- Italy

- /

- Gas Utilities

- /

- BIT:AC5

Acinque Leads Our 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As the European markets experience a modest upswing, with the pan-European STOXX Europe 600 Index rising by 0.90% amid easing inflation and favorable monetary policy shifts, there is renewed interest in identifying small-cap stocks that could benefit from these conditions. In this environment, undiscovered gems like Acinque stand out for their potential to capitalize on economic trends and market sentiments, offering intriguing opportunities for those seeking growth in Europe's evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Acinque (BIT:AC5)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acinque S.p.A. operates as a multi-utility company in Italy with a market capitalization of €426.26 million.

Operations: Acinque generates revenue through its multi-utility operations in Italy. The company's financial performance reflects a market capitalization of €426.26 million, with specific revenue segments contributing to its overall earnings.

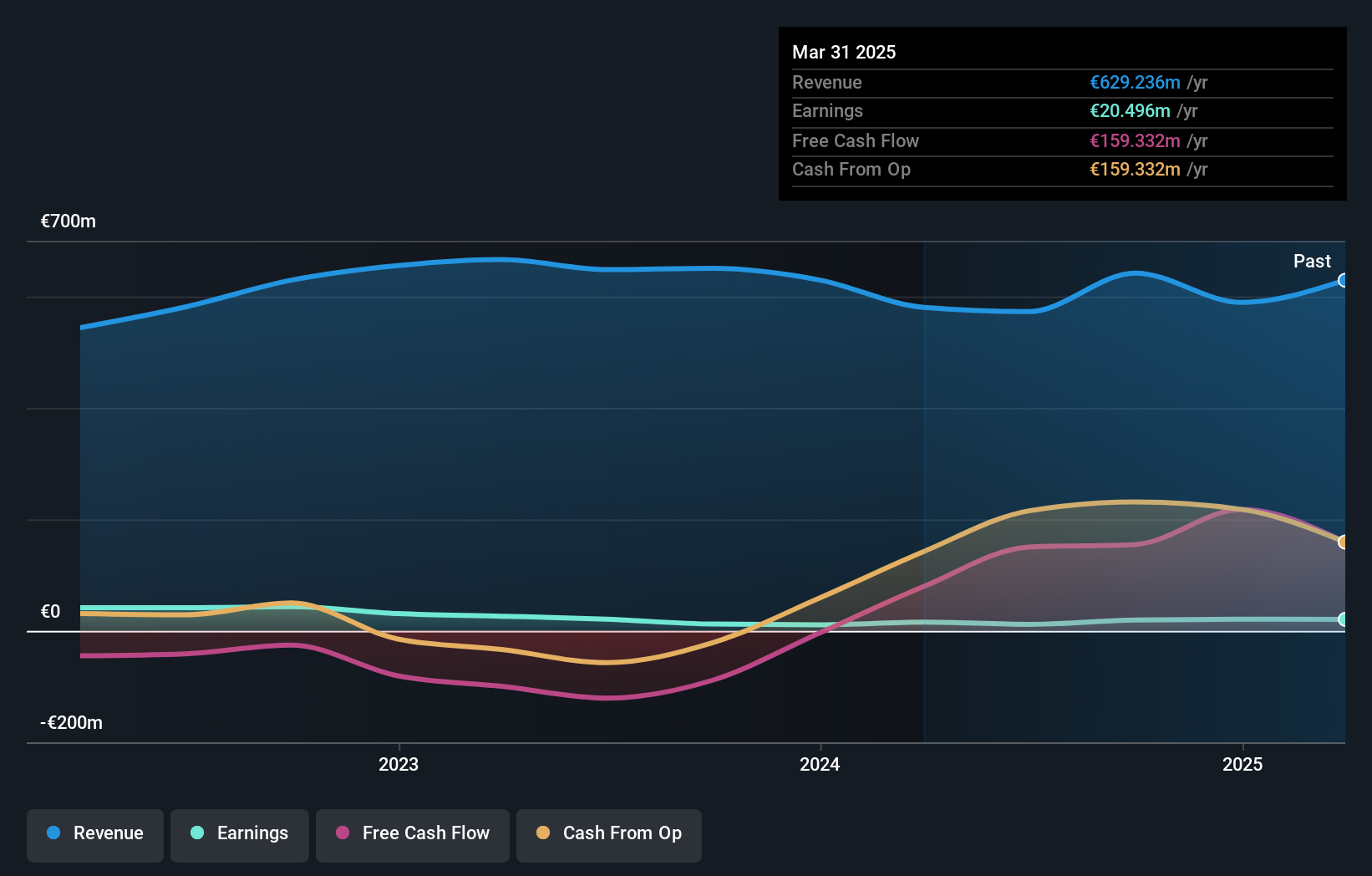

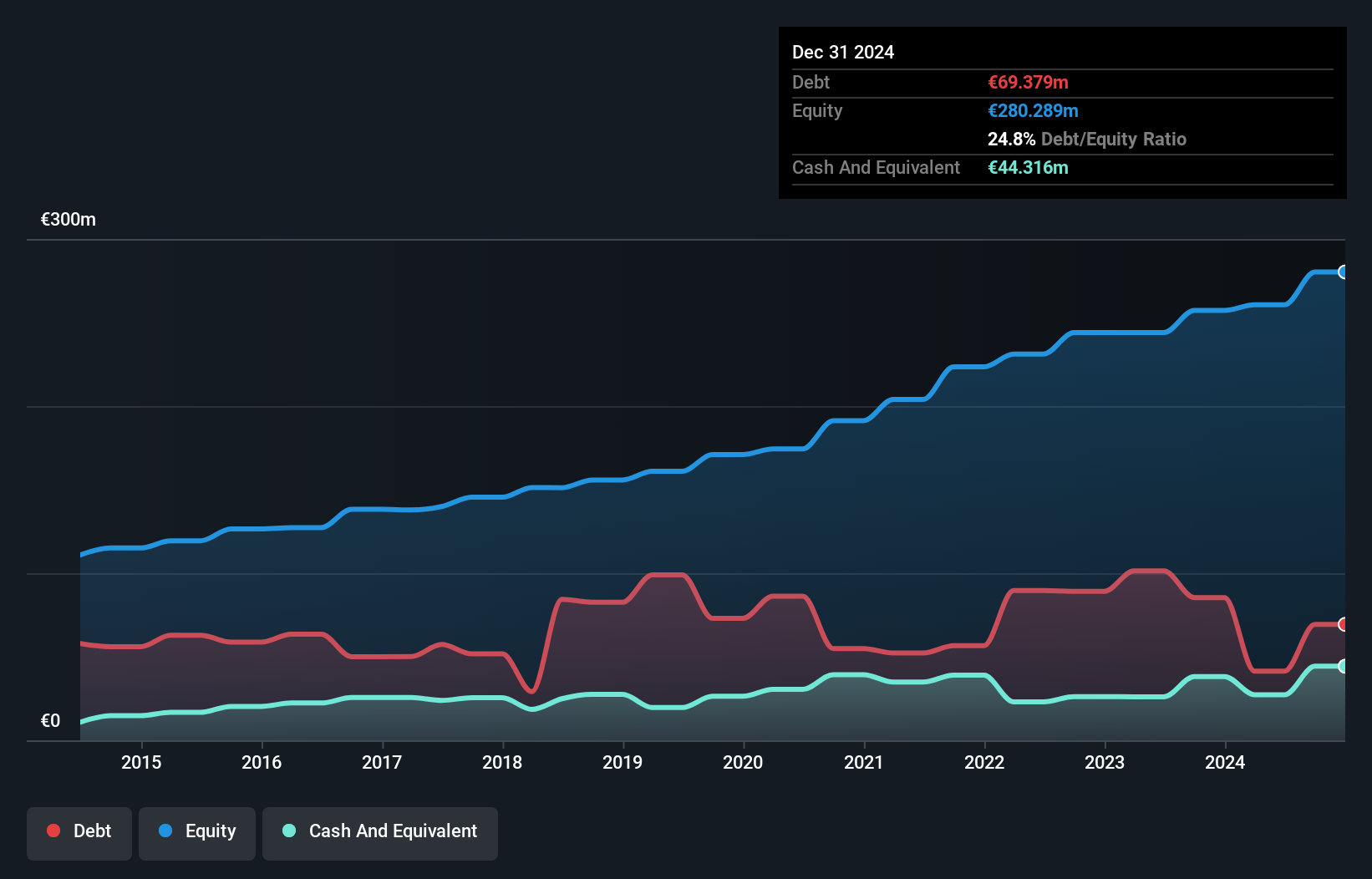

Acinque, a European player in the gas utilities sector, showcases intriguing dynamics with its recent performance. The company reported Q1 2025 sales of €214.75 million and net income of €9.9 million, reflecting solid profitability despite past challenges. Over the last year, earnings growth at 31% outpaced the industry average of 4.5%, highlighting robust operational efficiency. However, a rising debt to equity ratio from 25% to 57% over five years signals increased leverage that could be concerning for some investors. Trading at nearly 77% below estimated fair value suggests potential undervaluation, offering an enticing prospect for discerning investors.

- Get an in-depth perspective on Acinque's performance by reading our health report here.

Explore historical data to track Acinque's performance over time in our Past section.

Bouvet (OB:BOUV)

Simply Wall St Value Rating: ★★★★★★

Overview: Bouvet ASA is an IT and digital communication consultancy firm serving both public and private sectors across Norway, Sweden, and internationally, with a market cap of NOK8.03 billion.

Operations: Bouvet's primary revenue stream comes from its IT consultancy services, generating NOK3.98 billion.

Bouvet, a nimble player in the IT sector, showcases robust financial health with no debt over the past five years and consistent earnings growth averaging 12.5% annually. The company recently reported a net income of NOK 120.99 million for Q1 2025, up from NOK 105.42 million the previous year, indicating solid performance despite significant insider selling recently observed. With a price-to-earnings ratio of 20.1x that is below industry norms and high-quality earnings, Bouvet's strategic moves include board-approved share capital increases to fund acquisitions and a dividend payout of NOK 3 per share for fiscal year 2024, reflecting confidence in future prospects.

- Take a closer look at Bouvet's potential here in our health report.

Examine Bouvet's past performance report to understand how it has performed in the past.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market capitalization of approximately €320.31 million.

Operations: Uzin Utz SE generates revenue primarily from its Germany - Laying Systems segment, which contributes €206.90 million, followed by Western Europe at €78.49 million and Netherlands - Laying Systems at €84.16 million. The company's net profit margin is not specified in the provided data, so further analysis would be required to evaluate profitability trends comprehensively.

Uzin Utz, with its solid financial footing, is making waves in the European market. Over the past year, earnings surged by 30%, outpacing the Chemicals industry growth of 16%. The company's price-to-earnings ratio stands at 10.9x, significantly lower than Germany's market average of 19.2x, indicating a promising valuation. Its debt to equity ratio has impressively decreased from 42% to nearly 25% over five years, reflecting prudent financial management. Furthermore, Uzin Utz announced a dividend increase to €1.90 per share for May 2025 and reported net income rising from €22 million to €29 million last year.

- Click to explore a detailed breakdown of our findings in Uzin Utz's health report.

Understand Uzin Utz's track record by examining our Past report.

Summing It All Up

- Reveal the 329 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AC5

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives