- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

Further weakness as thyssenkrupp (ETR:TKA) drops 4.0% this week, taking five-year losses to 59%

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. To wit, the thyssenkrupp AG (ETR:TKA) share price managed to fall 61% over five long years. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 34% in the last year.

If the past week is anything to go by, investor sentiment for thyssenkrupp isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for thyssenkrupp

Because thyssenkrupp made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, thyssenkrupp grew its revenue at 3.7% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 10% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in thyssenkrupp. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

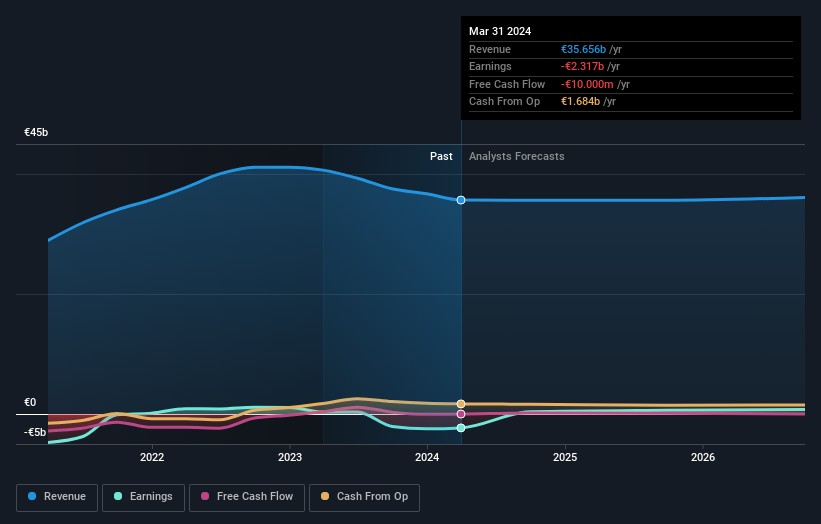

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think thyssenkrupp will earn in the future (free profit forecasts).

A Different Perspective

Investors in thyssenkrupp had a tough year, with a total loss of 32% (including dividends), against a market gain of about 6.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for thyssenkrupp that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives