Bayer (XTRA:BAYN) Is Up 10.8% After Oncology And Cardio Pipelines Clear Key FDA Hurdles - What's Changed

Reviewed by Sasha Jovanovic

- In recent weeks, Bayer has reported a series of product milestones, including FDA approval of HYRNUO for HER2-mutated non-small cell lung cancer, positive Phase III stroke-prevention data for asundexian, and the launch of the SUNFLOWER Phase III trial assessing Mirena for treating nonatypical endometrial hyperplasia.

- Alongside expanded FDA-cleared uses for its MEDRAD Centargo CT injector, these updates highlight Bayer’s efforts to broaden its pharmaceuticals and medical imaging franchises into areas of high unmet medical need.

- We’ll now examine how HYRNUO’s FDA approval and Bayer’s broader clinical progress fit into, and potentially reshape, its existing investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bayer Investment Narrative Recap

To own Bayer today, you generally need to believe that its late stage pharma pipeline and litigation containment efforts can eventually outweigh pressure from patent losses, crop regulation and legal overhangs. The latest approvals and trial starts look supportive of the pharma story but do not materially change the near term focus on resolving glyphosate and PCB litigation or the risk of further crop protection setbacks.

Among the recent updates, HYRNUO’s FDA approval for HER2 mutated non small cell lung cancer stands out because it directly adds a new oncology asset to the portfolio and speaks to the catalyst that Bayer’s innovation pipeline could help offset patent erosion, especially around Xarelto. Whether this kind of progress can fully counterbalance pricing pressure and ongoing legal payouts remains a central question for shareholders.

However, investors should be aware that unresolved glyphosate and PCB litigation could still...

Read the full narrative on Bayer (it's free!)

Bayer's narrative projects €48.0 billion revenue and €3.1 billion earnings by 2028. This requires 1.3% yearly revenue growth and a €6.5 billion earnings increase from €-3.4 billion today.

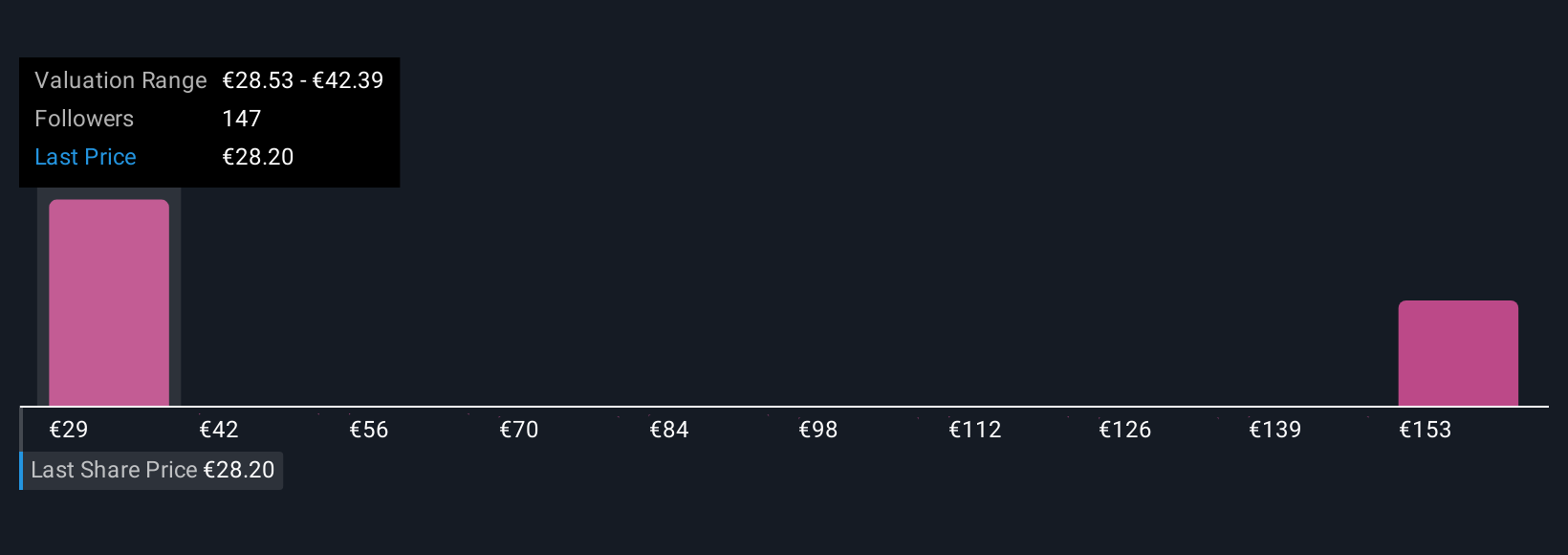

Uncover how Bayer's forecasts yield a €29.57 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Fourteen fair value estimates from the Simply Wall St Community span about €29.57 to €167.40 per share, showing a very wide spread in expectations. Against this backdrop, Bayer’s need to contain large legacy litigation exposures remains a key factor that could influence how these varied views play out over time, so it is worth comparing several of these perspectives before forming your own view.

Explore 14 other fair value estimates on Bayer - why the stock might be worth over 4x more than the current price!

Build Your Own Bayer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bayer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bayer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bayer's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026