on earnings and valuation, signaling a medium-term inflection in net margin, earnings quality, and investor sentiment.

Curious how a slow revenue ramp, a sharp earnings swing into profit, and a surprisingly modest future earnings multiple still point to upside potential? The full narrative shows exactly how those moving pieces add up to that fair value call.

Result: Fair Value of $29.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unresolved glyphosate lawsuits and mounting regulatory pressure on key crop protection products could quickly derail margin recovery and challenge today’s optimistic turnaround assumptions.

Find out about the key risks to this Bayer narrative.

Another View: Deep Discount on Sales

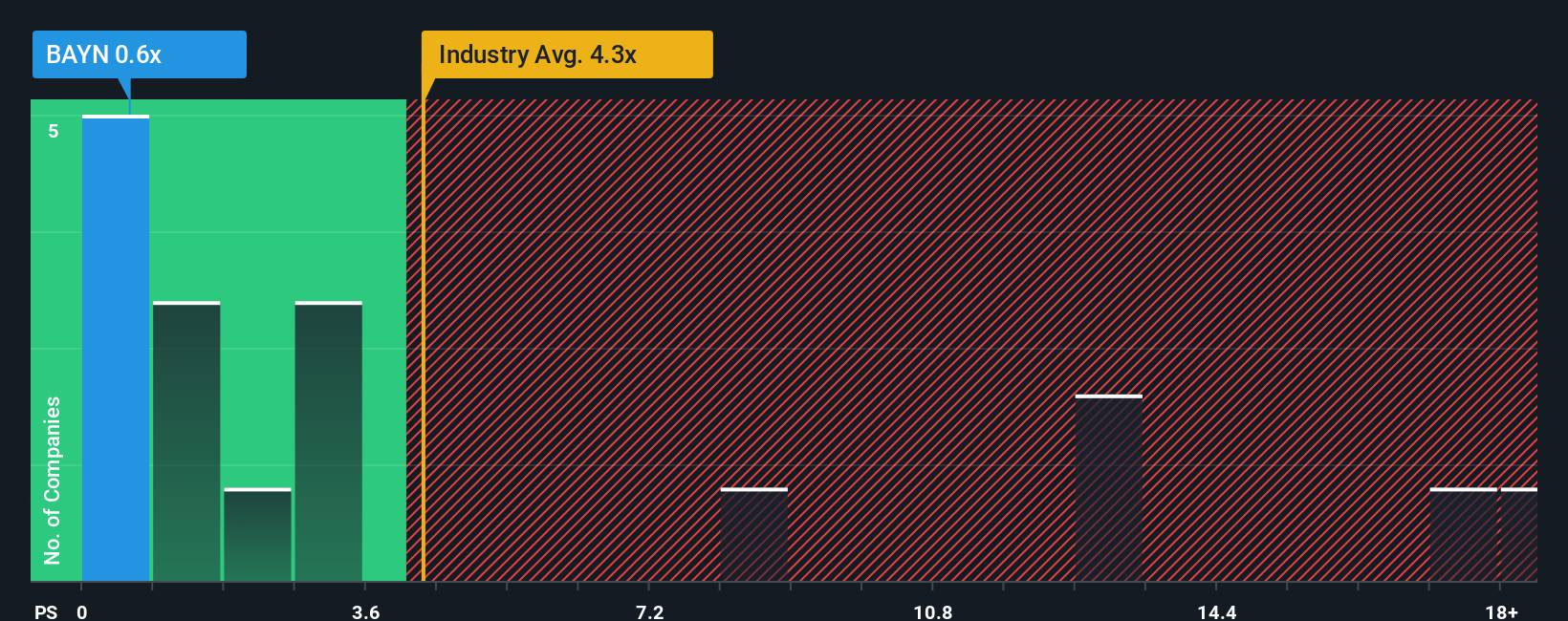

While the most popular narrative calls Bayer about 13.4% overvalued on a fair value basis, its share price tells a different story on sales. At 0.7x revenue versus a 1.8x fair ratio and a 3.1x industry average, the market is pricing in heavy execution risk, not recovery. Which story do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bayer Narrative

If you see the story differently or want to stress test your own assumptions, you can build a complete narrative yourself in just a few minutes: Do it your way.

A great starting point for your Bayer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused ideas tailored to your style and goals.

- Target reliable income by reviewing these 15 dividend stocks with yields > 3% that balance attractive yields with the financial strength needed to keep paying through market cycles.

- Capture high potential growth stories by scanning these 26 AI penny stocks positioned at the forefront of artificial intelligence innovation and adoption.

- Capitalize on market mispricings by filtering for these 908 undervalued stocks based on cash flows where cash flow strength and current prices look meaningfully out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026