- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

Thyssenkrupp (XTRA:TKA): Rethinking Valuation After Sweeping Restructuring Deal With IG Metall

Reviewed by Simply Wall St

Thyssenkrupp (XTRA:TKA) just signed a sweeping restructuring deal with IG Metall, locking in financing while cutting or outsourcing about 11,000 jobs and trimming steel capacity to roughly 8.7 to 9 million tonnes.

See our latest analysis for thyssenkrupp.

The restructuring news appears to have supercharged sentiment, with an 8.31% 1 day share price return and a 142.86% year to date share price return. Together, these have contributed to a powerful 246.70% 1 year total shareholder return that suggests momentum is still building rather than fading.

If this kind of turnaround story has you rethinking your watchlist, it might be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

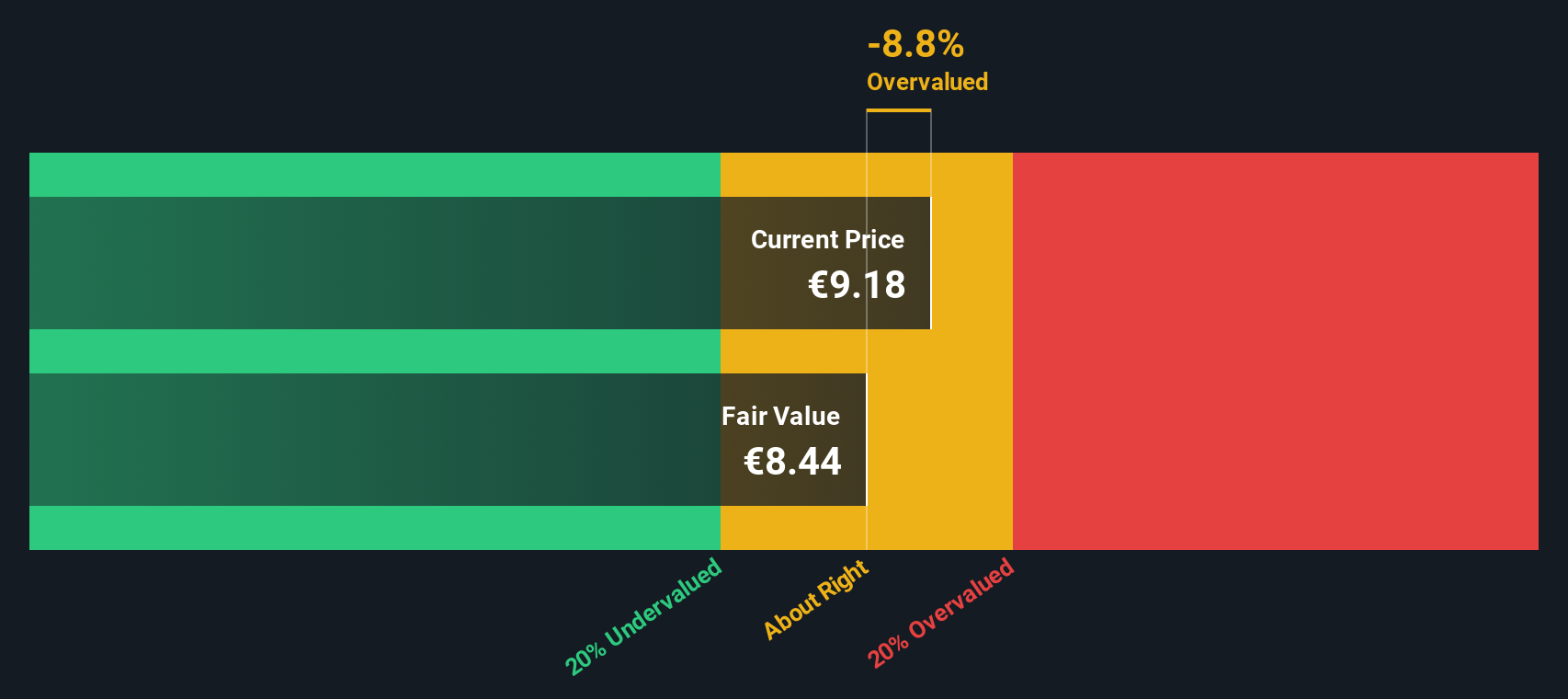

But with the share price now hovering around analyst targets and the stock no longer looking obviously cheap on intrinsic metrics, is this restructuring-fueled rally still a buying opportunity, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 4.5% Undervalued

With thyssenkrupp last closing at €9.75 against a most popular narrative fair value of €10.20, the story leans toward modest upside, anchored in structural change rather than a simple cyclical bounce.

The spin-off and impending separate listing of Marine Systems, together with planned segment autonomy across the portfolio, may unlock hidden asset value and improve transparency, supporting higher group valuation and better resource allocation, with positive effects on return on capital employed and earnings.

Curious how a slow growing industrial group can still justify a higher valuation? This narrative leans on profit revival, margin expansion and a surprisingly low future earnings multiple. Want to see how those moving parts fit together into that fair value call?

Result: Fair Value of €10.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on execution, as soft demand in core steel and materials segments and ongoing restructuring could potentially undermine the profit recovery story.

Find out about the key risks to this thyssenkrupp narrative.

Another View: Is the Market Already Ahead of Itself?

Our DCF model points in the opposite direction, with thyssenkrupp trading above an estimated fair value of €8.08, which suggests the shares look overvalued rather than modestly undervalued. Is the recent excitement simply pulling forward too much of the hoped for turnaround?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out thyssenkrupp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own thyssenkrupp Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Sharpen your edge today by scanning hand picked opportunities on Simply Wall Street’s screener so you do not miss the next standout performer.

- Capitalize on market mispricings by targeting companies that look attractively valued using these 933 undervalued stocks based on cash flows before the crowd catches on.

- Ride powerful innovation waves by zeroing in on cutting edge opportunities through these 24 AI penny stocks shaping the future of automation and intelligence.

- Focus on income generating opportunities via these 14 dividend stocks with yields > 3% if you are aiming to build a portfolio designed to generate ongoing cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026