Amid easing trade tensions and optimism over potential U.S. interest rate cuts, the European market has shown resilience with key indices like the STOXX Europe 600 Index ending higher. In this favorable economic climate, identifying promising small-cap stocks can be crucial for investors looking to capitalize on emerging opportunities in Europe's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Value Rating: ★★★★☆☆

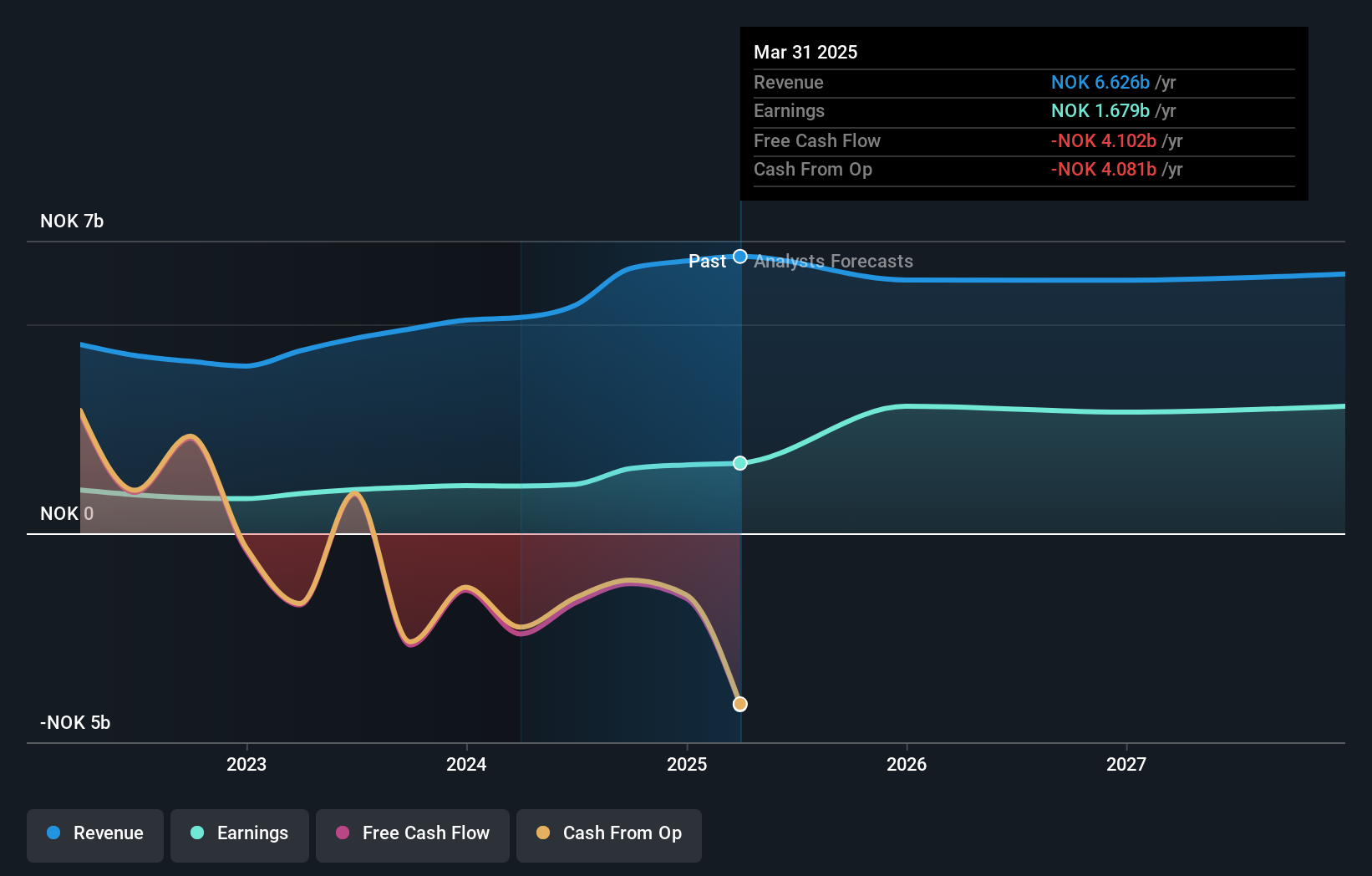

Overview: SpareBank 1 Nord-Norge offers a range of banking services in Northern Norway and has a market capitalization of NOK14.63 billion.

Operations: SpareBank 1 Nord-Norge generates revenue primarily from its Retail Market segment, contributing NOK2.54 billion, and Corporate Banking (Excluding SMB), adding NOK1.79 billion. The bank also earns from Sparebank 1 Finans Nord-Norge and Eiendoms-Megler 1 Nord-Norge with revenues of NOK369 million and NOK198 million respectively.

SpareBank 1 Nord-Norge, a bank with total assets of NOK144.1 billion and equity of NOK19.1 billion, has demonstrated robust earnings growth of 45% over the past year, outpacing the industry average of 18%. Despite its high-quality earnings and low-risk funding structure—76% sourced from customer deposits—the bank faces challenges with a high bad loans ratio at 2.6%, paired with a low allowance for these loans at 42%. Recent financial results show net income for Q2 at NOK938 million, up from NOK742 million last year, reflecting positive momentum amidst these hurdles.

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

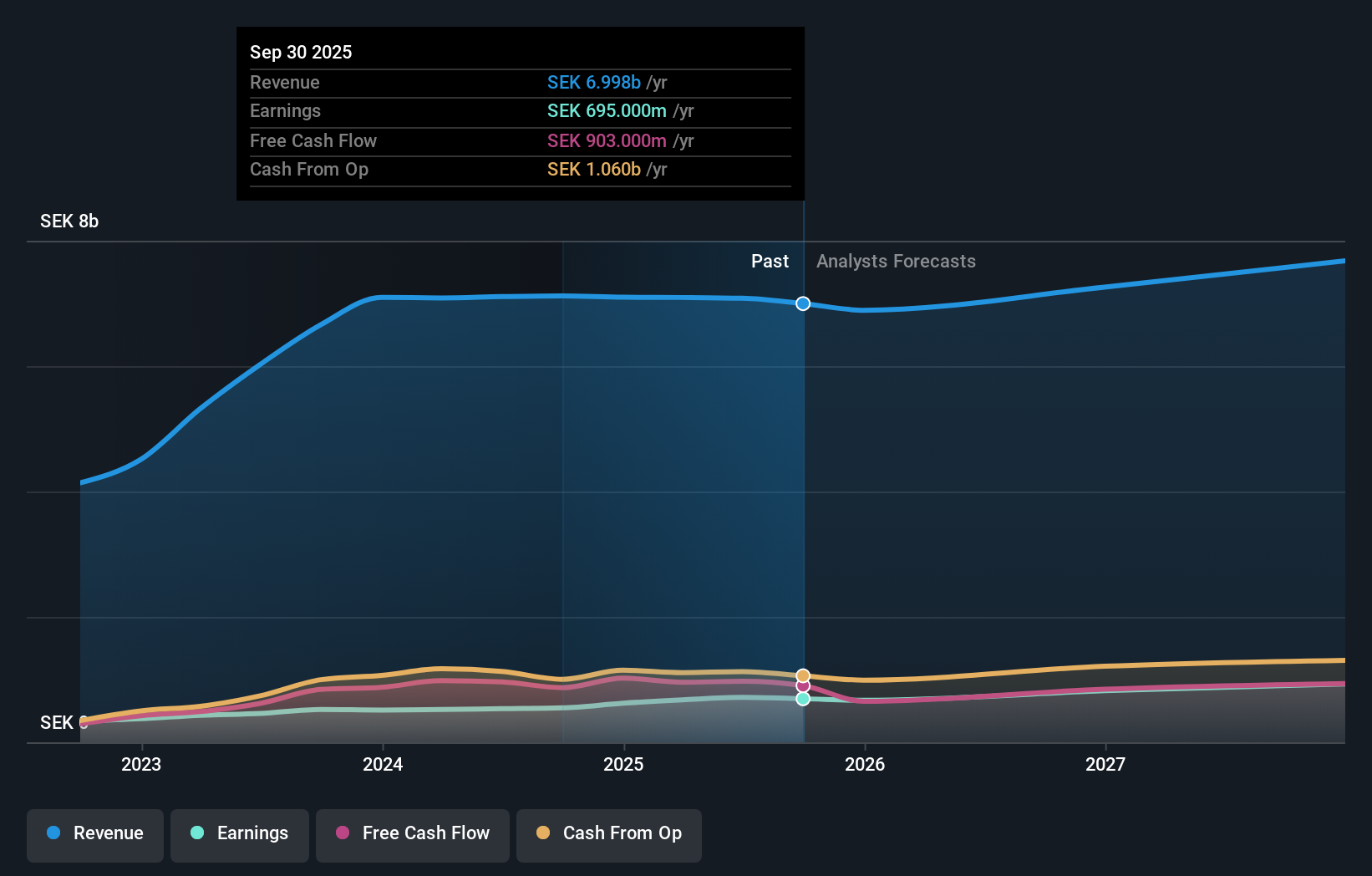

Overview: Alimak Group AB (publ) designs and manufactures vertical access solutions across various regions including Europe, Asia, Australia, and the Americas with a market capitalization of approximately SEK17.02 billion.

Operations: Alimak Group generates revenue primarily from its Facade Access, Construction, Industrial, HS & PS, and Wind segments, with Facade Access contributing the highest at SEK1.99 billion.

