Not Many Are Piling Into Apontis Pharma AG (ETR:APPH) Stock Yet As It Plummets 27%

Unfortunately for some shareholders, the Apontis Pharma AG (ETR:APPH) share price has dived 27% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 51% loss during that time.

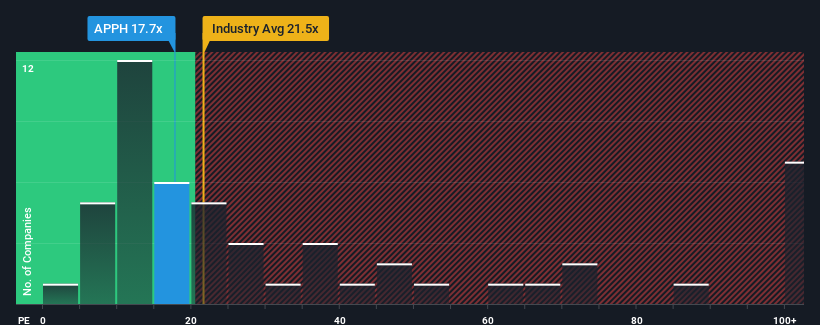

Although its price has dipped substantially, there still wouldn't be many who think Apontis Pharma's price-to-earnings (or "P/E") ratio of 17.7x is worth a mention when the median P/E in Germany is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Apontis Pharma as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Apontis Pharma

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Apontis Pharma's is when the company's growth is tracking the market closely.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Turning to the outlook, the next three years should generate growth of 29% each year as estimated by the three analysts watching the company. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Apontis Pharma's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following Apontis Pharma's share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Apontis Pharma's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - Apontis Pharma has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:APPH

Apontis Pharma

Engages in the marketing and sale of medical drugs for indication fields of internal medicine in Germany.

Excellent balance sheet and good value.