Is Media and Games Invest's (ETR:M8G) 207% Share Price Increase Well Justified?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Media and Games Invest plc (ETR:M8G) share price had more than doubled in just one year - up 207%. It's also good to see the share price up 144% over the last quarter. And shareholders have also done well over the long term, with an increase of 205% in the last three years.

View our latest analysis for Media and Games Invest

While Media and Games Invest made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Media and Games Invest grew its revenue by 79% last year. That's stonking growth even when compared to other loss-making stocks. And the share price has responded, gaining 207% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

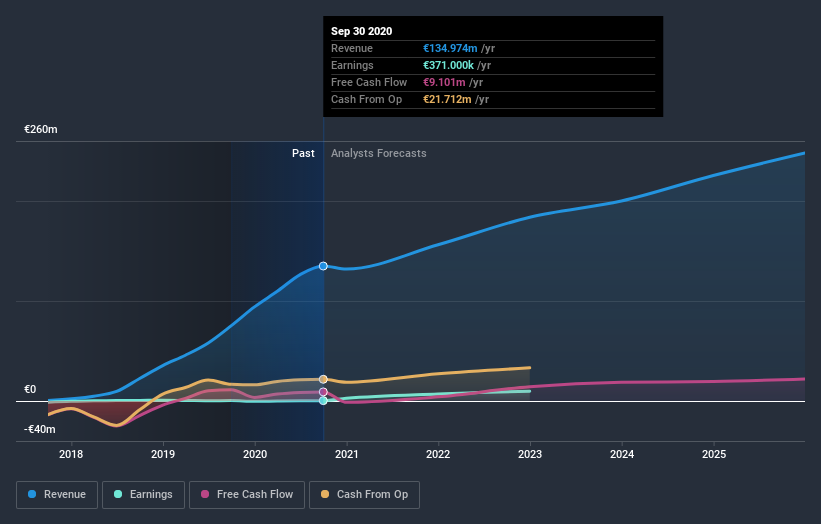

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Media and Games Invest has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Media and Games Invest stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Media and Games Invest shareholders have gained 207% (in total) over the last year. That gain actually surpasses the 45% TSR it generated (per year) over three years. The improving returns to shareholders suggests the stock is becoming more popular with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Media and Games Invest has 4 warning signs we think you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

When trading Media and Games Invest or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:M8G

Verve Group

A digital media company, engages in the provision of ad-software solutions in North America and Europe.

Moderate and good value.

Similar Companies

Market Insights

Community Narratives