ad pepper media International N.V.'s (ETR:APM) Shares May Have Run Too Fast Too Soon

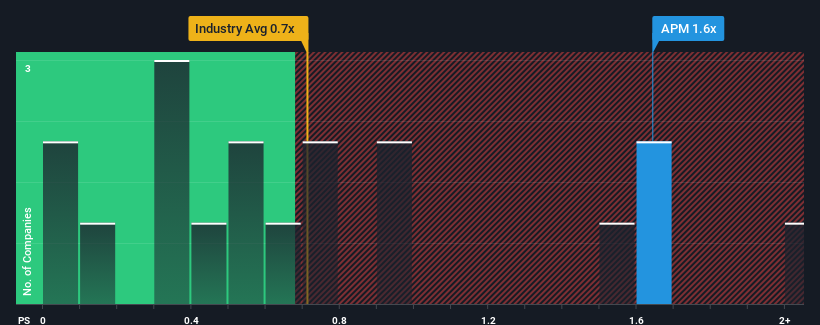

When close to half the companies in the Media industry in Germany have price-to-sales ratios (or "P/S") below 0.7x, you may consider ad pepper media International N.V. (ETR:APM) as a stock to potentially avoid with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ad pepper media International

How ad pepper media International Has Been Performing

ad pepper media International could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think ad pepper media International's future stacks up against the industry? In that case, our free report is a great place to start.How Is ad pepper media International's Revenue Growth Trending?

In order to justify its P/S ratio, ad pepper media International would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.5%. As a result, revenue from three years ago have also fallen 3.6% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 5.1% per year as estimated by the one analyst watching the company. That's shaping up to be similar to the 6.1% per year growth forecast for the broader industry.

In light of this, it's curious that ad pepper media International's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that ad pepper media International currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for ad pepper media International that you should be aware of.

If you're unsure about the strength of ad pepper media International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:APM

ad pepper media International

An investment holding company, engages in the development of performance marketing solutions in Germany, the United Kingdom, Spain, Switzerland, France, Italy, and the Netherlands.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives