As global markets navigate the complexities of rate cuts by central banks and fluctuating economic indicators, investors are keenly observing shifts in major indices, with the Nasdaq reaching new heights while other indexes face declines. Amidst these dynamic conditions, dividend stocks remain a compelling option for income-focused investors seeking stability and regular returns. A good dividend stock typically offers consistent payouts and has a track record of financial health, making it an attractive choice in today's uncertain market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.20% | ★★★★★★ |

Click here to see the full list of 1858 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

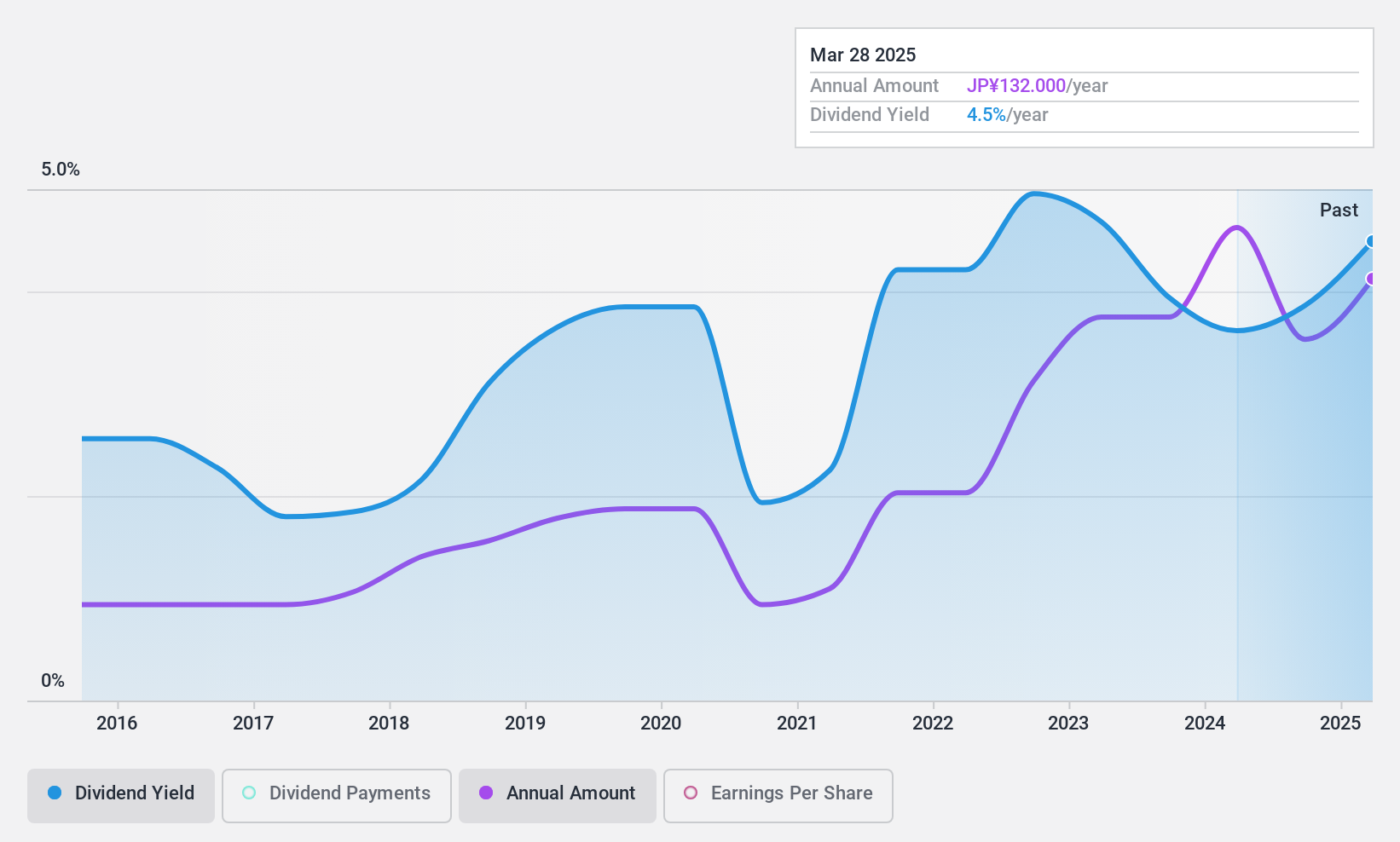

Rix (TSE:7525)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rix Corporation manufactures and sells machinery equipment and industrial materials in Japan with a market cap of ¥22.63 billion.

Operations: Rix Corporation's revenue segments include Car at ¥11.42 billion, Environment at ¥3.01 billion, Rubber/Tire at ¥3.85 billion, Machine Tools at ¥2.24 billion, Paper and Pulp at ¥993 million, Steel and Iron at ¥14.34 billion, Highly Functional Materials at ¥2.26 billion, and Electronics and Semiconductor at ¥6.84 billion.

Dividend Yield: 4.3%

Rix Corporation's dividend payments, while in the top 25% of Japanese market payers, have been volatile and recently decreased to JPY 53.00 per share for Q2 2024. Despite a low payout ratio of 39%, indicating coverage by earnings and cash flows, the dividend track record remains unstable. Recent upward revisions in financial guidance suggest improved profitability with net sales expected at ¥52 billion, but this hasn't translated into stable or growing dividends yet.

- Click here and access our complete dividend analysis report to understand the dynamics of Rix.

- Our comprehensive valuation report raises the possibility that Rix is priced lower than what may be justified by its financials.

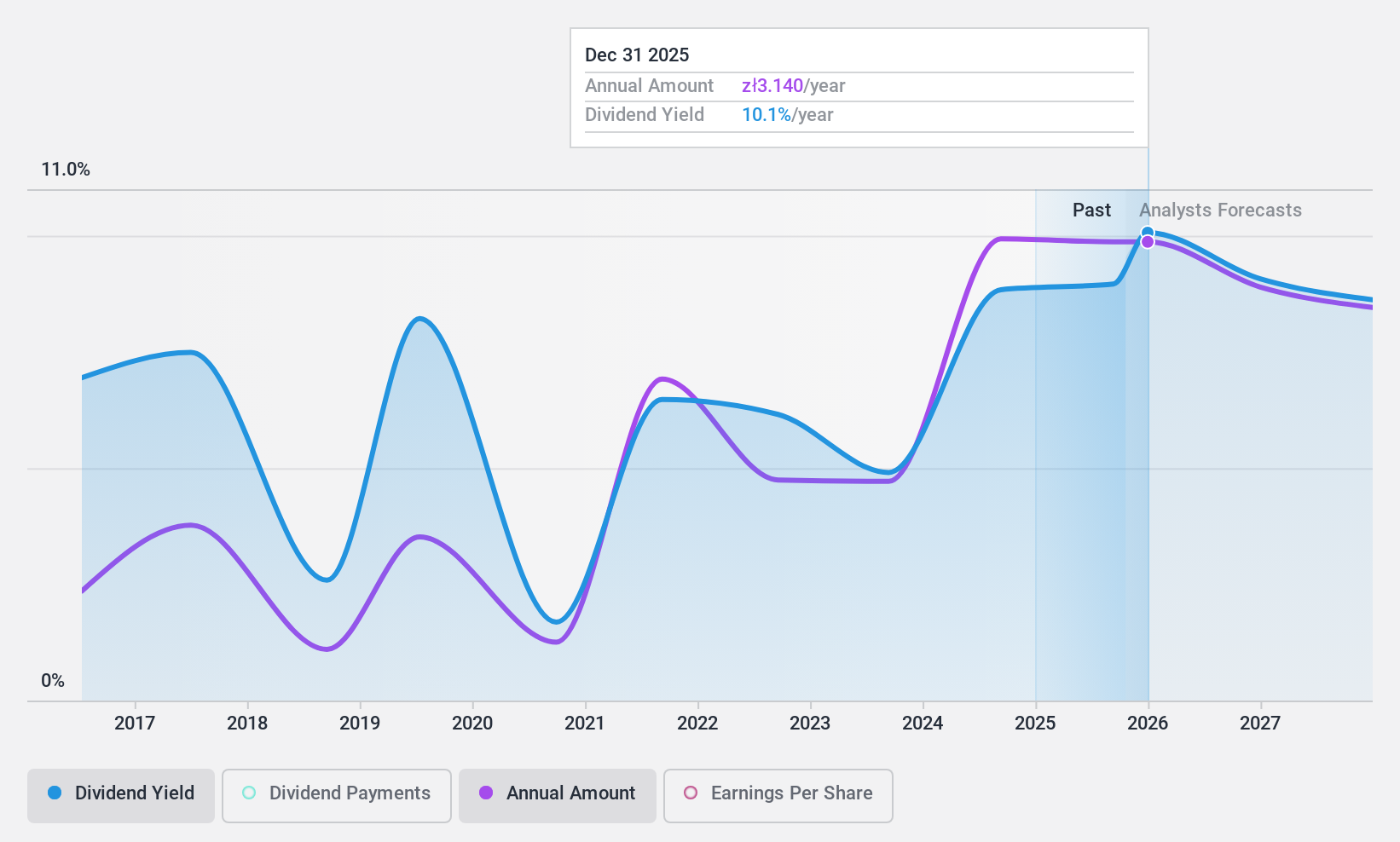

FERRO (WSE:FRO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FERRO S.A. manufactures and sells sanitary and plumbing fixtures in Poland and internationally, with a market cap of PLN741.37 million.

Operations: FERRO S.A.'s revenue is primarily derived from Sanitary Fittings (PLN371.37 million), Installation Fittings (PLN263.05 million), and Heat Sources (PLN132.49 million).

Dividend Yield: 9.1%

FRO's dividend yield ranks in the top 25% of Polish market payers, but its payments have been volatile over the past decade. Despite this instability, dividends are covered by earnings with a payout ratio of 88% and well-supported by cash flows at 43.1%. Recent earnings growth of 21.2% and increased net income to PLN 27.15 million for Q3 suggest potential for future stability, though past volatility remains a concern for consistent dividend reliability.

- Click here to discover the nuances of FERRO with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, FERRO's share price might be too pessimistic.

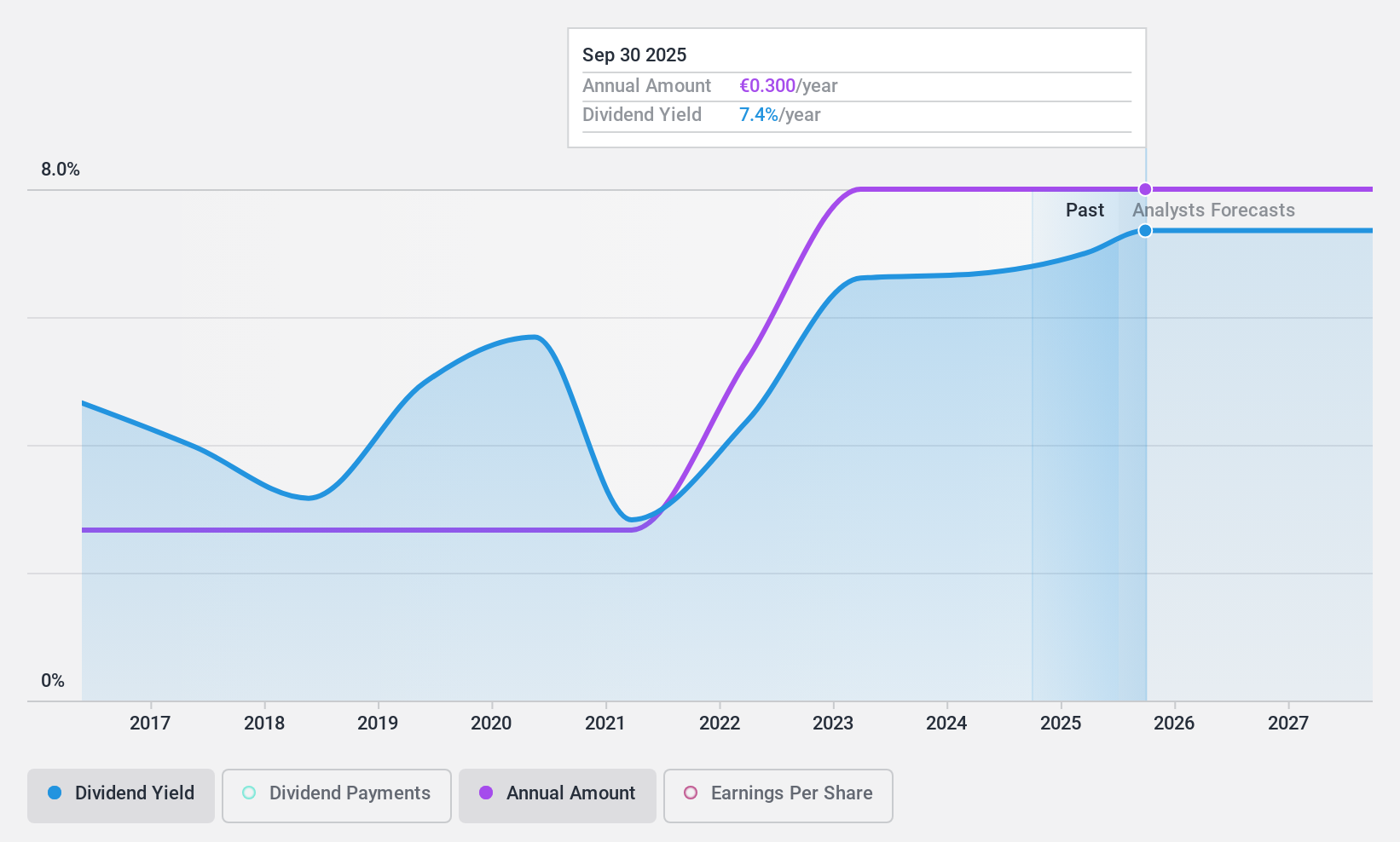

Edel SE KGaA (XTRA:EDL)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA, with a market cap of €95.74 million, operates as an independent music company in Europe through its various subsidiaries.

Operations: Edel SE & Co. KGaA generates revenue through its operations as an independent music company in Europe, leveraging its subsidiaries to drive its business activities.

Dividend Yield: 6.7%

Edel SE KGaA offers an attractive dividend yield of 6.67%, placing it in the top 25% of German market payers. Dividends have been stable and growing over the past decade, supported by earnings with a payout ratio of 52.7% and cash flows at 71%. Despite a high debt level, the company trades at good value compared to peers and industry standards, with recent earnings growth of 24% enhancing its financial position for sustainable dividends.

- Click to explore a detailed breakdown of our findings in Edel SE KGaA's dividend report.

- Our valuation report here indicates Edel SE KGaA may be undervalued.

Taking Advantage

- Access the full spectrum of 1858 Top Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7525

Rix

Manufactures and sells machinery equipment and industrial materials in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives