thyssenkrupp AG (ETR:TKA) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. thyssenkrupp AG operates in the areas of components technology, elevator technology, industrial solutions, marine systems, steel, and materials services in Germany, the United States, China, and internationally. The €3.8b market-cap company posted a loss in its most recent financial year of €304.0m and a latest trailing-twelve-month loss of €1.7b leading to an even wider gap between loss and breakeven. As path to profitability is the topic on thyssenkrupp's investors mind, we've decided to gauge market sentiment. Below we will provide a high-level summary of the industry analysts’ expectations for the company.

View our latest analysis for thyssenkrupp

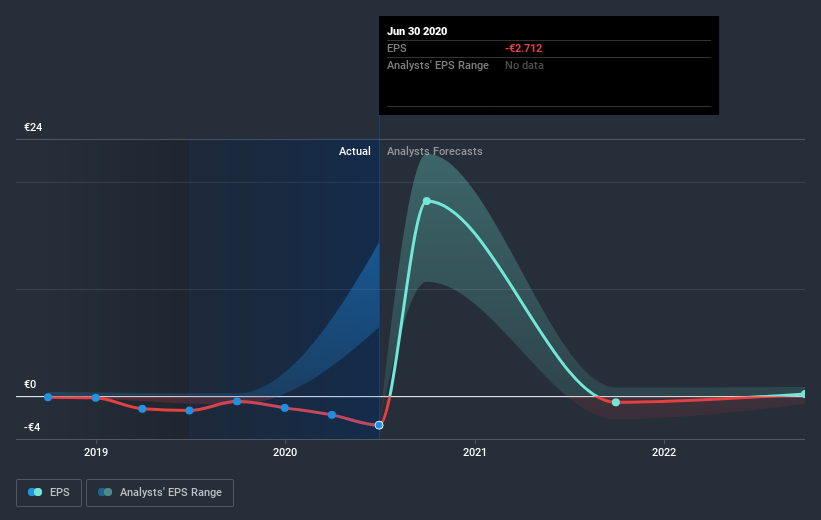

Consensus from 12 of the German Metals and Mining analysts is that thyssenkrupp is on the verge of breakeven. They expect the company to post a final loss in 2019, before turning a profit of €7.2b in 2020. So, the company is predicted to breakeven approximately a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2020? Working backwards from analyst estimates, it turns out that they expect the company to grow -139% year-on-year, on average,

We're not going to go through company-specific developments for thyssenkrupp given that this is a high-level summary, however, take into account that by and large metals and mining companies, depending on the stage of operation and metals mined, have irregular periods of cash flow. This means that a low or volatile growth rate in the near future is not unusual, especially if the company is currently in an investment period.

One thing we would like to bring into light with thyssenkrupp is it currently has negative equity on its balance sheet. This can sometimes arise from accounting methods used to deal with accumulated losses from prior years, which are viewed as liabilities carried forward until it cancels out in the future. Oftentimes, losses exist only on paper but other times, it can be a red flag.

Next Steps:

There are too many aspects of thyssenkrupp to cover in one brief article, but the key fundamentals for the company can all be found in one place – thyssenkrupp's company page on Simply Wall St. We've also put together a list of essential factors you should further examine:

- Valuation: What is thyssenkrupp worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether thyssenkrupp is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on thyssenkrupp’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

When trading thyssenkrupp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:TKA

thyssenkrupp

Provides industrial and technology solutions and services in Germany and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)