Alimak Group, a specialist in vertical access solutions, is making strides with its satisfactory net debt to equity ratio of 32% and well-covered interest payments at 7.3 times EBIT. The company’s earnings grew by 33.6% last year, outperforming the machinery industry’s -0.6%. Recent strategic acquisitions like Century Elevators and investments in digital innovation are poised to enhance margins and market presence despite challenges such as construction sector weakness and regulatory pressures. In Q2 2025, Alimak reported sales of SEK1.79 billion with net income rising to SEK184 million from SEK143 million the previous year, reflecting solid financial health amidst industry uncertainties.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

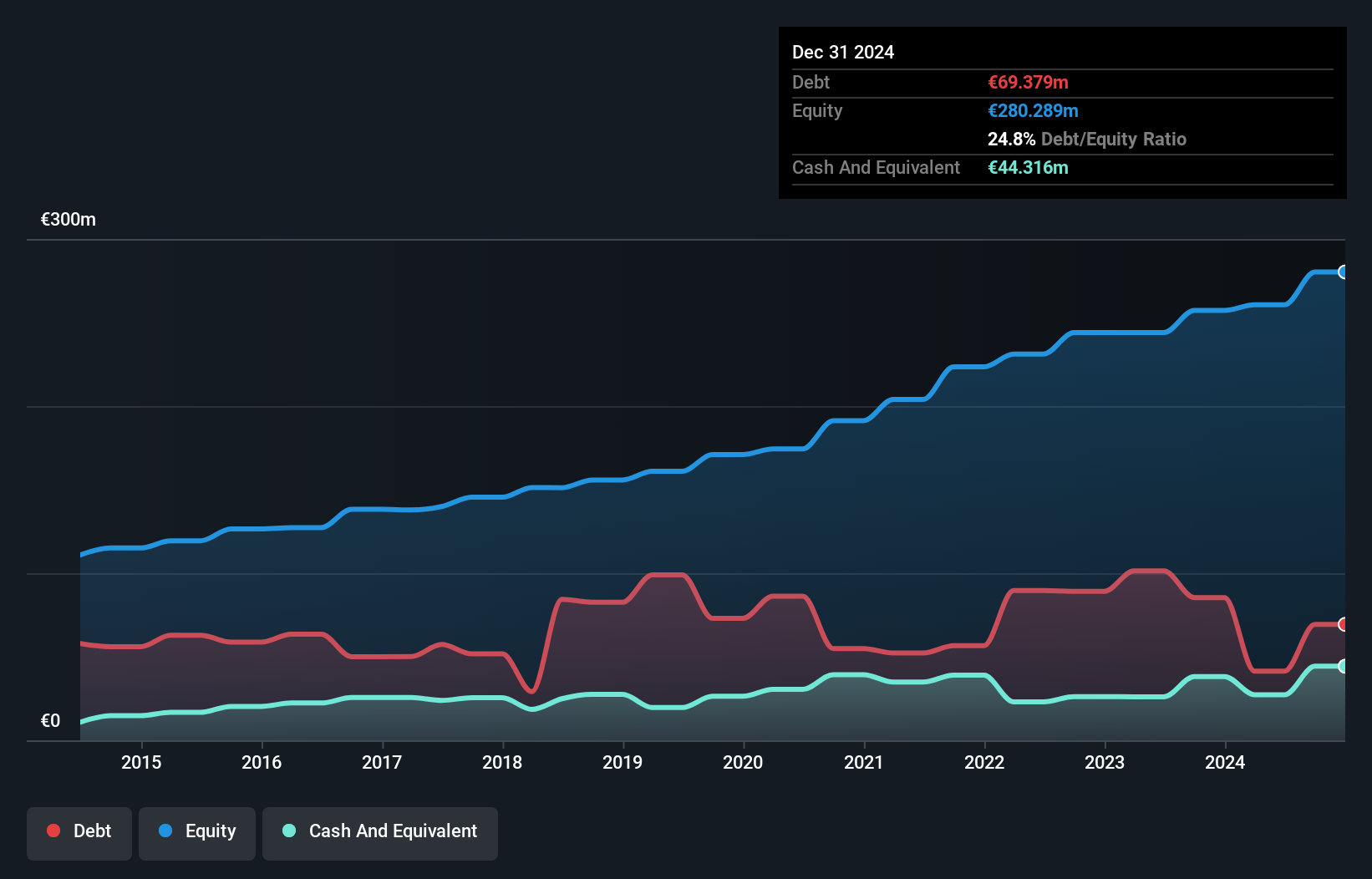

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, the Netherlands, and internationally with a market capitalization of approximately €355.62 million.

Operations: Uzin Utz SE generates significant revenue from its Germany - Laying Systems segment, contributing €213.88 million, followed by Western Europe at €77.63 million and Netherlands - Laying Systems at €88.65 million. The USA - Laying Systems also plays a crucial role with revenues of €73.12 million. The company's net profit margin provides insight into its profitability dynamics over time without delving into specific figures here.

Uzin Utz, a standout in the European market, showcases strong financial health with its net debt to equity ratio at 15.4%, which is considered satisfactory. Over the past five years, this ratio has impressively reduced from 49.5% to 26.4%. The company’s interest payments are well-covered by EBIT at a solid 16.2x coverage, indicating robust operational efficiency. Recent earnings results highlight growth with sales reaching €251.75 million and net income climbing to €13.95 million for the half-year ended June 2025, up from last year’s figures of €242.29 million and €12.38 million respectively, reflecting promising momentum in revenue generation and profitability.

- Dive into the specifics of Uzin Utz here with our thorough health report.

Gain insights into Uzin Utz's past trends and performance with our Past report.

Summing It All Up

- Click through to start exploring the rest of the 329 European Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NONG

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives